Will Gibbs, Partner at Octopus Ventures

When investing in a given tranche of companies qualifying for the Enterprise Investment Scheme (EIS), timing has an impact on the potential for long-term returns.

If you have suitable clients with a higher appetite for risk, market conditions are potentially opportune for backing start-ups right now. Here are five reasons why.

1. Attractive valuations for new investments

The current market presents a unique opportunity to access companies at attractive valuations.

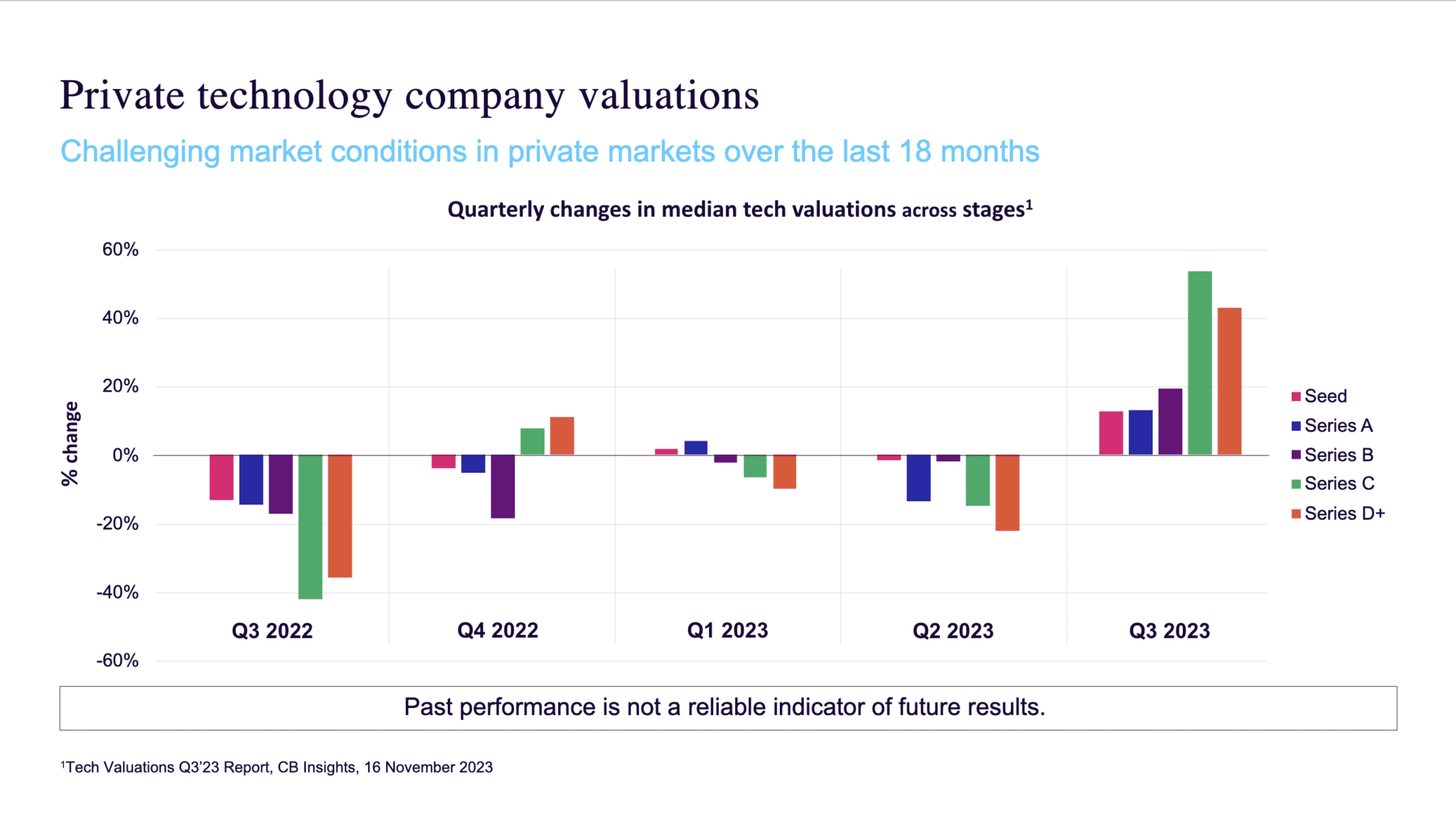

In the last three to six months, market conditions for investing at the early stages of a private company’s growth have rapidly improved. This follows a challenging and volatile period, which directly impacted performance and meant that underlying portfolio companies had to overcome headwinds to deliver target returns. Those headwinds have now become a tailwind.

Back in 2021, if you had a software business that was turning over £10 million in revenue, many investors would have valued that company at around 20x revenue. Today, that same company could be valued at just 8x revenue.

Now we’re seeing the downward pressure on valuations begin to ease as sentiment improves and underlying performance of startups has remained strong. So there are new investment opportunities available at fair prices and a future that is supportive of higher valuations.

This improvement in investor sentiment has also been felt at the later stages of investing, supporting our portfolio companies as they scale and approach investors for follow-on funding for growth. Whilst it felt like the taps had been closed for the last twelve months on growth investing, we are now seeing meaningful follow-on funding return. The below graph shows how private technology company valuations, for example, have recovered over the last six months, illustrating how this downward pressure on valuations has begun to abate. Recent portfolio follow-on investments are indicative of that and would have been harder to imagine a year ago.

2. Less competition

Over the last 24 months, we saw many investors opportunistically broaden the type of companies they were looking to invest in. We saw lots of multi-manager and US funds enter the UK venture capital market because they saw the calibre of technology companies being built here. It brought an influx of capital, often from investors that weren’t experienced in venture capital, that were all looking to invest earlier in the value chain and back idea-stage companies. This period of increased competition drove up the market and valuations.

But the trend has since reversed, with established and specialised funds returning to what they are best at. We’ve seen most of those competitors, who were distorting the fair value of potential investments, disappear from the UK or retrench back to what was their initial sweet spot of investing.

With less capital available in the market today, there is less competition from other world-class venture capital houses to invest in the best new companies, which means Octopus is in a great position to invest in the best companies and on the best terms possible.

3. Valuable tax reliefs

Tax reliefs have always been a feature of EIS. But following a challenging and uncertain period for UK markets, it’s worth highlighting that they create an especially supportive environment for investors who take on the risk of backing startups.

Unlike most investments targeting growth, loss relief is available for EIS investments on a per-company basis. This provides some compensation for the risk investors take when investing in early-stage companies. At the same time, should a company succeed, any growth is tax-free.

4. Better talent availability and the ‘people puzzle’

Many leading companies have had to put in place hiring freezes or trigger redundancies, significantly increasing the talent pool in technological sectors. Before this, many our portfolio companies experienced rapidly increasing salary expectations from their employees, driven by many of the largest, and best-capitalised technology companies increasing salaries. This made it expensive to build teams and retain best-in-class talent. This is now much easier.

Talent is critical to achieving high growth. I often like to think of growing a start-up as a “people puzzle” – it’s about that company getting the right people in the right positions to unlock success. The scale of lay-offs from respectable tech employers – the likes of Meta, Google, and Microsoft – means that early-stage, growth-hungry companies are in a great place to cherry-pick the best talent coming out of Europe to power their growth.

5. Innovation hasn’t slowed down

Big businesses, in the face of a challenging economy, tend not to invest in innovation. It can leave the door open for small businesses and new ideas to fill the gap.

Technology and innovation don’t slow down if the market slows down. If anything, we see the opposite happen.

There are so many ground-breaking innovations and revolutions that have continued in the last six to twelve months across generative AI, privacy, genomics, precision psychology, immersive gaming, blockchain, robotics, space – the list goes on. The UK remains at the front of many of these global races for innovation and those operating within research and innovation are busier and more excited than ever.

Key risks to bear in mind:

- The value of an investment, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest.

- Tax treatment depends on personal circumstances and may change in the future.

- Tax reliefs depend on portfolio companies maintaining their qualifying status

- EIS investments could fall or rise in value more than other shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

- These investments have minimum holding periods. If shares are sold before the minimum holding period, reliefs claimed will have to be repaid. Other reliefs may no longer be available.