UK Equities – Are you ready for a recovery?

Now is the time to be reassessing your allocation to UK equities, in particular UK growth markets.

It’s looking more likely that UK interest rates have peaked. And we’re seeing a significant disconnect between valuations and the underlying operational performance of many listed companies. This is especially true at the small- to mid-cap end of the market.

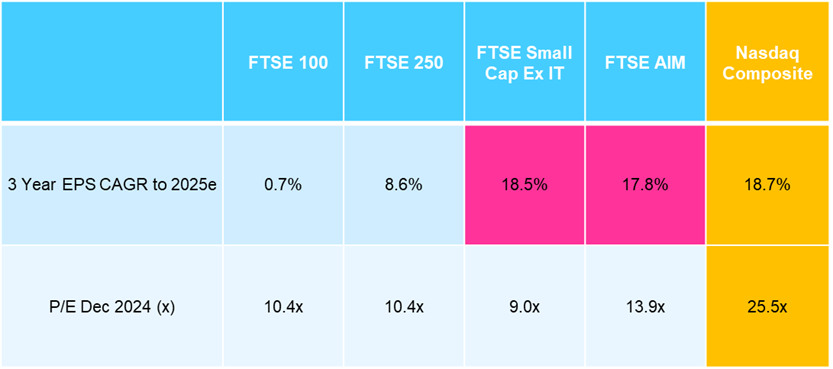

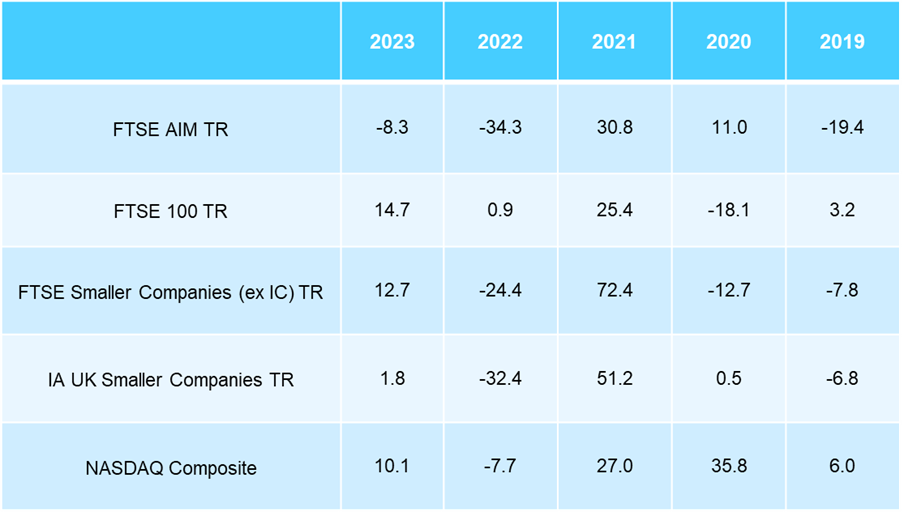

Although we have recently seen the FTSE AIM index recover some of the ground lost over the last couple of years, stock performance for UK equities has remained subdued for 2023, especially when you consider returns that have been delivered elsewhere. The FTSE 100 has been roughly flat year-to-date, but FTSE AIM stocks have had a tougher time, down by more than 13%. This compares against NASDAQ, for example, which is up 36.5% in the period1.

Whilst NASDAQ is the growth-index of choice for many investors, what is less well documented is that the FTSE UK Smaller Companies Index (ex Investment Trusts) and the FTSE AIM Index both offer similar earnings growth potential to NASDAQ. Two years’ of capital flowing away from smaller UK growth companies, however, means many stocks trade at almost half the price/earnings multiple.

We suggest that this valuation versus growth disconnect is a once-in-a-cycle opportunity and will not be around for long. Increasing bids for listed companies at significant premiums are signalling a correction is on its way.

It is time for investors to position for a recovery.

UK growth indices – Presenting exceptional value

Past performance is not a reliable indicator of future results. Source – Octopus/Factset 21/11/2023

Why are valuations at these levels?

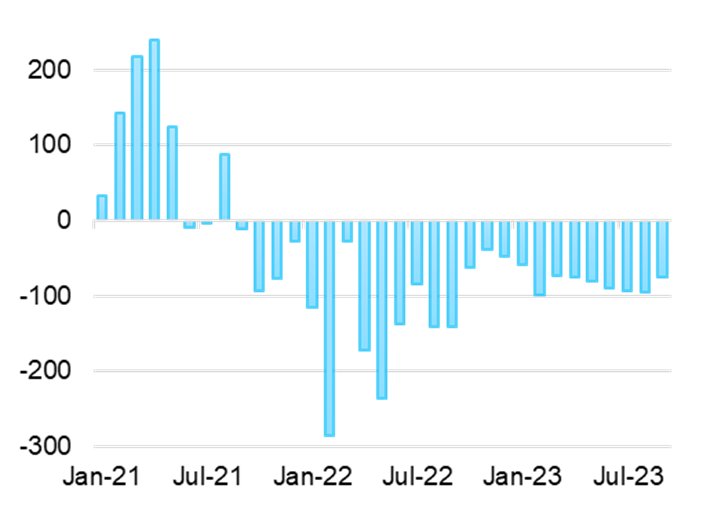

The simple answer is capital flows. As has been much discussed in the financial media, UK equity flows have been materially negative in recent years, across the full spectrum of investors; from pensions funds, to retail investor flows.

From a pension perspective, according to the Financial Times [2], British pension fund allocations to UK equities have declined from 56% of assets in 1997, down to 6% currently. A similar experience can be seen within retail fund flows.

Since the market peak in September 2021, there has been over £2.4 billion of retail fund flows away from the IA UK Smaller Companies sector leaving it standing at just under £10 billion.

A reversal, or at the very least a reduction in these negative flows, would likely to prove to a material catalyst for the UK equity markets, and smaller companies in particular.

We are also seeing increasing interest in publicly listed companies from trade and private buyers. Other buyers will continue to emerge while listed equity valuations remain subdued.

IA UK Smaller Company retail flows

(£m/month)

Source – Investment Association – September 2023

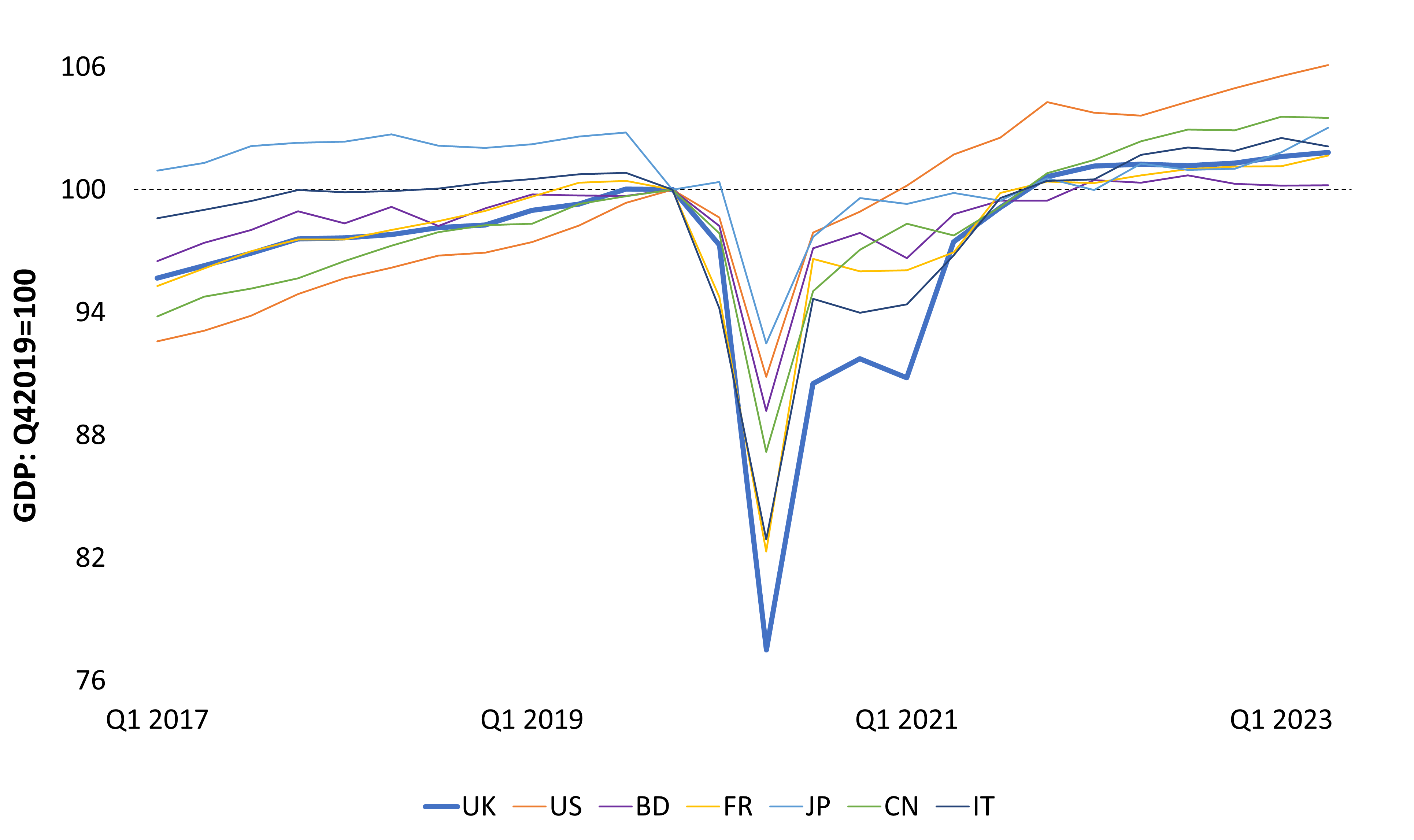

UK economy proving more resilient than predicted

A range of factors can be attributed toward the recent investor malaise toward UK equities. These include geopolitical events, inflation, interest rates and worries over the UK’s economic growth.

Whilst geopolitics could continue to be a negative influence, other factors are definitely looking more positive for equities and growth-focussed companies in particular.

The UK economy had been feared to deliver a more sluggish post-covid recovery than many developed market peers. But recently revised data from the ONS has upgraded its assessment of UK economic performance – not just once, but twice.

UK economic growth is in line with peers

Source – Simon French, Panmure Gordon, 2 October 2023

Some market commentators remain concerned around the prospects for a modest UK economic recession. We do not share this view. Our portfolio companies, on the whole, continue to deliver results that are at least in line with consensus expectations. Whilst many share prices remain subdued, this is not because company management teams are failing to deliver.

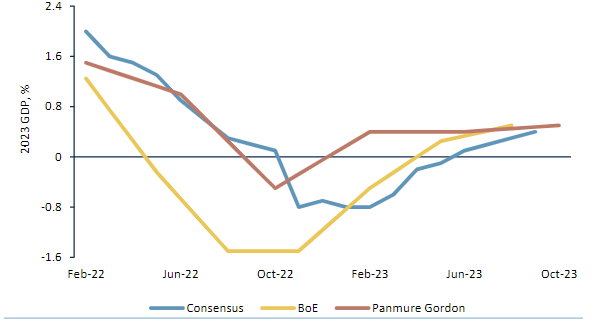

No doubt, there will be further debate as to whether the UK could see a modest economic retraction going forward. Regardless, the mood music is definitely improving. As we have progressed through 2023, economic forecasts for the UK have been repeatedly revised upwards. This is welcome news for investors.

2023 UK economic growth forecasts continue to evolve upwards

Source – Panmure Gordon, Bank of England, HM Treasury

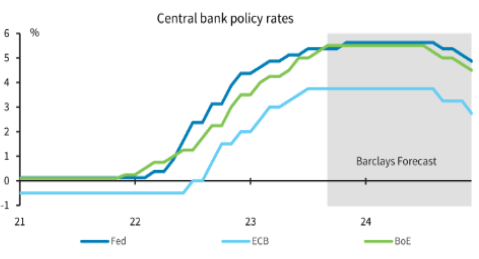

Interest rates look to have peaked

Another area of potential boost to smaller growth companies is the growing consensus view that interest rates have peaked. Although we are not expecting a quick journey back to levels we had a couple of years ago, we do believe UK rates are unlikely to rise further and would expect some modest cuts as we progress through 2024. A reduction in interest rates expectations is likely to improve sentiment towards growth businesses.

Central bank policy rates peaking

Source – Barclays Economic Research

Where to from here?

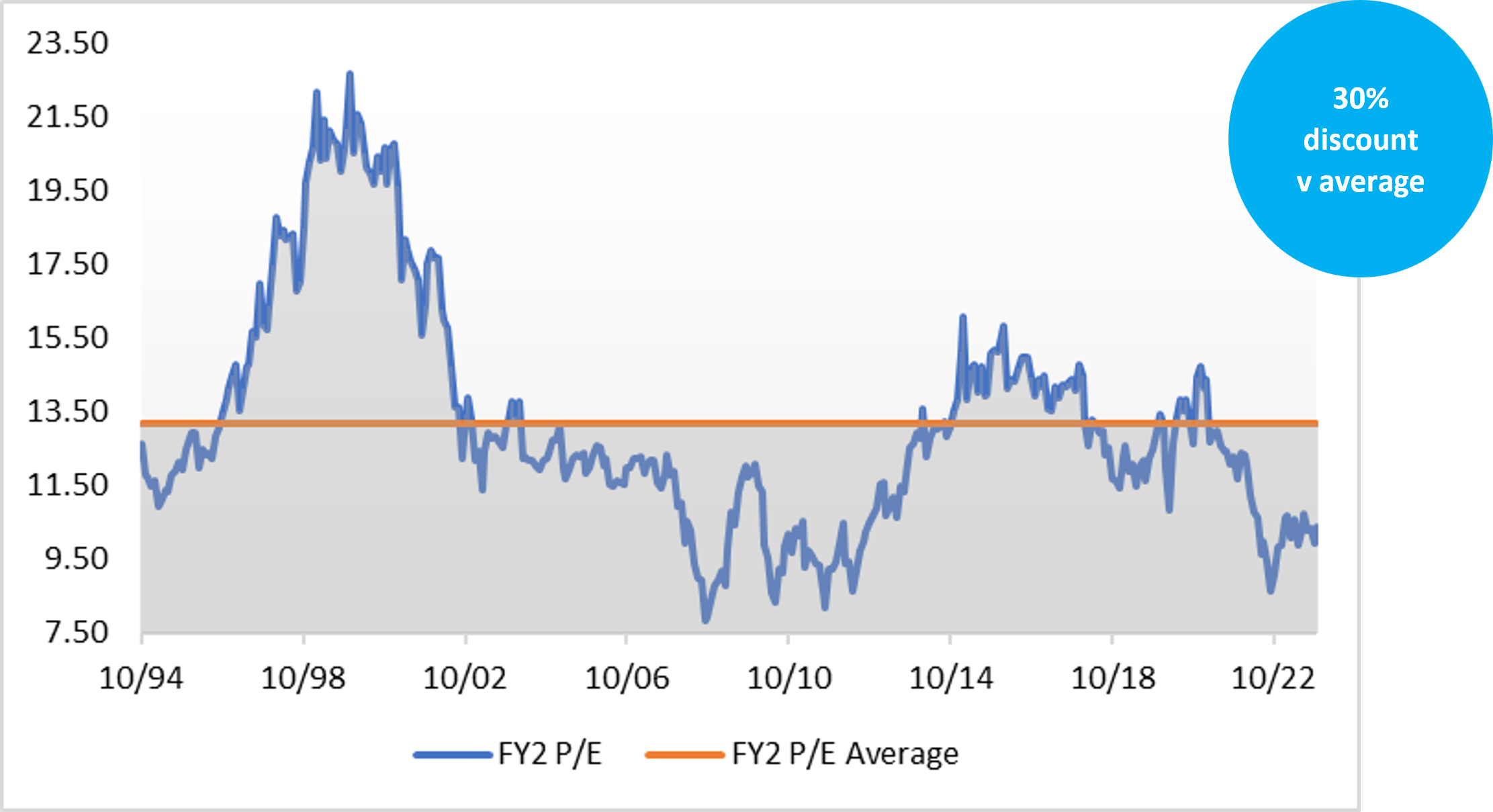

So, we have positive news for growth equities from both an economic and an interest rate perspective. From a valuation standpoint, UK equities remain attractively priced against long term metrics.

The FTSE 100 is at a c.30% discount to its long-term average multiple. UK Smaller Companies are even more attractively valued, with a further significant discount to long term average valuation multiples compared to larger cap names.

FTSE 100 – Cheap versus long term average

Source – Octopus Investments, Factset November 2023

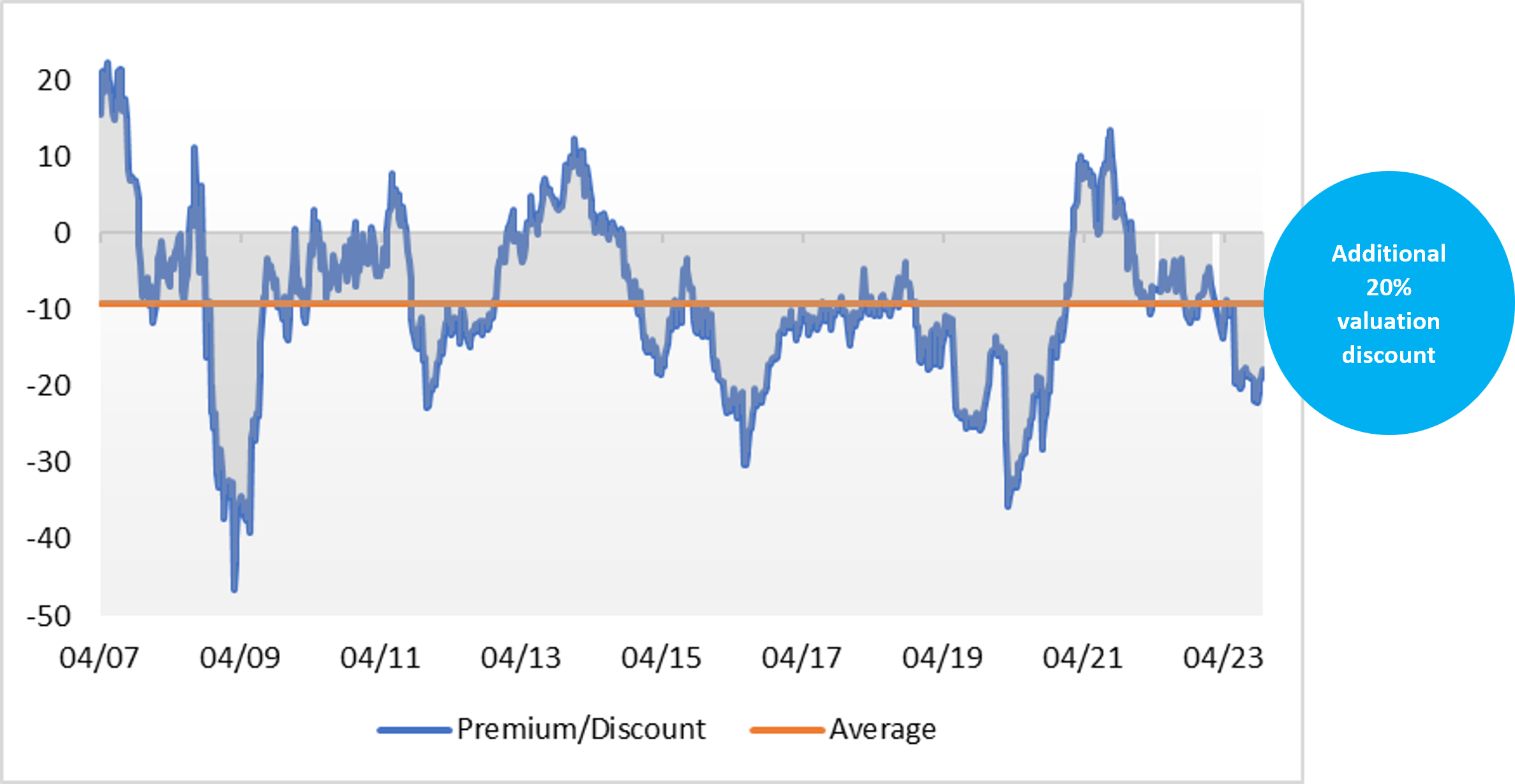

UK smaller company equities remain at a material discount to larger cap stocks, despite the far superior growth forecasts as outlined above. Despite the recent smaller company share price outperformance against larger cap companies, these stocks remain at a c.20% valuation discount to larger peers, almost a 10% larger discount than historic average.

This offers UK smaller company investors with a double-discount valuation opportunity, and scope for material upside returns from current levels.

FTSE Smaller Companies valuation discount/premium versus FTSE 100

Source – Ian Williams, Peel Hunt November 2023

The potential rebound

Clearly the UK market is astoundingly cheap, and as we have noted, even more so the case for smaller growth companies. In previous cycles, when growth company equity valuations have reached similar or greater discounts to current levels, the subsequent two-year sector recovery was material, and far outstripped returns generated by larger cap peers.

UK Smaller Companies – previous recoveries

| IA UK Smaller Companies Total Return | |

| March 2009 – 2011 | +110% |

| Nov 2011 – 2013 | +66% |

| Feb 2016 – 2018 | +42% |

| March 2020 – 2022 | +64% |

Source – Octopus/Lipper August 2023

But what will act as the catalyst for the rebound? Clearly this is hard to call, but as discussed above, several headwinds have eased in recent months and sentiment towards growth businesses is expected to improve further from here.

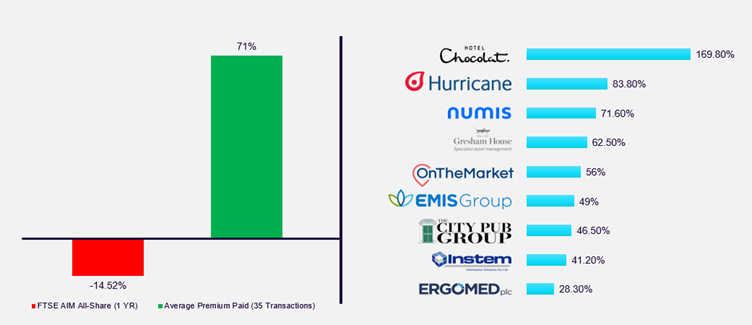

What is a key signal, however, is that buyers are emerging while UK listed equity valuations remain subdued.

In the chart below we have plotted some of the key bids for UK listed companies that we have seen in the year-to-date. More bids are currently being tabled, almost daily. These buyers are often bidding for these publicly listed companies at what look like significantly more attractive multiples, but in many cases are at much less attractive prices than compared to historic valuations.

M&A highlights the current material valuation discount

| Source – Matt Butlin, Allenby Capital, Factset Research Systems, 16 November 2023 |

Clearly a source of frustration for public market investors such as ourselves is to see high quality, growth businesses leaving our investable universe. But this M&A is also welcome, as it clearly serves to remind the markets of the huge, almost once-in-a-generation value that is on offer within UK smaller growth equities.

Given this significant valuation disconnect you should be reassessing your current allocations toward UK growth companies.

Are you ready for the recovery?

Discrete 1-year performance % return

Source: Lipper / Octopus Investments to September 30

Risks to bear in mind

The value of an investment can fall or rise and you may not get back the full amount you invest. Smaller company shares are also likely to fall and rise in value more than shares in larger, more established companies listed on the main market of the London Stock Exchange. They may also be harder to sell.

Watch this webinar

Why now is the time to consider a multi-cap approach to UK equity income

Hear from Chris McVey lead fund manager of the FP Octopus UK Multi Cap Income Fund who’ll explain the benefits of the fund’s broad investment universe, its core-satellite investment approach and why he believes now is the time to invest in the UK.

This webinar will cover:

- The ‘double-discount’ opportunity in the UK stock market.

- How a multi-cap approach to income investing can support your clients’ objectives.

- Fund performance and learnings over its first five years.

Key risks:

- Our investment products put capital at risk. The value of an investment can fall or rise and you may not get back the full amount you invest.

- The shares of smaller companies are likely to fall and rise in value more than shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

- For the FP Octopus UK Multi Cap Income, fees will be deducted from capital, which will increase the amount of income available for distribution. However, this will erode capital and may hinder capital growth. Yield is not guaranteed.

1 Performance year to 21 November 2023

2 Source – Financial Times July 2023