Building on brand new research, Charlotte shares her tips and tricks to help you build professional connections and grow your business.

Over the past four years, my work delivering best practice workshops has given me insight into the good, the bad, and the ugly of professional connections. I’ve heard plenty of success stories out there, but also lots of persistent myths.

Given this, it was a surprise to find the industry lacked any hard evidence to demonstrate the benefits of professional connections, or which tried to better understand how to build and maintain these important relationships.

That’s why we commissioned some research which asked financial advisers, accountants and solicitors(1), about their experience of working together. We now have the data to prove that developing professional connections is worthwhile, as well as plenty of insights that will help you build better relationships.

Put a strategy in place

One thing that became clear from our research is that implementing a professional connections strategy benefits advice firms. But advisers must be proactive if they want to forge relationships that benefit both their business and their clients.

Our research found that advisers who actively seek professional connections as part of their business strategy see a significant increase in referrals. Nine out of Ten advisers have received a referral from either a solicitor or accountant in their career, but those who actively pursue these connections see a significant increase – racking up four times as many referrals as those who let the referrals come to them.

Valuable referrals

The good news is that those who are receiving referrals are also getting the sort of work they want, providing even more incentive to get started on a professional connections strategy.

The most common type of referral work advisers receive is around personal retirement planning, followed by estate planning, and thirdly, investment and savings.

It’s not a surprise that these areas come top as they are conveniently interlinked. With the introduction of pension freedoms, individuals have to make more choices than ever on how to invest their retirement savings, how to withdraw their pension and also how they pass more wealth on to their loved ones when they die.

Estate planning in particular is a core area where financial advisers should consider building links with solicitors and accountants, who will often see clients with Inheritance Tax liabilities but are unable to offer solutions to them.

Advisers are in the unique position of being able to show clients, via the use of cash-flow modelling, how much income or savings they need to retain access to, in order to pay for future costs. These conversations can also open their eyes to other investment opportunities that can help them manage their finances effectively and address tax liabilities.

Rohan Sivajoti, founder of NextGen Planners, urged advisers to start building connections early and said there is a ‘massive’ opportunity for the next generation of financial planners.

“They are in a great position to build relationships with their legal and accountancy peers, who are going to be in positions of power in the future.”

– Rohan Sivajoti

Advisers are awake to the benefits of professional connections, with 70% agreeing that they are important for growing their firm and 87% agreeing that offering holistic, integrated advice with accountants or solicitors creates better outcomes for clients.

Dave Seager, managing director of SIFA Professional, which helps financial advisers build valuable relationships with solicitors, said ‘Clients don’t think in silos, so why do we offer them solutions in silos?’

Despite the large number of advisers extolling the benefits of creating a relationship with other professionals, not all are following through; just 56% said building professional connections was part of their business strategy.

If advisers are able to bridge this mismatch, they will benefit from business growth and add value to their clients by providing a holistic financial planning service, so what exactly is holding advisers back?

Forget the misconceptions

According to advisers, the main barrier when it comes to developing relationships with accountants and solicitors is a perceived lack of interest, with three in five advisers surveyed saying they thought accountants and solicitors ‘lacked appetite’ to build relationships.

A further 39% thought ‘saturation’ was an issue, believing that accountants and solicitors who do foster these relationships are inundated with offers and most likely already work with enough financial advisers.

However, the statistics reveal a different story. Only 29% of accountants and solicitors surveyed cited too many existing relationships as a barrier to building new connections and, on average, each profession said they work with four to five advisers over the past two years. This proves there is plenty of opportunity to build new relationships, with just 1% of accountants and solicitors having never referred a client to an adviser.

Another misconception was advisers underestimating the number of solicitors and accountants who make referrals in order to protect themselves from complaints. Only 17% of advisers thought this is a factor in their decision, yet in reality, 52% of accountants and 37% of private client solicitors surveyed said this was a key driver for referrals.

This is something advisers should be aware of when working with professional connections, many whom will be very aware of the Swain Mason vs Mills & Reeve case, where a solicitor was taken to court for failing to refer a client for urgent financial advice.

That said, it is not always as simple as passing a client between professionals, as what happens next is just as important. Solicitors said their number one barrier to developing relationships with advisers was a poor client experience after they had been referred.

With so much trust required for successful relationships between professionals and their clients, it is understandable that solicitors, accountants, and advisers all seek to protect their client relationships.

If advisers want to ensure they gain that trust, there are a number of things they can do.

Get connected

The first step is making a connection in the first place. So, where should you start when it comes to actually building these relationships? For advisers who have successfully navigated this area, there were three clear winners.

Attending networking events was ranked as being the best approach (42%), which is perhaps no surprise. However, this was closely followed by asking clients for introductions (41%), with many advisers saying they had introduced them to accountants and solicitors.

As well as this, 40% of advisers said that taking on accountants or solicitors as clients themselves had proven effective. This approach certainly gives you a clear opportunity to demonstrate the value and service you can offer.

Other less common approaches that advisers have found helpful include running seminars and webinars (14%), gaining more qualifications & accreditations (13%) or increasing their online presence on LinkedIn (13%).

Credentials count

While most advisers haven’t found it to be the best approach to establishing new relationships, gaining relevant, specialist qualifications is still a smart way for them to demonstrate expertise.

Having the right qualifications and accreditations is particularly important to accountants surveyed, where 40% said it was the most important factor when deciding which financial advisers to work with. For private client solicitors, it was an advisers’ past experience of working with solicitors (43%), and they also said it was important for advisers to have a clear specialism (31%).

Tish Hanifan, barrister and chair of the Society of Later Life Advisers (SOLLA), said the qualification offered by SOLLA is seen as the ‘gold standard for advising later life clients’, which appeals to solicitors as it means they ‘can demonstrate that they’ve done proper due diligence’ when referring clients.

As well as gaining qualifications, Rohan Sivajoti said specialising in a certain area ‘whether in personal injury settlements or IHT’ prevents advisers from being put in ‘a bucket of generalist’ advisers and ensures they stay at the front of professionals’ minds when a case arises.

Deliver what’s needed

In order to build the right relationships, financial advisers need to know what solicitors and accountants want from their professional connections. The answer isn’t one size fits all.

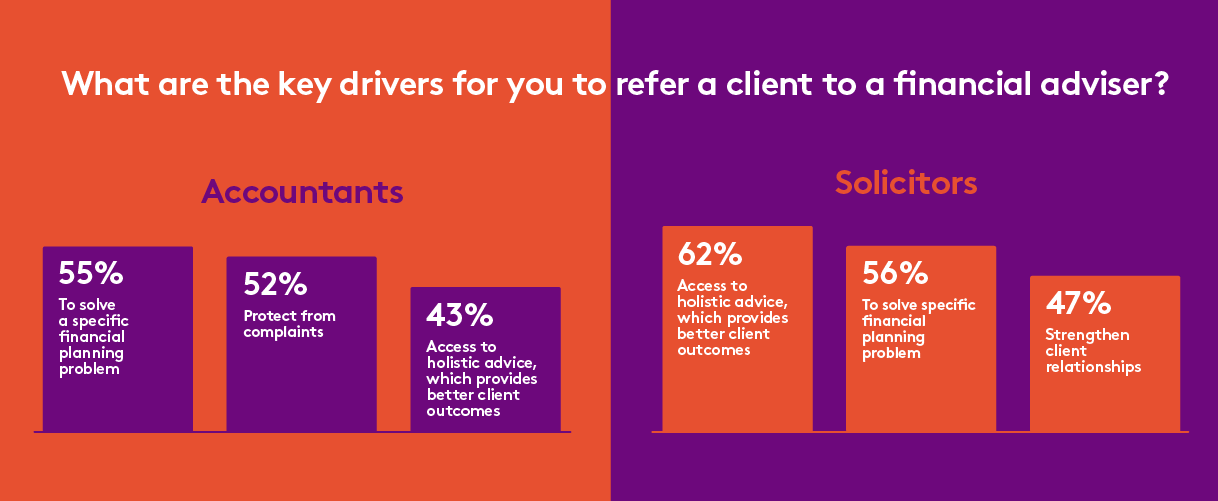

The top three reasons private client solicitors refer clients to financial advisers are to gain access to holistic advice, which provides better client outcomes; to solve a specific financial planning problem; and to strengthen client relationships.

For accountants, solving a specific financial planning problem is the primary reason for referral; protection from complaints comes in second; and providing clients with access to holistic advice rounds off the top three.

Richard Bertin, founder and chief executive of Tether, which helps accountants more closely integrate the business and personal financial plans of their clients, said communication is key for accountants.

‘Accountants, like financial advisers, hold a position of trust so if they refer a client out, they expect a first-class professional service from the get-go.’

Both solicitors and accountants were, however, looking for reciprocity, with 58% overall believing it is key for a successful professional partnership.

Don’t miss out on relationships with solicitors

Advisers said they tend to pursue and work with accountants more often, but they could be missing out greater opportunities for referrals from solicitors as the research revealed.

A large majority, 84%, of advisers who have implemented a professional connections strategy actively pursue a relationship with accountants, but only 54% do so with private client solicitors, and this number drops to 44% for those connecting with solicitors operating in family or divorce.

However, private client solicitors tend to refer clients more frequently than accountants; 61% of private client solicitors surveyed referred more than four clients a year, compared to 56% of accounts.

Tish Hanifan said private client work tends to be ongoing.

“A client may need to go back to their private client solicitor to update their will… or draft a Lasting Power of Attorney. It’s an area that often gives rise to needing other specialist advice, such as financial and tax.”

– Tish Hanifan

Be patient

Building a partnership with accountants and solicitors isn’t an easy win for advisers, who have to be prepared to put in the legwork in order to reap the rewards.

On average, it takes eight months for an adviser to build a professional connection and just under a third of advisers said it took a little over a year to see their first referral.

Alison Fitzsimons, associate director at Tilney, said that one of these relationships ‘typically takes a year to build’ and ‘quite often it can be longer than that’. The key for Alison is patience, adding ‘you’re in it for the long term, it’s about building relationships and building trust.’

‘It’s definitely a long-term play, it’s definitely got long-term benefit, and is wholly worthwhile,’ said Rohan Sivajoti.

Building relationships during a pandemic

There is also no denying that in the current Covid-19 climate it is even tougher to pursue these connections, with 59% of advisers who actively pursue a strategy of professional connections saying it has been harder to build relationships.

Coronavirus-induced restrictions mean the 81% of advisers who want to meet someone in person before making referrals will have to adapt and find new ways to communicate, embracing video conferencing technology.

‘If you have the confidence to talk through what you do in a Zoom environment and you’re keen to build new professional connections, it’s actually quite easy to talk to solicitors at the moment,’ said Dave Seager.

Rohan Sivajoti agreed, adding ‘people still haven’t accepted that this is how it is right now, and this is how it’s probably going to be for a while. It’s time to adapt, it’s time to accept, and it’s time to find a new way of building relationships.’

A common goal

Ultimately, while there may be some misconceptions that need addressing, our research demonstrated that advisers, solicitors, and accountants are motivated by one goal: to provide better outcomes for their clients. If you remember this, you can’t go far wrong, and Dave Seager believes that integrated holistic advice is key to this.

‘Modern clients are holistic, whether they know they are or not.’

‘They think they have a set of problems that need solving, and within that there might be tax, investment, and legal needs… they want a joined-up process, a trusted adviser. We need all the professionals to recognise that and work better together.’

By working with people who offer excellent service, and by providing the same to clients referred to you, advisers give themselves not only a happy client base, but also a major opportunity to grow their business.

***

- Research conducted by Opinium between 7 and 14 October 2020. Sample: 200 financial advisers in the UK.

- Research conducted by Opinion Matters between 7 and 9 October 2020. Sample: 100 accountants and 100 private client solicitors.