WhitepaperInheritance tax

What is the 14 year inheritance tax rule?

Gifting and the 14-year rule

Last updated: 5 January 2026

What is the 14-year inheritance tax rule?

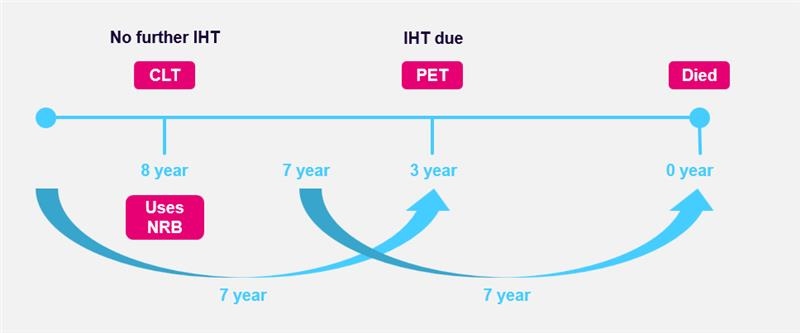

When considering how much of the nil rate band (NRB) is available to offset against chargeable lifetime transfers (CLTs) or potentially exempt transfers (PETs) made within seven years of death, you need to consider any chargeable transfers which have taken place in the seven years preceding the date of the transfer. A chargeable transfer in this case is:

- a CLT made seven years before the CLT in question, or

- a failed PET (i.e. within seven years of death), made seven years before the CLT in question.

This is normally referred to as the 14 year rule in that, if a failed PET or CLT was made within seven years before the donor’s death, to calculate the inheritance tax (IHT) due, you then must look back a further seven years for CLTs and other failed PETs made before the failed PET or CLT in question.

In effect, the CLTs and other failed PETs made seven years before the failed PET/CLT in question, reduces the available NRB when assessing the IHT. This means even if a CLT for example, was made more than seven years before an individual died (and therefore has no further IHT due on it at death), if that CLT was made before seven years before a failed PET then that CLT reduces the NRB available when assessing the IHT on the failed PET.

This rule also applies during a settlor’s lifetime, whereby the NRB which is available to offset against a CLT will be reduced by any CLTs made in the seven years preceding the date of the CLT. Note that any PETs made prior to settling property into trust will not impact the NRB when considering a CLT charge on an in-life transfer. Explore our chargeable lifetime transfer whitepaper for more information.

Ask Octopus

Do you have a question about inheritance tax and estate planning?

Use our free helpdesk to Ask Octopus

How do you apply the 14 year rule to an inheritance tax calculation?

How do you apply the 14-year rule to an inheritance tax calculation?

Steps to calculate IHT on CLT or PETS within seven years of death

To calculate the IHT on a CLT or failed PET within seven years of an individual’s death, broadly one would:

- Step 1: take the value of a CLT or failed PET made within seven years of death.

- Step 2: add the value of any CLT made within seven years of the CLT or failed PET at step 1.

- Step 3: add the value of any failed PET (i.e PETs within seven years of death), made within 7 years of the CLT or failed PET at step 1.

- Step 4: minus the available NRB.

- Step 5: then apply IHT at 40%.

Note: there is a separate calculation for the death estate which also includes any CLT or PET made within seven years. Explore our chargeable lifetime transfer or potentially exempt transfer papers for more details.

It is worth noting that a Business Relief-qualifying asset held for two years and gifted into trust or to another individual should be free from IHT and should not impact the NRB for the 14-year cumulation rule, even if the donor died within seven years. Provided the recipient (trust or individual) continues to hold the BR asset at the time the donor dies. Explore our Business Relief gifting whitepaper.

Tax legislation, rates and allowances are correct at time of publishing for the tax year 6 April 2024 – 5 April 2025.

For deaths before 6 April 2026, Business Relief investments (AIM or unquoted shares) held for two years attracts 100% inheritance tax (IHT) relief to an unlimited value.

From 6 April 2026, 100% IHT relief will continue for the first £2.5 million of combined agricultural and unquoted Business Relief qualifying property (e.g. sole traders, partnerships, unquoted companies). Amounts over £2.5 million will attract 50% IHT relief. Business Relief qualifying companies listed on the Alternative Investment Market (AIM), will attract 50% IHT relief irrespective of the investment amount.

Inheritance tax (IHT) calculator

Related resources

Related resources

Chargeable lifetime transfers

A Chargeable Lifetime Transfer (CLT) is a gift made during an individual's lifetime that is immediately subject to Inheritance Tax (IHT).

Business Relief – key considerations

This whitepaper provides an in-depth analysis of Business Relief (BR), a longstanding relief from inheritance tax in the UK. It explains the types of assets eligible for BR, such as unquoted companies and shares listed on the AIM market, and outlines the criteria to qualify.

IHT Toolkit

You can educate and nurture clients with these resources when having conversations about estate planning using this handy Toolkit.