Estate planning for clients with a loan trust in place

What to do for clients with a loan trust in place?

With a loan trust, any investment growth on the capital lent to the trust will be expected to fall outside the client’s estate for inheritance tax purposes.

However, the amount of the original loan remains subject to inheritance tax (IHT) when the client dies.

This example explains why investments that qualify for Business Relief (BR) may be interesting to clients who set up a loan trust years ago.

About this planning scenario

We created this tax planning scenario to help advisers develop suitable planning strategies for clients. It does not provide advice on investments, taxation, legal matters, or anything else.

Tax-efficient investments aren’t suitable for everyone. Any recommendation should be based on a holistic review of a client’s financial situation, objectives and needs.

Advisers should also consider the impact of

charges related to the product, such as initial fee, ongoing fees, and annual management charges.

Meet Tony

Meet Tony, who has named his children as beneficiaries of a loan trust

Tony is in his late 70s and has an attractive income from his pension. Two decades ago, Tony inherited a large sum of money. He used this inheritance to set up a loan trust so that the growth on his capital would benefit his children.

At the time, the capital lent to the trust was invested into a portfolio of stocks and shares which have delivered growth. However, while the growth of Tony’s investment is outside of his estate for inheritance tax purposes, the capital lent to the trust remains inside the estate, and is therefore still subject to inheritance tax.

A tax-planning solution

Tony is aware that the capital is subject to an inheritance tax liability, and is now considering wider estate planning. He talks to his financial adviser, who makes an assessment based on his risk profile, and attitude towards investing in unquoted companies.

He explains to him the benefits and risks of investments that qualify for BR. Now that the underlying investments in the loan trust have matured, his adviser suggests Tony requests repayment of the loan and reinvests the proceeds in the Octopus Inheritance Tax Service, a BR qualifying investment held in his own name.

This would effectively turn the loan capital into an investment that is inheritance-tax efficient. As long as Tony has held his investment in the Octopus Inheritance Tax Service for at least two years when he dies, the shares are expected to be able to pass to his beneficiaries free from inheritance tax. The growth achieved by the loan trust would continue to be outside of Tony’s estate for inheritance tax purposes, and could itself be invested to generate further growth within the trust.

Tony’s adviser explains the risks

Tony’s adviser makes it clear to him that BR-qualifying investments are high-risk. The value of an investment, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest.

Tax treatment depends on individual circumstances and tax rules could change in the future. Tax relief depends on portfolio companies maintaining their qualifying status.

His adviser explains that the shares of unquoted companies could fall or rise in value more than shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

How it works

How it works in practice

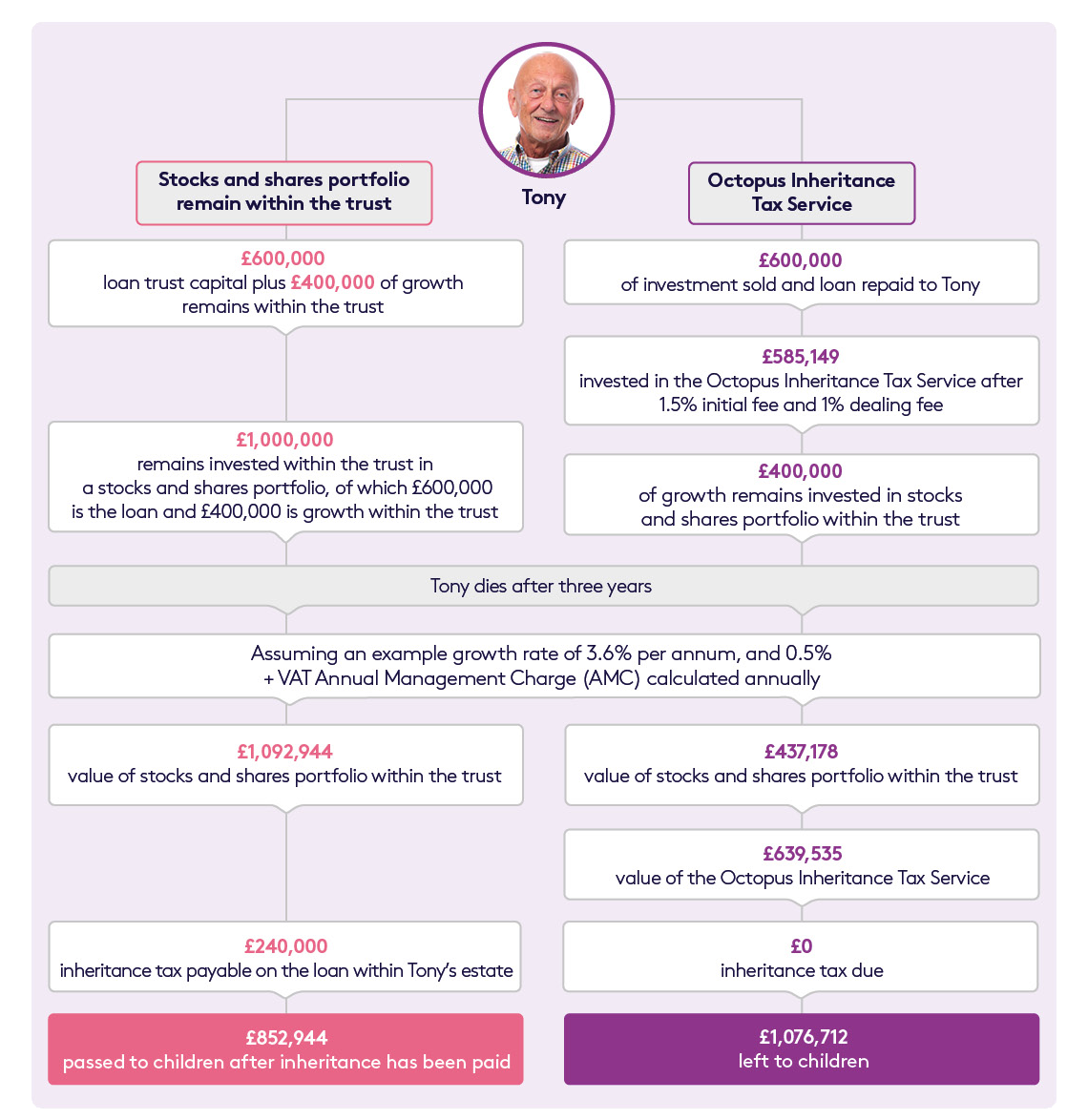

Let’s see how it might look if Tony was to request repayment of the loan and invest the proceeds in the Octopus Inheritance Tax Service, a service that invests in the shares of one or more unquoted companies expected to qualify for BR.

Note: Tax legislation, rates and allowances are correct at time of publishing for the tax year 2025-26. This example is for illustrative purposes only and does not propose to address all possible tax consequences that may be relevant to investors. In addition, each investor’s own tax situation may be different. It assumes that the investments will be held until death, the nil-rate band is offset against other assets and that the investment in Octopus Inheritance Tax Service has been reviewed by HMRC and deemed exempt from inheritance tax at death.

The Octopus Inheritance Tax Service has an initial charge of 1.5%, a deferred annual management charge of up to 0.5%+VAT per annum and a dealing fee, for investments and withdrawals, of 1%. We only take our annual management charge after the investor or their beneficiaries ask us to sell shares. Also, we will only take our full annual management charge if the investment has delivered the annual target return of 3% over its lifetime, after our charges have been taken into account. This example does not include any charges paid for financial advice.

Get in touch with your local IHT expert to discuss this scenario

Please note:

- This example is for illustrative purposes only and each investor’s own tax situation may be different.

- For ease of comparison, we’ve assumed identical charging structures, an annual growth rate of 3.6%, and that annual management charges are calculated annually.

- The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ.

- This example does not include any charges paid for financial advice.

- The Octopus Inheritance Tax Service has an initial charge of 1.5%, a deferred AMC of 0.5% + VAT and a dealing fee of 1%. AMC is calculated daily.

- This example assumes that the investments will be held until death and the nil-rate band is offset against other assets.

Find out more about how the Octopus Inheritance Tax Service could help clients like Tony

Other scenarios