Estate planning for clients who have a power of attorney in place

Estate Planning

What to do for clients who have a power of attorney in place?

Estate planning options can be limited where a power of attorney is in place. Any decisions made by the attorney will need to be in the best interest of the donor on whose behalf they’re acting.

Planning will of course depend on the donor’s circumstances and wishes but making lifetime gifts or settling assets into trust is typically difficult.

Investments that qualify for Business Relief (previously called Business Property Relief or BPR) are a potential solution for donors who have expressed wishes to plan for their estate. That’s because a BR qualifying investment stays in the donor’s name.

Remember, Business Relief (BR) won’t be right for everyone. It puts investor capital at risk and comes with other considerations that we explain further below.

About this planning scenario

This is a tax-planning scenario designed to help you build appropriate strategies for your clients.

This is a tax-planning scenario designed to help you build appropriate strategies for your clients.

Advisers should consider the value of tax reliefs for a client and the impact of charges relevant to the product represented or any product chosen.

Meet Barbara and Malcolm

Meet Barbara and Malcolm

Meet Barbara, who has lost capacity

Let’s consider a potential scenario that illustrates how a BR-qualifying investment can help clients plan for inheritance tax when there’s a power of attorney in place.

Barbara and Malcolm are 88 and 90. Both have lost capacity, and a lasting power of attorney is in place for their financial affairs, with their grandson acting as attorney.

Barbara and Malcolm’s grandson wants to help them stay in their home, where they receive at-home care. The cost of this care is being met by income from Barbara and Malcolm’s pensions.

He is also mindful of inheritance tax, and the fact that Barbara and Malcolm have expressed the desire to leave as much of their estate as they can to their great-grandchildren.

Although Barbara and Malcolm’s adviser explains that their ongoing needs are expected to be met from their income, their attorney is reluctant to make gifts from their estate in case they need access to the funds in the future.

A tax planning solution

The adviser assesses Barbara’s needs and objectives, appetite for risk and capacity to bear losses and suggests moving £300,000 of the couple’s existing investments into an investment that qualifies for Business Relief.

He explains that if BR-qualifying investments are held for two years and at the time of death, they are zero-rated for inheritance tax.

BR-qualifying portfolios invest in the shares of one or more unquoted or AIM-listed companies. They are higher risk investments than the couple’s existing investments, and the tax relief is designed to provide some compensation to investors for taking additional risk.

While they are not expected to need to access this pot of money during their lives, the investment will remain in their names, and so they can request a withdrawal should they need to. Their adviser makes it clear, however, that withdrawals cannot be guaranteed.

Key risks

The adviser explains the risks to the attorney

Making a BR-qualifying investment would put Barbara’s capital at risk. The value of their investment, and any income from it, could fall or rise, and they may not get back the full amount they put in.

BR-qualifying investments have to be made into unquoted or AIM-listed shares. The shares of unquoted companies and those quoted on the Alternative Investment Market can fall or rise by more than shares quoted on the main market of the London Stock Exchange. They may also be harder to sell.

Barbara’s attorney is made aware that requests to withdraw might not always be able to be met.

The couple’s adviser also explains that HMRC assesses BR on a case-by-case basis when an estate makes a claim. The ability to claim the relief would depend on the company or companies Barbara invests in qualifying at the time the claim is made. Tax treatment would also depend on their personal circumstances, and tax rules could change in future.

Get in touch with your local IHT expert to discuss this scenario

How it works

How it works in practice

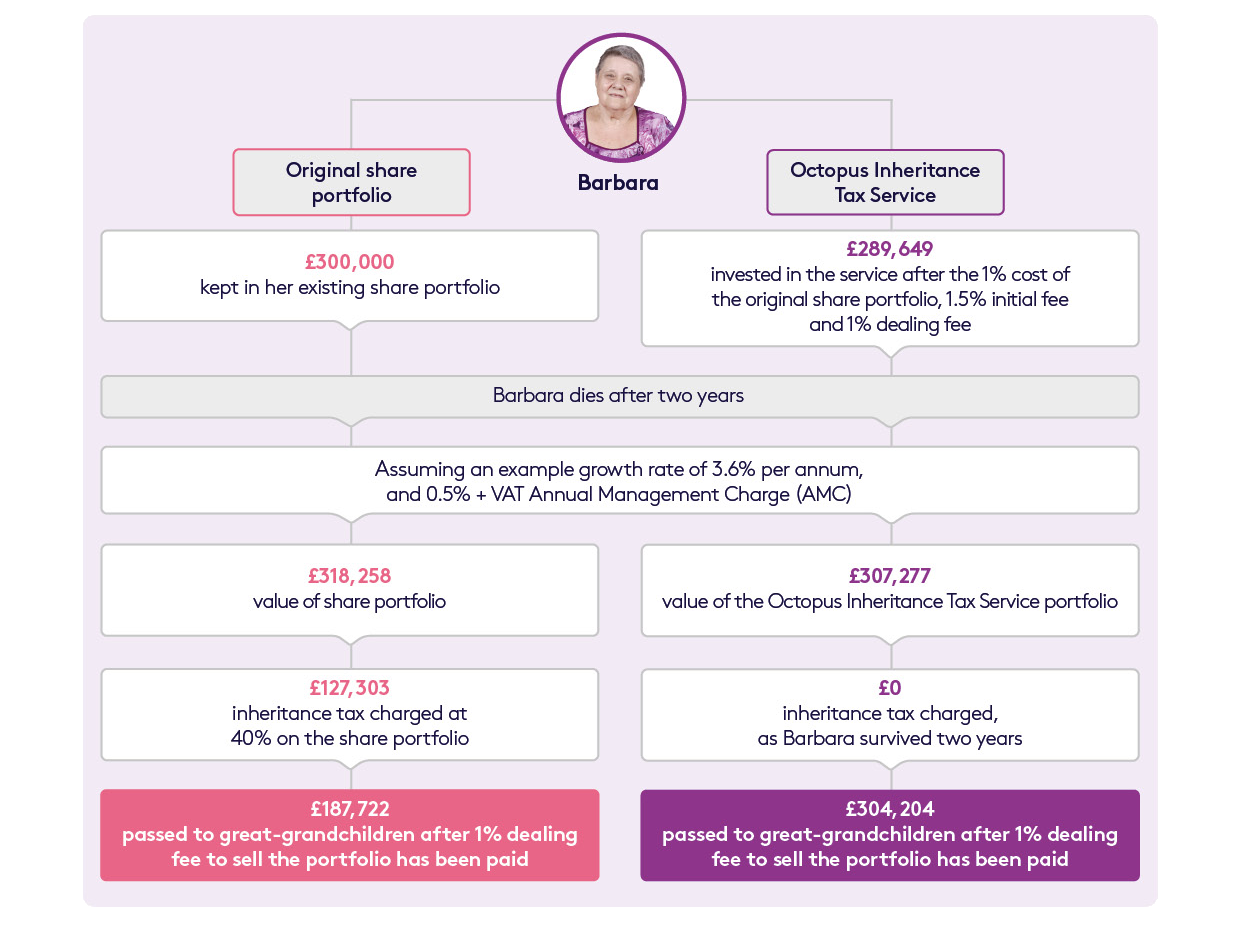

Let’s see how it would work if Barbara was to invest in the Octopus Inheritance Tax Service, a service that invests in the shares of one or more unquoted companies expected to qualify for Business Relief (previously called Business Property Relief or BPR).

Please note

- This example is for illustrative purposes only and each investor’s own tax situation may be different.

- For ease of comparison, we’ve assumed identical charging structures, an annual growth rate of 3.6%, and that annual management charges are calculated annually.

- The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ.

- This example does not include any charges paid for financial advice.

- The Octopus Inheritance Tax Service has an initial charge of 1.5%, a deferred AMC of up to 0.5% + VAT and a dealing fee of 1% for investments and withdrawals. AMC is calculated daily.

- This example assumes that the investment will be held until death, the nil rate band is offset against other assets, and the Octopus Inheritance Tax Service investment qualifies for BR.

Find out more about how the Octopus Inheritance Tax Service could help clients like Barbara

Other Scenarios

More tax planning scenarios?

Estate planning for clients who’ve sold a business in the last three years

Alan recently sold his business and wants to leave the proceeds to his daughters free of inheritance tax.

Estate planning for clients who want to retain access to capital

Carol is aged 86 with a large estate. She's worried about unexpected care costs and is reluctant to gift.

Estate planning for clients who worry it’s too late

Harold worries that in his 90s it's too late to plan for inheritance tax.

Estate planning for clients who want to settle assets into trust

Louise is worried that her child's marriage will end in divorce, and wants control over what will happen to her assets.

Estate planning for clients who want an inheritance tax-efficient ISA

Peter has a large ISA pot that's subject to inheritance tax. He wants to plan for inheritance tax but keep the benefits of the ISA wrapper.