Estate planning for clients with a loan trust in place

Estate planning

What to do for clients with a loan trust in place?

With a loan trust, any investment growth on the capital lent to the trust will be expected to fall outside the client’s estate for inheritance tax purposes. However, the amount of the original loan remains subject to inheritance tax when the client dies.

This example explains why investments that qualify for Business Relief (BR) may be interesting to clients who set up a loan trust years ago.

Remember, BR won’t be right for everyone. It puts investor capital at risk and comes with other considerations. We cover the risks in more detail in this scenario.

About this planning scenario

This is a tax-planning scenario designed to help you build appropriate strategies for your clients.

Nothing here should be viewed as advice. Any suitability decisions should be based on a client’s objectives and needs, as well as their attitude and capacity for risk.

Advisers should consider the value of tax reliefs for a client and the impact of charges relevant to the product represented or any product chosen.

Meet Tony

Meet Tony, who has named his children as beneficiaries of a loan trust

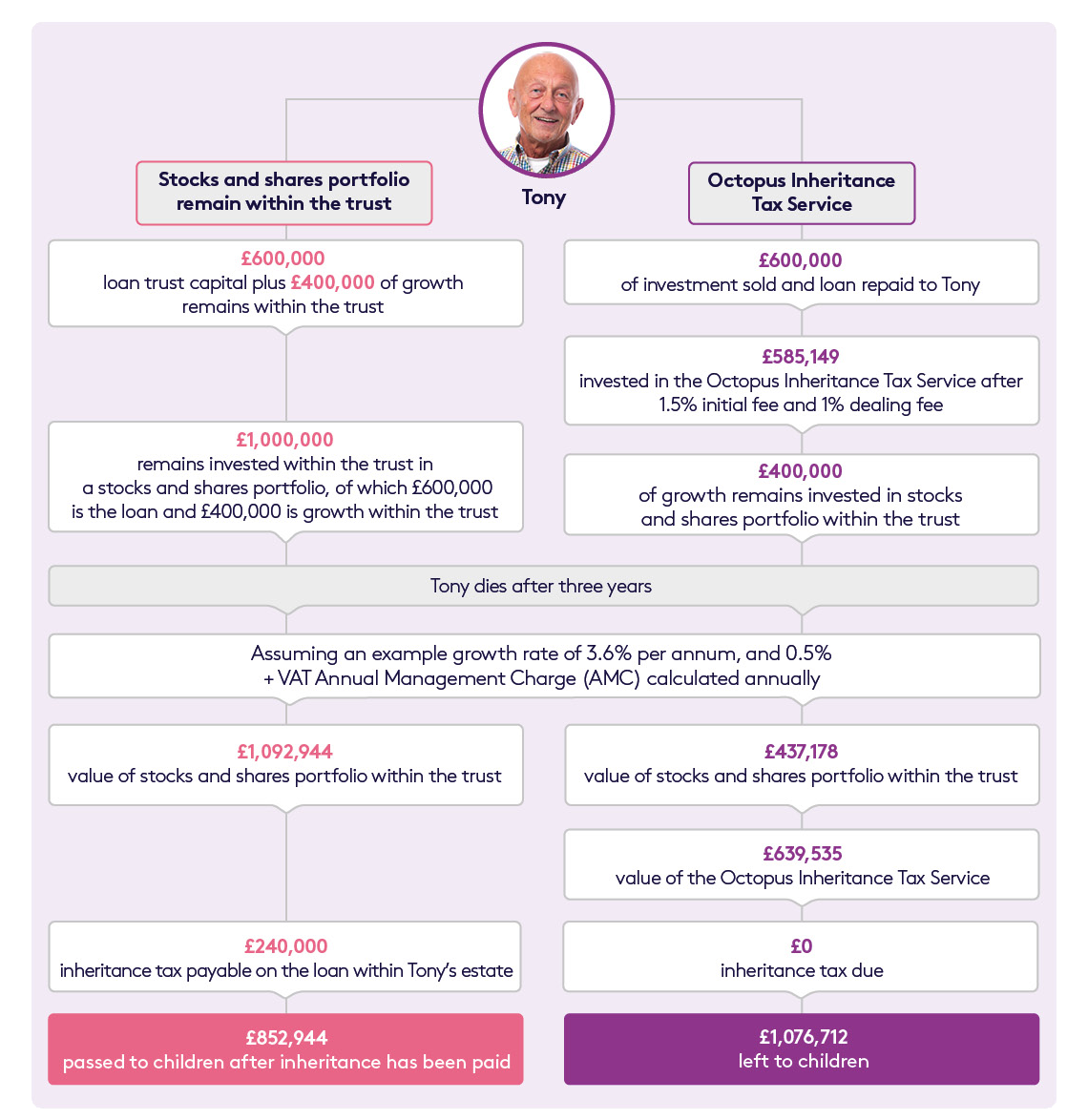

Tony is in his late 70s and has an attractive income from his pension. Two decades ago, Tony inherited a large sum of money. He used this inheritance to set up a loan trust so that the growth on his capital would benefit his children.

At the time, the capital lent to the trust was invested into a portfolio of stocks and shares which have delivered growth. However, while the growth of Tony’s investment is outside of his estate for inheritance tax purposes, the capital lent to the trust remains inside the estate, and is therefore still subject to inheritance tax.

A tax-planning solution

Tony is aware that the capital is subject to an inheritance tax liability, and is now considering wider estate planning. He talks to his financial adviser, who makes an assessment based on his risk profile, and attitude towards investing in unquoted companies.

He explains to him the benefits and risks of investments that qualify for BR. Now that the underlying investments in the loan trust have matured, his adviser suggests Tony requests repayment of the loan and reinvests the proceeds in the Octopus Inheritance Tax Service, a BR qualifying investment held in his own name.

This would effectively turn the loan capital into an investment that is inheritance-tax efficient. As long as Tony has held his investment in the Octopus Inheritance Tax Service for at least two years when he dies, the shares are expected to be able to pass to his beneficiaries free from inheritance tax. The growth achieved by the loan trust would continue to be outside of Tony’s estate for inheritance tax purposes, and could itself be invested to generate further growth within the trust.

Key risks

Tony’s adviser explains the risks

Tony’s adviser makes it clear to him that the value of a BR qualifying investment, and any income from it, can fall as well as rise. He may not get back the full amount he invests. His adviser also explains that BR is assessed by HMRC on a case-by-case basis, and that this assessment happens when an estate makes a claim.

The ability to claim the relief will depend on the company or companies Tony invests in qualifying for BR at the time the claim is made. Tax treatment will also depend on his personal circumstances, and tax legislation could change in the future.

His adviser explains that the shares of unquoted and AIM-listed companies can be harder to sell than shares listed on the main market of the London Stock Exchange. Their share price may also be more volatile.

Get in touch with your local IHT expert to discuss this scenario

How it works

How it works in practice

Let’s see how it might look if Tony were to invest in the Octopus Inheritance Tax Service, a service that invests in the shares of one or more unquoted companies expected to qualify for Business Relief.

Please note:

- This example is for illustrative purposes only and each investor’s own tax situation may be different.

- For ease of comparison, we’ve assumed identical charging structures, an annual growth rate of 3.6%, and that annual management charges are calculated annually.

- The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ.

- This example does not include any charges paid for financial advice.

- The Octopus Inheritance Tax Service has an initial charge of 1.5%, a deferred AMC of up to 0.5% + VAT and a dealing fee of 1%. AMC is calculated daily.

- This example assumes that the investments will be held until death and the nil-rate band is offset against other assets.

Find out more about how the Octopus Inheritance Tax Service could help clients like Tony

Other scenarios