Venture Capital Trusts portfolio companies

Back businesses with growth potential.

The UK has a rich ecosystem of early-stage businesses with growth potential. But without funding and specialist support, many might never get off the ground.

A Venture Capital Trust (VCT) is a company that buys small stakes in a large number of early-stage companies. The VCT can hold these companies for many years and support their growth, adding new investments over time.

Learn more about the exciting companies our VCTs invest in.

Key investment risks

Capital at risk

VCTs are a high-risk investment. The value of an investment, and income from it can fall as well as rise. You could end up getting back less than you put in.

Tax treatment

Tax treatment depends on individual circumstances and tax rules could change in the future.

Volatility and liquidity

VCT shares could fall or rise in value more than other shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

VCT qualification status

Tax reliefs depend on the VCT maintaining its qualifying status.

Octopus Apollo VCT

Octopus Apollo VCT invests in higher risk smaller businesses that have already brought their product or service to market successfully. Investors get access to a diversified portfolio of around 45 companies (focusing on business-to-business (B2B) software) with high growth potential, as well as the expertise of Octopus Ventures.

Apollo portfolio companies

Octopus AIM VCTs

The Octopus AIM VCTs feature around 80 established, maturing businesses from a diverse range of sectors, from building materials and pharmaceuticals to software development and battery technology.

The team focuses on companies where there’s a strong business idea and plenty of room to grow.

AIM portfolio companies

Octopus Future Generations VCT

Octopus Future Generations VCT invests in businesses that are helping to build a sustainable planet, empower people, or revitalise healthcare.

We think these businesses have the potential to transform the world for the better as well as delivering the best returns for investors over the coming decades. Why?

- Tackling society’s biggest challenges means there is a huge market opportunity for those who can tackle them.

- The demand for solutions to the planet’s challenges is urgent and growing.

- People increasingly want to buy from and work for businesses that make a positive difference in the world

The team focuses on companies where there’s a strong business idea and plenty of room to grow.

Future Generations portfolio companies

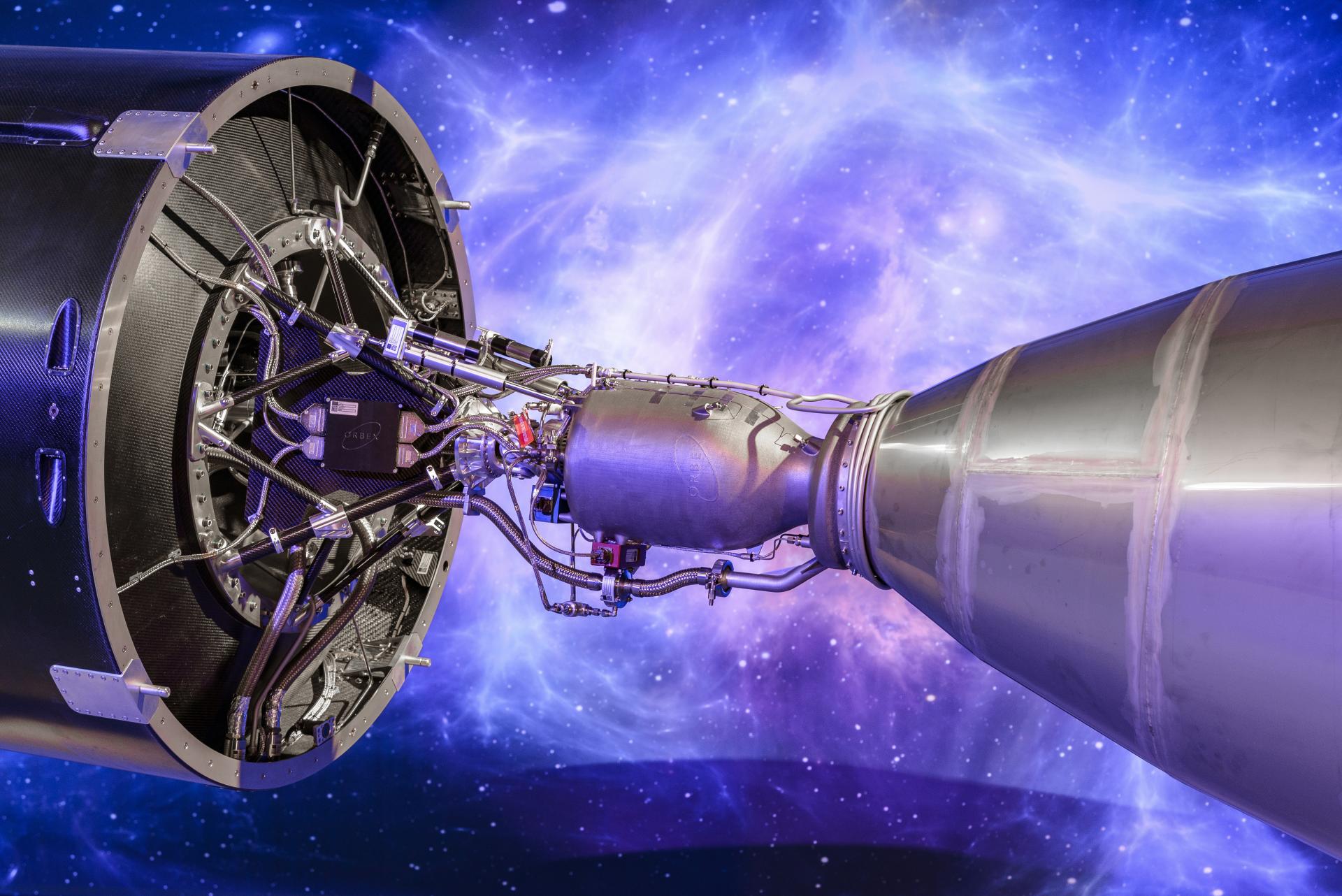

Octopus Titan VCT

Octopus Titan VCT invests in tech-enabled businesses with high growth potential. Managed by Octopus Ventures, it currently has a portfolio of 145 early stage companies operating in a diverse range of sectors.

We’ve backed some of the UK’s most successful entrepreneurs, including the founders of Graze, Depop and Zoopla Property Group.

Titan portfolio companies

Please read: We do not offer investment or tax advice, and we always recommend investors talk to a financial adviser before making investment decisions. This advertisement is not a prospectus. Investors should only subscribe for shares on the basis of information contained in prospectus, supplementary prospectus, AIFMD supplement and the Key Information Document (KID), which are available on the VCT product pages.