Extracting money from a pension

When a retired client doesn’t need immediate access to the money in their pension, they may be looking for ways to extract it in a tax-efficient way.

This tax-planning scenario shows how investing in a Venture Capital Trust (VCT) could make the most out of money extracted from a pension.

Build appropriate strategies for your clients

This scenario might be useful for clients who:

- are retired

- don’t need immediate access to the money in their pension

- are looking for tax-efficient extraction options

Things to keep in mind

- Nothing in this scenario should be viewed as advice.

- Any suitability decisions should be based on a client’s objectives and needs, as well as their attitude and capacity for risk.

- You should consider the value, eligibility and timings of tax reliefs and liabilities.

- You should consider the impact of relevant product charges (including initial and ongoing) like administration fees and annual management charges.

Scenario

Kate needs a tax-efficient way to extract money from her pension

Kate’s been paying into her defined contribution pension for many years and has saved up a large sum of money. She’s been retired for five years and is financially comfortable.

Kate’s daughter recently had a second child. Although her grandchildren won’t go to school for several years, Kate wants to plan for supporting their education.

Kate wants to take advantage of pension freedoms and extract some money from her pension to help fund their future schooling. She’s looking at options for the most tax-efficient way to do this.

Kate’s financial adviser suggests investing in a Venture Capital Trust (VCT)

Kate talks to her financial adviser, who makes an assessment based on:

- her risk profile

- her investment time horizon: more than five years

- her attitude towards investing in smaller companies

Based on those factors, Kate’s adviser suggests investing in a VCT.

With a VCT, Kate can claim up to 30% income tax relief on up to £200,000 invested in any single tax year, as long as she holds her VCT shares for at least five years. Kate can also benefit from tax-free dividends, and won’t have to pay capital gains tax when she sells the shares. But please bear in mind that the amount of income tax relief Kate can claim cannot exceed the amount of income tax she owes.

Risks

Risks to remember when investing in a VCT

- VCTs aren’t suitable for everyone. They’re high risk and should be considered as long-term investments. The value of an investment, and any income from it, can fall or rise. Investors may not get back the full amount they invest.

- Tax treatment depends on individual circumstances and tax rules can change in the future. Tax reliefs also depend on the VCT maintaining its qualifying status. Tax relief is available on investments of up to £200,000 per year.

- VCT shares could fall or rise in value more than other shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

VCT overview

An overview of VCTs

VCTs were first introduced in 1995 and they’ve grown in popularity since. They’re a good fit for investors who:

- already have personal pensions and Individual Savings Accounts (ISAs)

- are comfortable with higher risk investments

VCTs have a different risk profile to pensions and ISAs and shouldn’t be compared on tax reliefs alone. A VCT isn’t likely to be suitable for investors who:

- need guaranteed income

- can’t tolerate loss

- want to keep immediate access to their money

How it works

Tax benefits of investing money extracted from a pension in a VCT

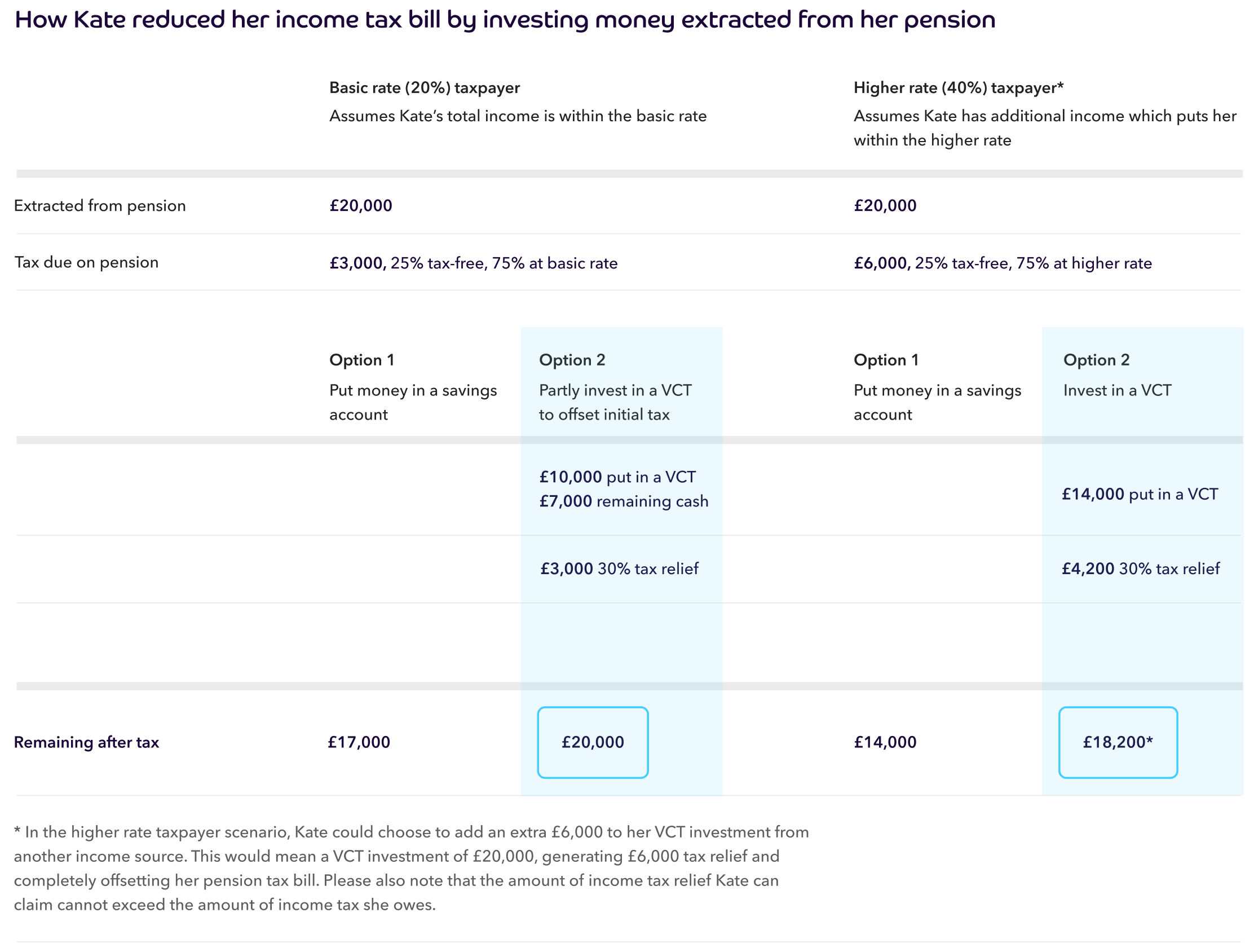

Here’s an example that shows how Kate could reduce her income tax bill by investing money she extracts from her pension into a VCT. There are two options, depending on whether Kate’s a basic or higher rate taxpayer.

Things to remember about this example

- In this example, we’ve assumed no gain or loss on investments, and it doesn’t take into account any initial fees or ongoing charges.

- When clients choose to sell VCT shares, they’re often sold at a small discount to the value of their underlying net asset value.

- Please note that when selling shares in a VCT, it is not possible to claim tax relief on new shares bought in the same VCT within six months of the sale. You should consider the impact of this when assessing any specific products.

- Before investing in a VCT, investors should read the product prospectus and Key Information Documents (KID).

Our VCTs

Interested in VCTs?

We’re the largest provider of VCTs in the market, offering

three types of investments that can provide attractive tax reliefs.

Octopus AIM VCTs

closed

Two VCTs featuring established portfolios of around 80 AIM-listed companies with growth potential.

Octopus Apollo VCT

closed

A portfolio of around 45 established smaller companies which targets commercialised businesses looking to scale.

Octopus Titan VCT

closed

The UK’s largest VCT invests in a portfolio of over 140 early-stage companies with the potential for high growth.

About Octopus

We’re a financial services provider with a difference. Our main goal is to help people plan for their financial future, so we’ve built market-leading positions in tax-efficient investment, smaller company financing, renewable energy and healthcare.

Related VCT resources

Venture Capital Trusts Explained

Learn how VCTs function, the types of early-stage companies they invest in, and the tax benefits and risks involved.

How to claim VCT tax relief

Learn how to claim up to 30% income tax relief on Venture Capital Trust (VCT) investments and enhance your understanding to support your clients’ investment decisions.

VCT FAQ’s

Our easy-to-read guide answers common questions about Venture Capital Trusts (VCTs), designed to help you understand VCTs better and assist your clients with confidence.