Estate planning for clients who’ve sold a business in the last three years

What to do for clients who’ve sold a business in the last three years?

While a family business can be passed on to beneficiaries with relief from inheritance tax, if a client sells their business they lose that exemption.

Investments that qualify for Business Relief (BR) offer a way for clients who have sold a business in the last three years to invest some or all of the proceeds in an asset that should immediately qualify for inheritance tax (IHT) relief.

Remember, BR won’t be right for everyone. It puts investor capital at risk and comes with other considerations. We cover the risks in more detail in this scenario.

About this planning scenario

We created this tax planning scenario to help advisers develop suitable planning strategies for clients. It does not provide advice on investments, taxation, legal matters, or anything else.

Tax-efficient investments aren’t suitable for everyone. Any recommendation should be based on a holistic review of a client’s financial situation, objectives and needs.

Advisers should also consider the impact of

charges related to the product, such as initial fee, ongoing fees, and annual management charges.

Meet Harold

Meet Alan, who sold his business in the last three years

Alan sold his business two years ago for £3 million. He’s a widower and his health has recently deteriorated.

When he sold his business, he invested half of the proceeds to help generate a retirement income.

Alan would like to be able to leave proceeds from his investments to his three daughters without them facing a large inheritance tax bill.

Given Alan’s poor health, traditional forms of estate

planning, such as gifts and trusts, may not be suitable

because they will take seven years before providing

relief from inheritance tax.

Alan’s adviser explains that when Alan owned his company, his shares in the business would have been expected to qualify for Business Relief, meaning he could have left them to his daughters with relief from inheritance tax. However, the cash he received from selling the business will be subject to inheritance tax because of the size of his estate.

A tax-planning solution

The adviser assesses Alan’s objectives, appetite for risk

and capacity for loss and deems him suitable for an

investment that qualifies for BR. He suggests that Alan

invest £1 million of the cash proceeds from the sale of

his business in a BR-qualifying investment.

New investments into BR-qualifying shares usually take two years to qualify for relief from inheritance tax. However, Alan’s adviser has some good news.

He explains that there is a three-year window during which some or all the proceeds from selling a BR-qualifying business can be invested back into BR-qualifying shares. If Alan does this, the new BR qualifying investment should immediately qualify for relief from inheritance tax.

BR-qualifying portfolios invest in the shares of one or more unquoted or AIM-listed companies. They are higher risk investments than a portfolio of main market listed equities, and the tax relief is designed to provide some compensation to investors for taking additional risk.

Alan’s adviser explains the risks

Alan’s adviser makes it clear that BR-qualifying investments are high risk. The value of a BR-qualifying investment, and any income from it, can fall as well as rise. He may not get back the full amount he invests.

He also explains that BR is assessed by HMRC on a case-by-case basis, and that this assessment happens when an estate makes a claim. The ability to claim the relief will depend on the company or companies Alan invests in qualifying for BR at the time the claim is made.

Tax treatment will also depend on personal circumstances, and tax legislation could change in future.

While Alan is not expected to need to access this pot of money during his life, the investment will remain in his name, and so he will be entitled to request a withdrawal should he need to.

His adviser makes it clear that withdrawals cannot be guaranteed, as the shares of unquoted and AIM-listed companies can be harder to sell than shares listed on the main market of the London Stock Exchange. Their share price may also be more volatile.

How it works

How it works in practice

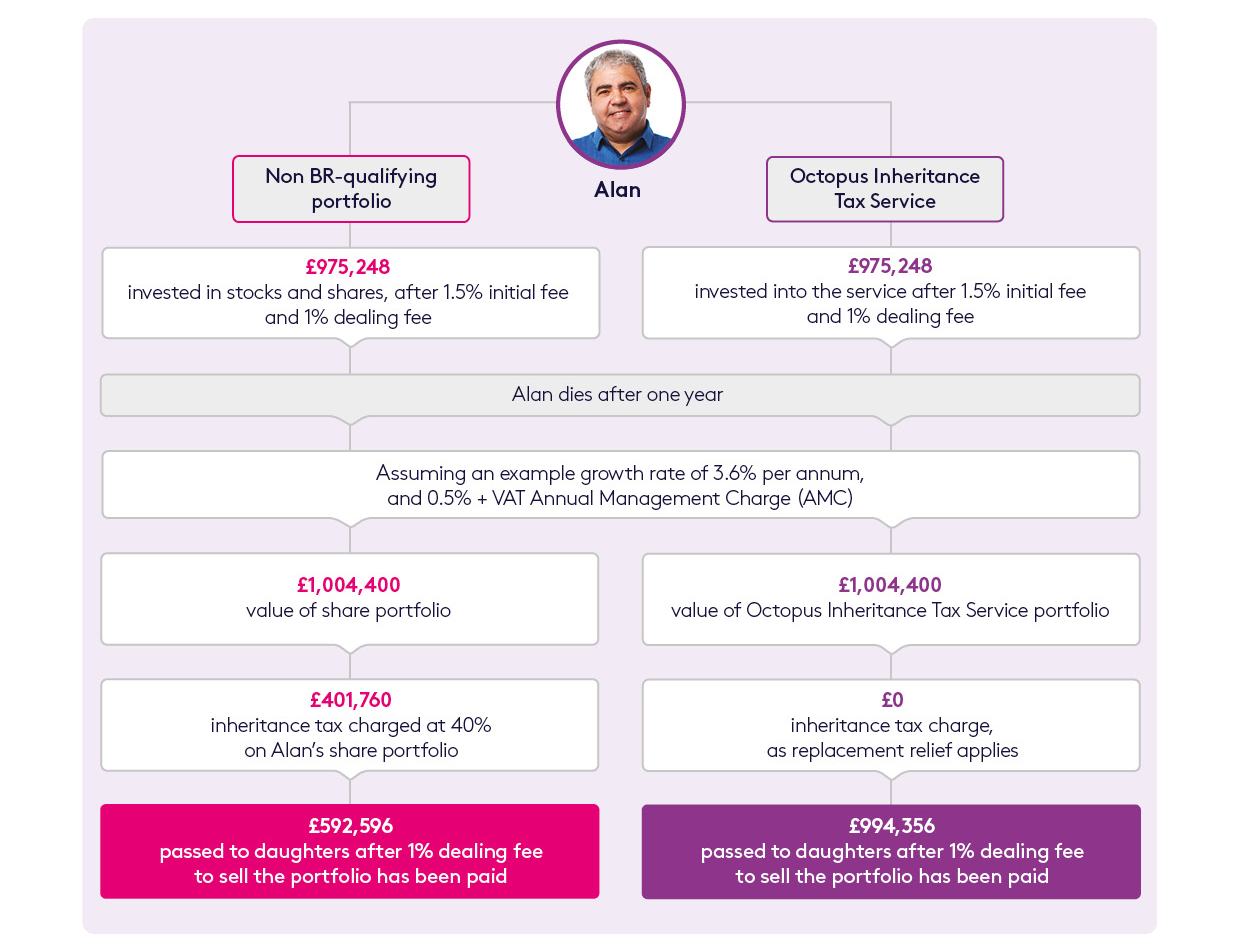

Let’s see how it might look if Alan were to invest in the Octopus Inheritance Tax Service, a service that invests in the shares of one or more unquoted companies expected to qualify for Business Relief.

Note: Tax legislation, rates and allowances are correct at time of publishing for the tax year 2025-26. This example is for illustrative purposes only and each investor’s own tax situation may be different. For ease of comparison, we’ve assumed identical charging structures, an annual growth rate of 3.6%, and that annual management charges are calculated and paid based on the investment value at the end of each annual period. The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ. This example does not include any charges paid for financial advice. In practice the Octopus Inheritance Tax Service has an initial charge of 1.5%, a deferred AMC of up to 0.5% + VAT and a dealing fee of 1%. AMC is calculated daily and paid pro-rata, contingent on performance, when shares are sold. This example assumes that the investments will be held until death and the nil-rate band is offset against other assets.

Get in touch with your local IHT expert to discuss this scenario

Please note

- This example is for illustrative purposes only and each investor’s own tax situation may be different.

- For ease of comparison, we’ve assumed identical charging structures, an annual growth rate of 3.6%, and that annual management charges are calculated annually.

- The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ.

- This example does not include any charges paid for financial advice.

- The Octopus Inheritance Tax Service has an initial charge of 2%, a deferred AMC of 0.5% + VAT and a dealing fee of 1%. AMC is calculated daily.

- This example assumes that the investments will be held until death and the nil-rate band is offset against other assets.

Find out more about how the Octopus Inheritance Tax Service could help clients like Alan

Other scenarios