Clients looking to transfer wealth from their pension tax efficiently

About this planning scenario

With pensions set to become subject to inheritance tax (IHT) from April 2027, many retired clients are re-evaluating their estate planning and now seeking alternative options to pass on their pension wealth tax efficiently.

This planning scenario illustrates how investing in a VCT could help maximise the value of funds withdrawn from a pension.

We created this tax planning scenario to help advisers develop suitable planning strategies for clients. It does not provide advice on investments, taxation, legal matters, or anything else. As you know, tax-efficient investments aren’t suitable for everyone. Any recommendation should be based on a holistic review of a client’s financial situation, objectives and needs. Before recommending an investment, you should also consider the impact of charges related to the product, such as initial fee, ongoing fees, and annual management charges.

Pension wealth will be subject to inheritance tax

In the October 2024 Budget, the government announced that, from April 2027, unused pensions will form part of an individual’s estate for inheritance tax (IHT) purposes. Until now, pensions have often been used as a highly efficient vehicle for passing on wealth inheritance tax-free.

Many affluent individuals, particularly those with sufficient assets outside their pension, had planned not to access their pension at all during retirement – intending to pass the full pot to beneficiaries free of IHT on death. This change may unwind long-standing estate planning strategies.

For retired clients who don’t need to draw on their pension for income, but still wish to pass on wealth efficiently, attention may now turn to how best to extract funds from their pension and gift them during their lifetime – in a way that manages both income and inheritance tax exposure.

Meet Cynthia, a 72 year old retiree

Cynthia spent her career building up a large pension worth £1 million. Cynthia is five years into retirement; she lives comfortably using income from other sources and has left her pension untouched.

Cynthia had planned to preserve her pension as a tax efficient way to pass wealth to her children. However, from April 2027, unused pensions will be brought into the taxable estate for IHT purposes.

This change means that if Cynthia were to pass away after age 75:

- Her estate could face a 40% IHT charge on the remaining pension value, and

- Her children may also be liable for income tax when they withdraw funds from the inherited pension, resulting in a combined effective tax rate of approximately 52% for basic-rate taxpayers or up to 64% for higher-rate taxpayers.

Concerned about the impact on her legacy plans, Cynthia is now considering whether to annually withdraw from her pension to gift the value to her children.

However, she’s also mindful of the income tax she would pay on withdrawals and is looking for a tax-efficient strategy to support her in achieving this objective.

To explore her options, Cynthia turns to her adviser for guidance on how best to extract pension funds and reduce her future IHT liability.

Her financial adviser makes an assessment based on:

- her tolerance for risk,

- forecasting her future income needs and the available sources, and

- her attitude towards investing in higher risk investments, such as smaller companies

A tax planning solution from Octopus

Based on those factors, Cynthia’s adviser suggests withdrawing funds from her pension and using the proceeds to invest in a VCT.

With a VCT, Cynthia can claim up to 30% income tax relief on up to £200,000 invested in any single tax year, as long as she holds her VCT shares for at least five years. Cynthia can also benefit from tax-free dividends, and won’t have to pay capital gains tax when she sells the shares. Cynthia’s adviser reminded her that the amount of income tax relief she can claim cannot exceed the amount of income tax she owes.

VCTs versus Pensions on death

Should Cynthia die whilst holding the VCT shares, the shares will form part of her taxable estate, therefore subject to 40% IHT, in the same way the value would have been if it had remained in her pension. However, unlike assets inherited from a pension – which when drawn down are subject to the beneficiaries income tax rate – VCTs shares can be sold with zero tax to pay.

Gifting from income

The tax-free dividends from VCTs can be gifted to children as part of regular income meaning they are immediately inheritance tax free.

How it works in practice

Let’s see how Cynthia could take advantage of the tax benefits associated with investing in a VCT to offset or partly offset her pension income tax bill. There are two scenarios as Cynthia has not yet accessed her pension, she has her 25% tax free cash available, however we have also illustrated how the planning works for an individual who has fully utilised their allowance.

*Cynthia could choose to add an extra £15,000 to her VCT investment from another source. This would mean a VCT investment of £50,000, generating £15,000 tax relief and completely offsetting her pension tax bill. Please also note that the amount of tax relief Cynthia can claim cannot exceed the amount of income tax she pays.

Things to remember about this example

- Please note that when selling shares in a VCT, it is not possible to claim tax relief on new shares bought in the same VCT within six months of the sale. You should consider the impact of this when assessing any specific products.

- Before investing in a VCT, investors should read the product prospectus and Key Information Documents (KID).

- Nothing in this scenario should be viewed as advice.

- Any suitability decisions should be based on a client’s objectives and needs, as well as their attitude and capacity for risk.

- You should consider the value, eligibility and timings of tax reliefs and liabilities.

- You should consider the impact of relevant product charges (including initial and ongoing) like administration fees and annual management charges.

Inheritance tax planning options after 5 years

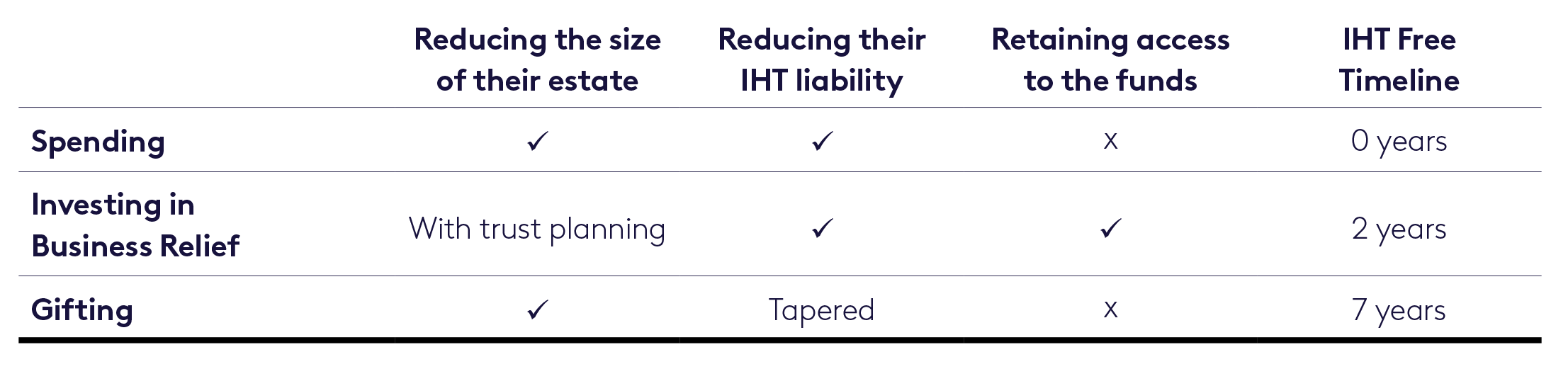

VCT shares must be held for five years to retain tax relief. After this period, Cynthia has several options to reduce her estate or her IHT liability, depending on her needs, motivations and timeline. Here are a few:

- Spending: Cynthia can simply spend the money she draws down to enjoy in her retirement.

- Invest in Business Relief (BR): If BR-qualifying investments are held for two years and until death, they are exempt from inheritance tax. Find out more about key considerations of BR.

Additionally, after being held for two years, these investments can be transferred into a trust without triggering a chargeable lifetime transfer (CLT). Find out more about Business Relief and Trusts. - Gifting: Cynthia can give away her assets to family and friends. These gifts take seven years before they become exempt from inheritance tax. Within the seven years the amount of tax the money is subject to tapers the closer she gets to the end of the seven year period. Cynthia can also give away a total of £3,000 worth of gifts each tax year without them being added to the value of her estate. This is known as your ‘annual exemption’.

- Recycling into another VCT: After five years, Cynthia can withdraw funds from her current VCT and reinvest in a new one. The 30% income tax relief on the new investment could be used to offset tax on additional pension withdrawals.

Read this planning scenario on clients who want to reduce their income tax bill.

Key risks to remember:

- VCTs and BR investments are high risk. The value of an investment, and any income from them, can fall as well as rise. Your clients may not get back the full amount they invest.

- Tax treatment depends on your client’s circumstances and may change in the future.

- Tax reliefs depend on VCTs and BR companies maintaining their qualifying status.

- The value of VCT and BR qualifying company shares could fall or rise in value more than other shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

Find out more about how the Octopus Venture Capital Trusts could help clients like Cynthia

More tax-planning scenarios?

Clients who want to reduce their income tax bill

Anthony is a higher rate tax payer with significant pension and ISA investments.

Clients who want to extract money from their pension

Kate is looking to extract money from her pension in a tax-efficient way.

Clients who are landlords looking for a tax-efficient income stream

Daniel and Helen earn an income from buy-to-let properties. They’d like to invest the rental income tax-efficiently.