GuideEnterprise Investment Scheme

How to claim EIS income tax and deferral relief

Things to bear in mind when claiming income tax and deferral relief

If you’ve invested in Enterprise Investment Scheme (EIS) companies, there are several valuable tax reliefs available to you. This guide is designed to talk you through how to claim income tax relief and capital gains tax deferral. This guide should not be regarded as investment or tax advice.

Things to bear in mind

Income tax relief

Maximum investment for relief

You can claim up to 30% income tax relief on EIS investments of up to £1 million per tax year1. This increases to £2 million per tax year provided at least £1 million is invested in Knowledge Intensive Companies (KICs)2.

Carry back relief

You can choose to treat an investment as though it was made in the previous tax year. This means that up to £2 million can be invested in a tax year (£1 million in the current tax year and £1 million carried back to the previous tax year).

If at least £2 million of investments are made into KICs, a total investment of £4 million can be made in a tax year (£2 million for current tax year and £2 million treated as made in the previous tax year).

Relief limited to your income tax bill

The amount of income tax relief you claim can’t be more than the income tax you have to pay for that tax year. You can only reduce your income tax bill to zero.

Hold shares for three years

To keep your income tax relief, you’ll need to hold your EIS shares for at least three years from the date they were issued, or from the date each company started a qualifying trade (whichever is later).

Capital gains deferral relief

Defer gains throughout investment

A gain made on the sale of other assets can be reinvested in EIS shares and deferred over the life of the investment.

Unlimited deferral relief

There is no upper limit on the amount of gains that can be deferred.

Reinvestment deadlines

To qualify for deferral relief, the reinvestment into EIS-qualifying shares needs to be made no earlier than twelve months before, or three years after, the original gain.

Money equivalent to gain

It is only the money equivalent to the gain that needs to be reinvested in order to get full deferral relief.

Claiming tax reliefs

What you need to claim these reliefs

You will need an EIS certificate to claim income tax and deferral relief. The type of certificate and the timing of when you can claim these reliefs, will depend on whether you’re invested in an unapproved or approved EIS portfolio/fund3.

For an approved EIS portfolio/fund, you’ll receive one EIS 5 certificate that includes the details of each underlying company. For an unapproved EIS portfolio/fund, you’ll receive an EIS 3 certificate for each underlying company.

Throughout this guide, we show examples of EIS 3 certificates only. If you’re completing an EIS 5 certificate, the format may appear different, but the descriptions will be the same.

An approved EIS portfolio/fund, has additional conditions imposed by HMRC.

Some of these include:

- 80% of funds must be invested in Knowledge Intensive Companies (KICs) within two years.

- 50% of funds must be invested within twelve months of the fund closing (90% within two years).

Please see the table below which explains when you can claim in more detail. We’ll talk you through how to claim these reliefs later.

| When it’s available | Is there a time limit to claim? | ||

| Income tax relief | Unapproved EIS portfolio/fund: the tax year the investment into each underlying company is made. Approved EIS portfolio/fund: the tax year that the fund closes. | Five years from 31 January, after the tax year in which the shares were issued. | |

| Capital gains deferral relief | Unapproved and approved portfolio/fund: the tax year the investment into each underlying company is made. | Five years from 31 January, after the tax year in which the shares were issued. |

Claiming income tax relief

There are two ways to claim – either by sending your EIS certificate to your local tax office, or through your tax return.

Send your EIS certificate to your local tax office

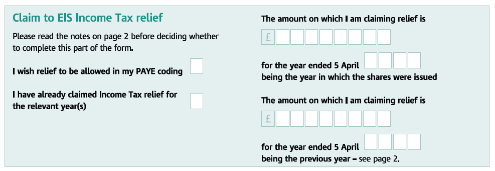

Complete the form on your EIS certificate. You’ll need to enter the amount on which you’re claiming relief. This figure is based on the amount invested into the EIS companies. For an approved portfolio/fund, this figure is based on the total amount invested across all EIS companies in the portfolio/fund.

You can send HMRC your EIS certificates issued in the:

Same tax year

The shares were issued (unapproved portfolio/fund) or portfolio/

fund closed (approved portfolio/fund).

If you pay your tax through PAYE, you will have less tax deducted from your salary each month and HMRC will change your tax code.

If you don’t pay your tax through PAYE, please see the claiming through self-assessment section.

Previous tax year

The shares were issued (unapproved portfolio/fund) or portfolio/fund

closed (approved portfolio/fund).

If you’ve already completed your tax return for the year in which you wish to make a claim, and paid your tax bill, HMRC will offer you a rebate.

If you’ve submitted your tax return but not yet paid your tax bill, your claim will be treated as an amendment to your return and your tax liability will be reduced accordingly.

Claiming through your self-assessment tax return (paper form)

Claiming through your self-assessment tax return (paper form)

Depending on when you claim your relief and how much you are due, you’ll receive the payment as either:

- a lump sum – via a cheque or a direct payment into your bank account

- a reduction of your overall tax bill

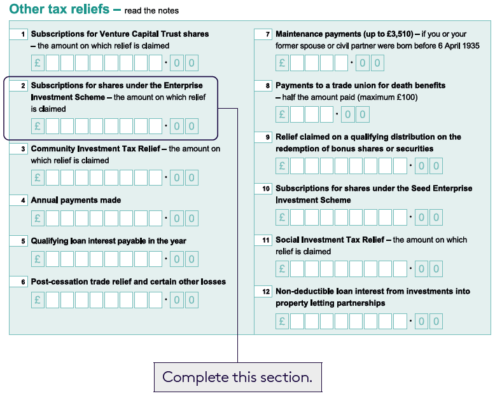

You will need to complete the standard SA100 form and the supplementary SA101 form. On the SA101 there is a box titled ‘Subscriptions for shares under the EIS scheme’ (shown below).

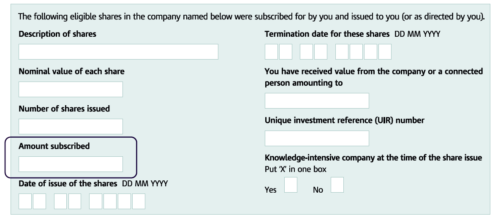

You will need to input the amount on which relief is being claimed for the relevant tax year. This should be the figure you wish to claim, based on the amount after charges which is stated on EIS certificates under ‘Amount subscribed’4 (shown below).

Then, in the large blank ‘Any other information’ box in the SA100 form, include:

- the name of each company you invested in

- the amount you invested in each company

- the amount on which you’re claiming relief for this year

- the date your EIS shares were issued

- if for a tax year, you’ve subscribed for more than £1 million for shares (or more than £2 million where investments are in KIC), how you want the relief attributed to them.

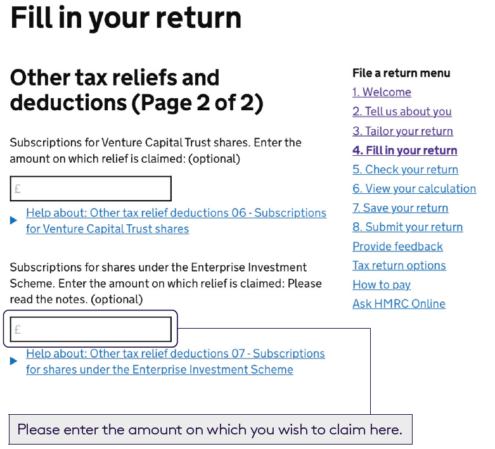

Claiming through your self-assessment tax return (online)

Claiming through your self-assessment tax return (online)

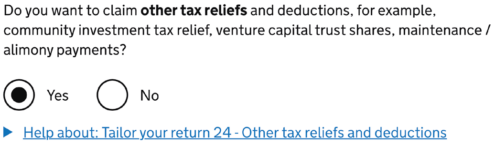

When completing your tax return online, you’ll need to ‘tailor your return’. This is based on your personal circumstances during the tax year you are filing for.

Please choose ‘Yes’ to the question below in section 3.

This will add ‘other tax relief and deductions’ to section 4 of your tax return ‘Fill in your return’. On page 2, you’ll need to enter the total amount of EIS subscriptions on which you’re claiming and provide details of each of your EIS investments. Remember, this is based on the amount invested, not the amount of tax relief you’d like to claim.

Please note, you don’t always need to send your certificates to HMRC when claiming income tax relief through a tax return. However, you need to have received them to be able to submit your tax return. HMRC might ask you to provide them with the certificates in the future, so keep them safe. You’ll also need a copy if you’d like to claim capital gains deferral in the future.

Claiming capital gains deferral

Claiming capital gains deferral

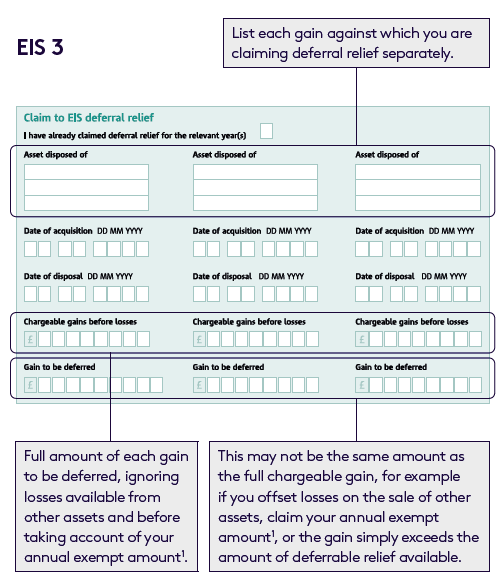

Complete the EIS deferral section of your EIS form and attach it to your tax return.

The SA100 form and online tax return also have a supplementary section called ‘Capital gains summary pages’ where you should provide details of the gains you are claiming against.

You can only do this for chargeable gains arising in a previous tax year, if the EIS shares were issued in the current tax year. If you’d like to defer gains arising in the current tax year, you’ll need to wait until you’re filing a tax return for this tax year.

1 Annual exempt amount is the annual tax-free amount you as an individual are usually entitled to each tax year, before you have to pay capital gains tax

If you’d like to claim income tax and capital gains deferral together or separately, there are some points to consider.

Together

When claiming your income tax relief (following the process above), you’ll also be able to claim any deferred gains. If you’re looking to defer gains in a previous tax year, and the EIS shares were issued in the current or previous tax year, you can send the EIS form completed with details of the deferral with your tax return.

Separately

The key thing to bear in mind if you’re looking to claim these reliefs separately (e.g. if the gain you’d like to defer is in the current tax year, but you’d like to claim income tax relief for the previous tax year) is that you retain a copy of your EIS form and certificate. Whilst HMRC may not request this in all cases, you will need to provide a completed original or copy of the form when you want to claim capital gains tax deferral.

Tax benefits and risks of EIS investments

Reminder of the tax benefits and risks of EIS investments

Key tax benefits

- Income tax relief: 30% income tax relief on the amount invested (provided the shares are held for at least three years).

- Tax-free capital growth: If the shares are sold for more than the original amount invested the growth should be free from capital gains tax (provided the shares are held for at least three years).

- Loss relief: If a company fails, relief can be claimed against either income tax or capital gains tax liabilities (reduced by any income tax relief claimed).

- Capital gains deferral: If an investor decides to reinvest the capital gain on the sale of another asset into an EIS-qualifying company, they can defer the gain until the EIS shares are sold, or eliminate the gain on death.

- Inheritance tax relief: EIS shares held at death should qualify for business property relief and pass to beneficiaries free from inheritance tax, provided they have been owned for at least two years.

Key risks

- Capital at risk: This is an investment in earlystage companies. It’s possible that some or all of the companies could fall in value, potentially to nil. Investors may not get back the full amount invested.

- The investment is high risk: Investing in smaller companies is considered a high-risk investment. They can fall or rise in value much more sharply than shares in larger, more established companies.

- The investment is illiquid: While the minimum holding period required for EIS tax relief is three years from the date of investment into each company, you should be prepared to hold your shares in each company for at least five years, and potentially up to ten years or more.

- Tax treatment: Tax treatment depends on personal circumstances and may change in the future.

- Companies may cease to be EIS-qualifying: A number of EIS tax reliefs depend on the portfolio companies maintaining their EIS-qualifying status for at least three years. Due to the nature of EIS investments, it is possible that a company might

cease to be EIS-qualifying. EIS reliefs previously granted could be repayable to HMRC.

FAQs

Frequently asked questions

How do I find my certificates?

You won’t be able to claim any EIS reliefs until you’ve received an EIS certificate.

If you’re invested in an Octopus Ventures EIS, all EIS certificates are issued electronically. The easiest way to keep up to date with your investment or the progress

of your EIS certificates, is through our online portal at portal.octopusinvestments.com. You can also call us on 0800 316 2295 if you’ve got any questions about anything in this guide.

When will I receive my EIS certificates?

The timing of when you will receive your EIS certificate will be dependent on your EIS manager, and whether you are invested in an unapproved or approved EIS portfolio/fund.

If you’re invested in an Octopus Ventures EIS, we’ll upload certificates to our online portal once we receive them from HMRC.

If you’re invested in an unapproved portfolio/fund, the EIS certificates are typically made available within six months of each investment, however some can take up to 12 months.

If you’re invested in an approved portfolio/fund, the EIS 5 will be available once we complete every investment from the Fund, and receive certificates for each individual investment from HMRC. This is typically 6 to 12 months after the final investment has been made by the Fund. Please note that timing cannot be guaranteed.

Which tax year is my claim based on?

Income tax relief

If you’re invested in an unapproved portfolio/fund, the tax year of your claim is based on the date your shares were issued to you, which is listed on each EIS 3 certificate you receive. The date of the EIS 3 certificate itself does not affect the tax year of the claim.

If you’re invested in an approved portfolio/fund, income tax relief is based on the tax year the portfolio/fund closes, not the date the underlying companies were invested into. This will be reflected on the EIS 5 certificate you receive.

Deferral relief

For both unapproved and approved EIS portfolios, deferring gains on the sale of other assets are by reference to the date of investment into each EIS company in the portfolio.

How do I find out more about my PAYE code or tax return?

For questions about PAYE, your tax code or your tax return call 0300 200 3300 or your usual tax office.

1 The tax year begins on 6 April and ends on 5 April the following year.

2 Knowledge Intensive Companies (KICs) are companies that consider research and development as its main business activity.

3 Please note, while the tax regulations refer to Enterprise Investment Schemes as ‘funds’ they should not be confused with mutual funds or collective investment schemes. An investor in an EIS fund will be the owner of shares in the underlying companies, rather than owning shares or units in any fund.

4 Be careful not to insert the nominal value which is shown above the number of shares on each certificate. The nominal value is the minimum price at which shares can be issued and is required under company law. It is not linked to the price you paid for your shares and does not affect the amount of tax relief you can claim.

We’re here to support you

Need help with our website, accessing live updates, or looking for general support? We’ll have one of our team give you a call.

Contact our team

Got a question?

Call us at 0800 316 2295