Companies we’ve backed: WaveOptics

Looking to the future of augmented reality

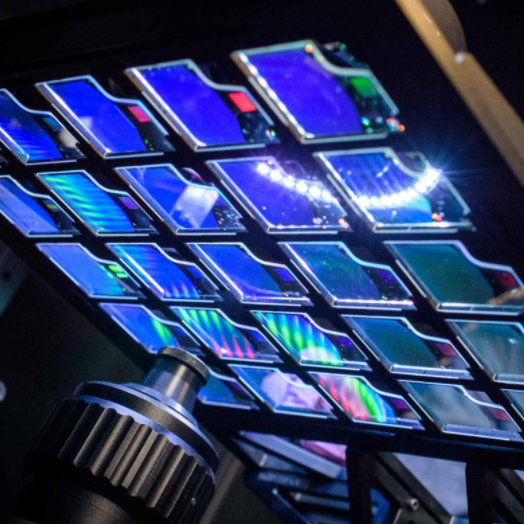

WaveOptics designs and manufactures ‘waveguides’, the see-through displays for augmented reality wearable devices, which overlay the real world with computer-generated images.

Building the components for wearable technology

WaveOptics designs and manufactures ‘waveguides’, the transparent displays in augmented reality (AR) devices which overlay the real world with computer generated images.

Originally a team of 20 engineers, WaveOptics has grown into a 120-strong global specialist in ‘near-eye’ displays, with offices in Taiwan, China, and North America. In fact, more than 70% of the R&D team are PhD researchers with expertise in nano-photonics, optical design and the commercial production of headmounted displays.

The global AR market is expected to be huge, with some estimating it at $75 billion by 2023 * (just as every smartphone needs a screen, every wearable AR device will need a waveguide). Likewise, products such as their recently launched Katana waveguide – the lightest and thinnest of its kind – are much easier to manufacture at scale than rival designs: a major factor in our decision to invest. WaveOptics is the brainchild of co-founders David Grey and Sumanta Talukdar – with David Hayes appointed as CEO in 2017. We think it has quickly established itself as a leading optical technology provider in the emerging AR ecosystem, and is on track for a five times growth in revenue by the end of 2020.

Investors can access the opportunity to invest in companies like WaveOptics through some of our tax products such as Octopus Titan VCT or the Octopus Ventures EIS Service.

*Digi-Capital AR/VR Analytics Platform and Augmented/Virtual Reality Report, May 2019

Remember, investing involves risk

Please remember that the value of an investment in VCT or EIS shares, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest.

In relation to tax products, tax treatment depends on individual circumstances and may change in the future. Tax reliefs depend on the VCT maintaining its qualifying status or the portfolio companies maintaining their EIS-qualifying status.

The shares of the smaller companies or VCT shares we invest in could fall or rise in value more than shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

More information and key documents can be viewed on the Octopus Ventures EIS Service and Octopus Titan VCT product pages.