Tax-efficient investment strategies for business owners

Smart solutions for business owners

For many business owners, becoming more tax-efficient is a priority

Many business owners find it harder to extract profits from their business tax-efficiently.

The investment landscape has changed recently. Business owners are looking for ways to reduce their personal tax liabilities and put their company’s cash to work.

Inflation-beating investment returns are proving harder to come by. And businesses holding large sums of cash on deposit have even fewer options.

Fortunately, financial advisers can recommend some solutions. One option is government-approved, tax-efficient investments.

This way, business owners can feel confident they’re helping companies like theirs grow and prosper while benefitting from tax relief on their investment.

Tax-planning ideas for business owners

This guide intends to help financial advisers, solicitors, accountants and other professionals to identify scenarios where tax-efficient investments can help business owners to:

- Plan for income tax.

- Plan for inheritance tax.

We focus on Venture Capital Trusts (VCTs), the Enterprise Investment Scheme (EIS) and investments that qualify for Business Relief (BR). You can use the client planning scenarios here to help people facing several challenges.

It’s worth noting that the valuable tax incentives available to investors depend on them being prepared to accept the additional risks associated with investing in UK smaller companies.

Read more about these risks later on or jump straight to them here.

Planning for income tax

Business owners have always looked for ways to be more tax-efficient, but it’s becoming more challenging.

Historically, the simplest ways for a business owner to reduce their income tax liability would be to invest larger sums into their pension or pay themselves a dividend. This used to attract a lower rate of tax. However, both of these options have become more expensive.

Pension provision

On 6 April 2016, the lifetime allowance (LTA) was set at £1 million for most people. Since then it’s only seen modest increases in line with inflation.

If your client has a pension pot worth more than £1.07 million when they start to benefit from it, they’ll have a tax charge of 25% if benefits are withdrawn as income.

A 55% tax charge is applied to the excess value If your client withdraws a cash lump sum from their benefit pot.

This test is applied every time the pension benefit is accessed, and if your client hasn’t taken all their benefits by 75 years old.

From April 2020, the annual allowance sits at £40,000 but tapers for those earning adjusted income over £240,000. This means for every £2 of adjusted income over £240,000, an individual’s annual allowance is reduced by £1. The minimum annual allowance is £4,000. Any contributions your client makes above their annual allowance don’t receive tax relief.

The dividend tax

Many small business owners take a salary from their company and receive additional income from dividends. In April 2018, the rate of tax applicable to dividends was changed. While this benefited individuals who previously paid tax on modest share portfolios, it means business owners who receive higher dividends from their company face a bigger tax bill now.

The benefits of tax-efficient investing

Most investors are aware of the benefits of investing tax-efficiently through a pension or an Individual Savings Account (ISA). But investors with significant sums to invest each tax year may want to consider VCTs and EIS.

VCTs and EIS both offer incentives, including the potential for tax-free growth. Plus, there’s the added attraction of providing investors with up-front income tax relief when investing.

We explain the features of VCTs and EIS here. Of course, neither VCTs nor EIS should be considered as a replacement for pension investments. It’s important to consider tax-efficient investments as part of a well-diversified investment portfolio.

Comparing EIS and VCTs for business owners

Both offer 30% upfront income tax relief. They invest in small companies with growth potential but target different outcomes for investors.

| EIS portfolios | VCT | |

|---|---|---|

| Structure | Investors hold shares directly in each company | Investors hold shares in a larger, listed company, the VCT |

| Primary return to investors | Capital growth. | Income stream. |

| Relief on returns | Growth is tax free. | Dividends are tax free. |

| Investment horizon | Long term – exits on sale of each company and investing for growth takes time. | Minimum hold is 5 years but can ask to sell shares at any time. |

| Diversification | Smaller number of companies in portfolio – typically 5-15. | Investment spread across between 20-85 holdings in the VCT. |

| Stage of growth | Only early-stage companies. | Range of early-stage and more established companies. |

| Risk of failure | 45% loss relief on each company that fails irrespective of portfolio performance. | Losses and gains are offset within the VCT. |

| Maximum investment | £1 million in a tax year. | £200,000 in a tax year. |

| Inheritance tax relief | Yes – shares should qualify for BR if held for two years at time of death. | No – investment is into the shares of a listed company so cannot qualify for BR. |

Three reasons to invest in VCTs

- VCTs have become an increasingly popular part of annual planning alongside pensions and ISAs.

- VCTs have potential to pay tax-free dividends. This is good for those clients who want to supplement their income during retirement.

- When it comes to selling shares in a VCT, it’s usually easier to return the proceeds to investors than a portfolio of EIS-qualifying companies.

Three reasons to invest in EIS

- An EIS qualifying portfolio can provide a way to target high growth with some attractive tax benefits. These benefits provide investors with an incentive for the risk they take, including to provide relief in cases were the investments to lose value.

- Investments are made directly into smaller companies, typically resulting in returns in capital growth. Although there will be limited opportunities to exit each portfolio company outside of an exit event.

- For some investors, an EIS qualifying investment can also provide the opportunity to defer the payment of Capital Gains Tax (CGT) due on the sale of other assets.

Important risks to consider

Clients need to understand the risks associated with VCT and EIS investments.

Investors could lose their money: The value of an investment, and any income from it, could fall as well as rise, and investors may not get back the full amount invested.

Shares may be difficult to sell: There isn’t an active market for VCT or EIS shares in the way there is for shares in big companies like BP and Vodafone. This means if your client decides to sell their shares, they may not be able to find a buyer. Or they may have to accept a price lower than the net asset value of the investment. Additionally, investors will often only be able to exit EIS companies during an exit event. The shares of the smaller companies invested in could fall or rise in value more than shares listed on the London Stock Exchange.

Tax rules can change: Rates of tax, tax benefits and tax allowances do change. The tax benefits available to investors through EIS and VCTs depend on an investor’s circumstances. Tax reliefs depend on the portfolio companies maintaining their qualifying status. HM Treasury can change the definition of a qualifying investment in the future. This could impact the nature of new investments an EIS or VCT can make over time.

Planning for inheritance tax

Many people sit on a potential inheritance tax liability and are either unaware of it or unsure what to do about it.

HM Revenue & Customs (HMRC) is collecting more inheritance tax than ever before. In 2019-20 inheritance tax receipts topped £5.2 billion. HM Treasury expects this number to rise to £6.7 billion in 2023-2024. What’s more, the threshold at which inheritance tax is paid on an estate – the ‘nil rate band’ – is just £325,000 and is expected to remain frozen until April 2021.

Thanks to rising property prices, even the new inheritance tax allowance – the ‘residence nil-rate band’ – can’t prevent families left with an unexpected and sizeable inheritance tax bill.

Most business-owning clients will have a business that qualifies for Business Relief, which opens up unique opportunities when planning for inheritance tax. And it opens the door for much-needed and timely advice.

Business Relief

Business Relief (BR) has been a part of inheritance tax legislation since 1976. The main aim of BR was to make sure a family-owned business could survive after the death of its owner by avoiding the need to sell the business to pay an inheritance tax liability. Over time, successive governments have expanded BR, and now it’s an investment incentive for private investors as well.

BR is a tax relief that encourages investment in trading businesses, regardless of whether the investor runs the business. It specifically rewards those investors willing to accept the potential additional risk of investing in companies that aren’t listed on the London Stock Exchange. Investments that qualify for BR can be passed on free from inheritance tax when a shareholder dies. Your client must have owned it for at least two years when they die. And there is no maximum amount of investment that can qualify.

Business Relief explained

Three reasons to invest in BR-qualifying companies

Speed

A BR-qualifying investment can be passed on at death free from inheritance tax if it’s been held for at least two years. Usually, a gift takes seven years for the estate to achieve full inheritance tax exemption.

Access and ownership

BR-qualifying investments can be kept in your client’s name rather than put in a trust or gift permanently. And, subject to liquidity, your client can ask to sell shares, have proceeds returned to them or set up regular withdrawals to meet their needs, such as care home fees.

BR-qualifying investments do not use the nil-rate band

Investors can use their £325,000 allowance to reduce the inheritance tax charge on less liquid assets, such as their home. Homes are difficult to remove from the estate when planning for inheritance tax.

BR-qualifying investments should be considered as an investment in their own right. The tax incentives are intended to encourage investment in unquoted and AIM-listed companies given additional investment risks.

Important risks to consider

BR-qualifying investments may not suit your client. Your client must understand the risks associated with such an investment.

Investors’ capital is at risk

Investments will be made in trading companies that are not listed on a main stock exchange. The companies invested in could fall in value. And investors may get back less than they invest.

Shares could be more volatile and less liquid

Investments in unquoted companies or those quoted on the Alternative Investment Market (AIM) are likely to have higher volatility and liquidity risk than securities on the London Stock Exchange’s main market.

Tax rules and reliefs can change

Tax rules could change in the future. The value of tax reliefs will depend on your client’s circumstances. BR is assessed when a claim is made, and there can be no guarantee that a company will remain BR qualifying.

Tax reliefs depend on the portfolio companies maintaining their qualifying status.

Investing in VCTs to complement existing pension arrangements

Investing in a VCT could help high-earning staff or directors at risk of hitting the Lifetime Allowance for pension contributions.

Successive governments have reduced the amount of money individuals can invest tax-efficiently in a personal pension over their lifetime. Some of your clients may one day have to stop contributing to their pension altogether.

And it’s not only top-rate taxpayers who are likely to be affected. Thanks to decades of compounding, even those investing relatively modest annual amounts throughout their working life could be forced to stop paying into their pension early or risk breaching the new limits. It could make life increasingly difficult for people facing a lengthy – yet underfunded – retirement.

High earners’ ability to make annual pension contributions tax-efficiently can be restricted to as little as £4,000 a year, following changes to the tapered annual allowance for additional rate taxpayers in 2020.

How a VCT can help

High earners comfortable with the risks of investing in UK smaller companies could invest in a VCT.

Your client can claim 30% income tax relief on up to £200,000 invested in any single tax year if they hold the VCT shares for at least five years. And where the income tax relief claimed doesn’t exceed the amount they expect to pay.

A high earner could even consider investing annually in a VCT. And build a tax-efficient investment to sit alongside their pension.

One of the biggest attractions of VCTs – particularly among income-seeking investors – is the potential to pay tax-free dividends.

However, VCT dividend payments aren’t guaranteed, so your client should take a close look at:

- The track record of the VCT manager, although past performance is not a reliable indicator of future results.

- The investment policy.

- And any dividend targets the manager will be looking to achieve.

The tax benefits of investing in VCTs

Your client can benefit from upfront tax relief on investments

Watch our video introduction

Familiarise yourself with the basics of VCTs

Extracting profits from a company tax-efficiently

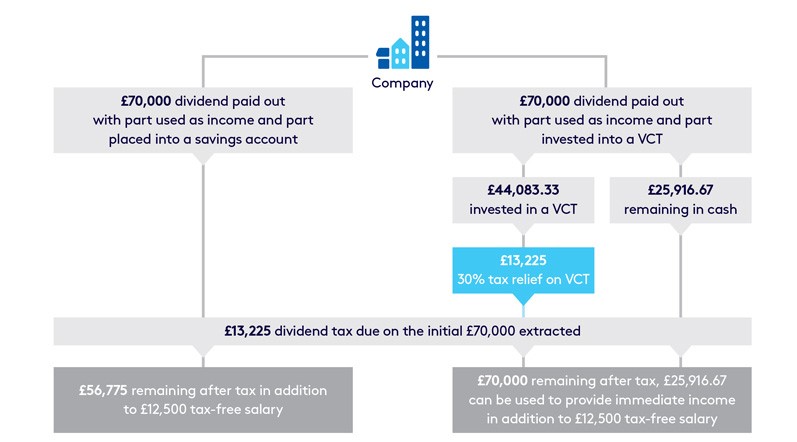

Investing in a VCT could help to extract surplus cash from a company in a tax-efficient manner.

Many small business owners often take a small, regular salary from their company. When there’s enough profit, they use dividends for extra income.

But while introducing an annual dividend allowance means individuals paying less income tax on modest share portfolios, business owners who expect to receive higher dividend income now face significantly larger tax bills.

How a VCT can help

It’s usual for self-employed consultants to use a limited company structure to work with several different companies.

For example, an IT consultant with a limited company could pay themselves an annual salary of £12,500. This salary would be tax-free, as it sits within the consultant’s personal allowance.

A consultant who stands to receive an additional £70,000 in dividends would need to know how these dividends would be treated when they withdraw them:

- The first £2,000 would be tax-free.

- The next £35,500 would be taxed at the basic rate of 7.5% (a tax liability of £2,662.50).

- The remaining £32,500 would be taxed at the higher rate of 32.5% (a tax liability of £10,562.50).

- This equates to an income tax bill of £13,225 leaving an after-tax sum of £56,775 from the dividends in addition to their salary.

Providing the consultant is comfortable with the higher risks of a VCT; they could invest a portion of their income for a minimum of five years.

They could claim 30% income tax relief on up to £200,000 invested in any single tax year, provided they hold the VCT shares for at least five years. The upfront income tax relief claimed through a VCT could offset the tax bill due on the dividend.

In this scenario, as a VCT investor, the consultant also benefits from tax-free dividends from the VCT. They would have no capital gains tax to pay if the VCT shares have grown in value when they decide to sell.

Investing dividends tax-efficiently in a VCT

Read the planning scenario on extracting money from a business.

The business owner can claim 30% income tax relief on their VCT investment. They can use it to offset the dividend tax due to the declared dividend (provided the owner holds the shares for a minimum of five years).

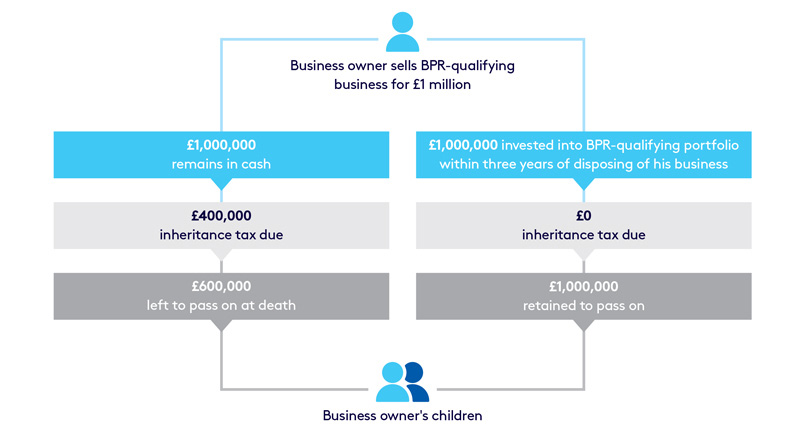

Retaining inheritance tax relief following the sale of a business

Someone planning to sell their business could invest the proceeds to reduce a potential inheritance tax bill due on their estate.

Take the example of a client who sold their business due to ill health. He holds £1 million proceeds in cash.

He’d like to leave this to his three daughters without them facing a large inheritance tax bill. When the client still owned his company, his shares would have qualified for BR upon his death. This means, he could have passed these shares to his daughters free from inheritance tax. But because he’s sold the business, the proceeds will now be subject to inheritance tax.

Now he’s sold the business, how could BR-qualifying investments help?

Given the client’s deteriorating health, an adviser would likely caution against traditional forms of estate planning, such as gifts and trusts. These take seven years before becoming inheritance tax-free. New investments into BR-qualifying shares usually take two years to become exempt from inheritance tax.

However, there is a three-year window during which some or all of the proceeds of a qualifying business sale can be invested back into BR-qualifying assets.

This is known as ‘Replacement Relief’.

If the client invests some or all of the sales proceeds into a BR-qualifying investment, it would immediately be exempt from inheritance tax.

The serial entrepreneur

Serial entrepreneurs wishing to take time out before another business venture can invest some or all sale proceeds into BR-qualifying investments.

While placing invested capital at risk, this planning could potentially eliminate the inheritance tax bill in the interim. And it provides the opportunity for their next business to instantly qualify for BR without resetting the two-year clock.

Business owners realising a large sum on their business’s disposal may want to use a discretionary trust to make early provision for future generations.

As your client’s investment should qualify for Replacement Relief, they could settle the new BR-qualifying investment into trust for the long term. They won’t need to wait for two years first and should not be required to pay the Chargeable Lifetime Transfer (CLT) charge of 20%.

Claiming relief on a business already sold

Watch this video about Alan, who sold his business in the last three years

Business owners investing proceeds for the future

Investing in an EIS portfolio can provide attractive tax benefits while backing other small business owners.

Business owners can have lots to think about when they sell their business. They go from having a large portion of their wealth tied up in their business to receiving a lump sum.

Many clients will have plenty of ideas about what they need this lump sum to deliver for them. It could be an income stream, start a new enterprise, or make investments for the future.

When selling a company, business owners typically benefit from some or all of the gain being taxed at a favourable rate of 10% Capital Gains Tax (CGT). This used to be called Entrepreneurs’ Relief and applied to the first £10 million of gains during a lifetime.

But since April 2020, it has been renamed Business Asset Disposal Relief (BADR) and is limited to the first £1 million of lifetime gains.

Why EIS might be interesting for small business owners

EIS portfolios invest in a portfolio of small companies with the potential for high growth. This can be attractive to business owners who want to use some of the proceeds from selling their own business to back fellow entrepreneurs. And they can afford to invest for the long term in high risk investments.

To qualify for EIS relief, companies must be small and at the start of their growth journey. These qualifying companies allow an investor to claim generous tax reliefs.

Your client gets upfront income tax relief at 30% of the amount invested. And any growth will be free from CGT. If a company fails to perform, your client can claim the net loss (amount invested less upfront income tax relief claimed) against income tax or capital gains tax.

This is a significant benefit when making a high risk investment.

Two extra reliefs for business owners who’ve recently sold their business

1. CGT deferral relief

CGT deferral relief allows a business owner to invest some of the capital gain realised on the sale of their business and defer the CGT due on it until a later date.

If the gain invested would have been covered by BADR, when each company in the portfolio is sold, the gain will revert at the BADR rate. If the gain invested was outside of BADR, then CGT rates applicable at that time would apply at the investor’s marginal rate.

The investment into qualifying shares must be made within three years of the business sale or made up to a year before a future sale to qualify for deferral relief.

2. Business Relief (BR)

EIS qualifying companies benefit from BR relief from inheritance tax.

Usually, unlisted businesses qualify for BR, although not all will. If the business sold qualifies for BR and is owned for at least two years before disposal, the EIS-qualifying shares will have a further benefit of qualifying for BR immediately.

This is due to a relief called “replacement relief”.

While unlikely to be a motivation to invest, it can be reassuring for a business owner to know that the investment should pass free from inheritance tax if they die while still invested. Any deferred gain will also be eliminated upon death.

Let’s look at an example.

A business owner sells her company for £2 million. She’s invested £500,000 in it over the years. The £1.5 million of growth will be subject to capital gains tax, £1 million at 10% (BADR) and £500,000 at the owner’s marginal rate of 20%. She invests £200,000 of the gain into a portfolio of 10 companies that each qualify for EIS six months later.

Here are the benefits:

- Claiming £60,000 of tax relief against her income tax bill for the current or previous year.

- CGT deferral relief allows her to reclaim £40,000 of capital gains tax paid on the disposal. This gain will come back into charge later when the shares are sold (even if they make a loss).

- Reassurance of knowing that if she unexpectedly passes away, her investment will pass to her children free from inheritance tax. If this were to happen, the deferred gain would be eliminated.

- And she is excited about backing potential future success stories and comfortable with the risk of losing her capital.

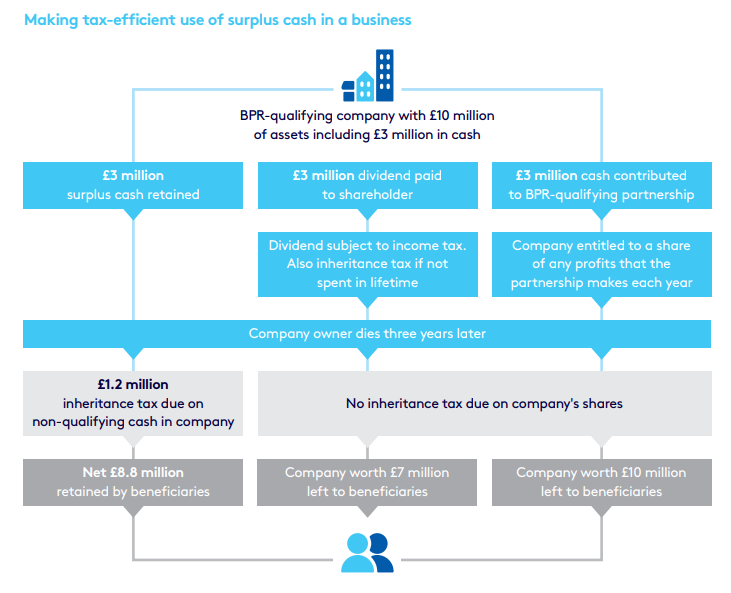

Companies looking to retain BR-qualifying status

Business owners need to make sure their company doesn’t fall foul of BR qualification rules

Companies that hold a significant cash surplus run the risk of being classed as an investment – rather than a trading business.

If your client fails to use cash in qualifying activities, it could mean that an otherwise BR-qualifying company’s shares do not qualify wholly or in part for BR when the business owner dies.

The resulting inheritance tax bill could mean the company has to be sold to pay the bill. And the owner’s wishes for the company and their beneficiaries doesn’t go to plan.

What options are available?

Business owners could take cash out of the company. This removes the non-BR-qualifying element. However, there are lifetime tax implications with this approach. Unless the owner spends the money before they pass away, it will still be subject to inheritance tax.

Plus, removing cash from the business may be impractical if the owner wishes to keep it in the company for future business use. An alternative option is to keep the cash within the company and use it for further trading activities.

Your client can also deploy capital in a different sector by contributing capital to trades carried on in partnership with other like-minded companies. A professional manager oversees this.

Becoming a member of a partnership that carries out qualifying trades would place capital at risk, but potentially restore BR. Once the cash balance has been deployed, the company could be 100% BR qualifying.

Putting cash to work in qualifying business activities offers the potential to generate additional profits for the business.

Let’s look at an example

A business owner with a trading company expects to qualify for BR with £10 million of assets. Following the sale of a warehouse, there’s £3 million in cash. Their tax adviser has warned that when they die, inheritance tax may be due on non-qualifying cash. The diagram below shows how the business owner could make tax-efficient use of surplus cash in their business.

Additional client scenarios

There are many other ways in which tax-efficient investments can help business owners with lifetime planning. Here are some examples:

VCTs can help buy-to-let landlords who get most of their income from their property portfolio to access upfront income tax relief. And VCTs can help them build an investment pot for retirement.

Business owners looking for tax-efficient pension drawdown

The upfront income tax relief available on a VCT can be used to offset the tax paid on pension drawdown post-retirement. This helps make pensions even more tax-efficient.

Clients with large income tax bills and current year plans to match

Some clients might want to invest in a VCT in the current year to diversify their portfolio and benefit from income tax relief on their investment. But they may have plans to spend their current year’s income elsewhere. Some VCTs accept investments through an ISA transfer. This maintains funds within the ISA wrapper while benefitting from the growth and tax relief that VCTs can afford.

Older people with large sums in ISAs

Many people are not aware that their ISAs will be subject to inheritance tax. Since 2013, investors have been able to access the AIM market through ISAs. Provided an ISA invests only in companies that qualify for BR, it can offer inheritance tax exemption as well as the traditional ISA benefits of tax-free income and capital growth.

Companies concerned about FRS102

For accounting periods starting after 1 January 2016, small companies must account for investment bonds at fair value each year. This can mean that Corporation Tax is payable before the bond pays out.

Investing in certain BR-qualifying businesses can avoid this mismatch, and provide additional tax benefits.

High net worth individuals setting up a Family Investment Company (FIC)

BR-qualifying investments may appeal to families looking to plan for future generations by managing some of their family’s wealth in a limited company.

Related tax-efficient investment resources

Inheritance tax investments from Octopus

We help investors reduce their estate’s inheritance tax liability while retaining access to their wealth.

Octopus Inheritance Tax Service

Save this guide for later

Download our guide to untangling inheritance tax straight to your device.

Enterprise Investments Schemes

Investments in exciting early-stage companies for people who are comfortable with high risk.

Venture Capital Trusts

Access attractive tax reliefs as an incentive to take on the risk of backing early-stage businesses.