Estate planning for clients who worry they’ve left it too late

What to do for clients worried they’ve left estate planning too late?

Many clients won’t think about estate planning until rather late in life, by which time approaches like gifting or life insurance may not be appropriate.

Business Relief (BR) can achieve inheritance tax (IHT) relief within just two years, provided certain conditions are met.

About this planning scenario

We created this tax planning scenario to help advisers develop suitable planning strategies for clients. It does not provide advice on investments, taxation, legal matters, or anything else.

Tax-efficient investments aren’t suitable for everyone. Any recommendation should be based on a holistic review of a client’s financial situation, objectives and needs.

Advisers should also consider the impact of

charges related to the product, such as initial fee, ongoing fees, and annual management charges.

Meet Harold

Meet Harold, who worries he’s left estate planning too late

Harold and his wife are in their 90s. Most of their assets

are in Harold’s name, with his wife his sole beneficiary.

The pair recently celebrated their platinum wedding

anniversary, causing Harold to reflect on his advancing

years and his legacy. Harold and his wife are not getting

any younger, and they would like to do estate planning

so that they can leave something for their two children

and five grandchildren.

The couple’s adviser tells them that a £500,000 chunk of

their investment portfolio would be liable for inheritance

tax were they both to pass away without putting any

planning in place.

Harold is concerned that neither he

nor his wife may survive the seven years necessary to

get the full benefit from gifting. Life insurance is also

an unrealistic option because of their ages.

A tax-planning solution

The adviser assesses Harold’s objectives, appetite for

risk and capacity for loss and suggests making an

investment that qualifies for BR. He explains

that if a BR-qualifying investment is held for two years

and at the time of death, it should offer relief from

inheritance tax.

If Harold survives for two years after making the

investment and continues to hold the shares until he

passes away, they would be expected to qualify for BR.

That means he should be able to leave them to any

beneficiary with relief from inheritance tax when

he dies.

If Harold survives for two years after making the

investment and continues to hold the shares until he

passes away, they would be expected to qualify for BR.

That means he should be able to leave them to any

beneficiary with relief from inheritance tax when

he dies.

If Harold were to die within two years of making the

investment and is survived by his wife, the shares can

pass to her without the need to pay any inheritance

tax. His wife would then continue the two-year clock

and only need to survive until the two-year anniversary

of Harold making the investment for the shares to offer

relief from inheritance tax.

In other words, so long as one spouse survives two years,

the investment should offer relief from inheritance tax.

BR-qualifying portfolios invest in the shares of one or

more unquoted or AIM-listed companies. They are higher

risk investments than the couple’s existing investments,

and the tax relief is designed to provide some

compensation to investors for taking additional risk.

For deaths before 6 April 2026, Business Relief investments (AIM or unquoted shares) held for two years attract 100% inheritance tax relief. From 6 April 2026, 100% inheritance tax relief will continue for the first £1 million of combined agricultural and unquoted Business Relief qualifying property (e.g. sole traders, partnerships, unquoted companies). Amounts over the £1 million will attract 50% inheritance tax relief. Business Relief-qualifying companies listed on AIM, will attract 50% inheritance tax relief irrespective of the investment amount.

Harold’s adviser explains the risks

BR-qualifying investments are high-risk. The value of an investment, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest.

The shares of unquoted companies could fall or rise in value more than shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

Tax treatment depends on individual circumstances and tax rules could change in the future. Tax relief depends on portfolio companies maintaining their qualifying status.

How it works

How it works in practice

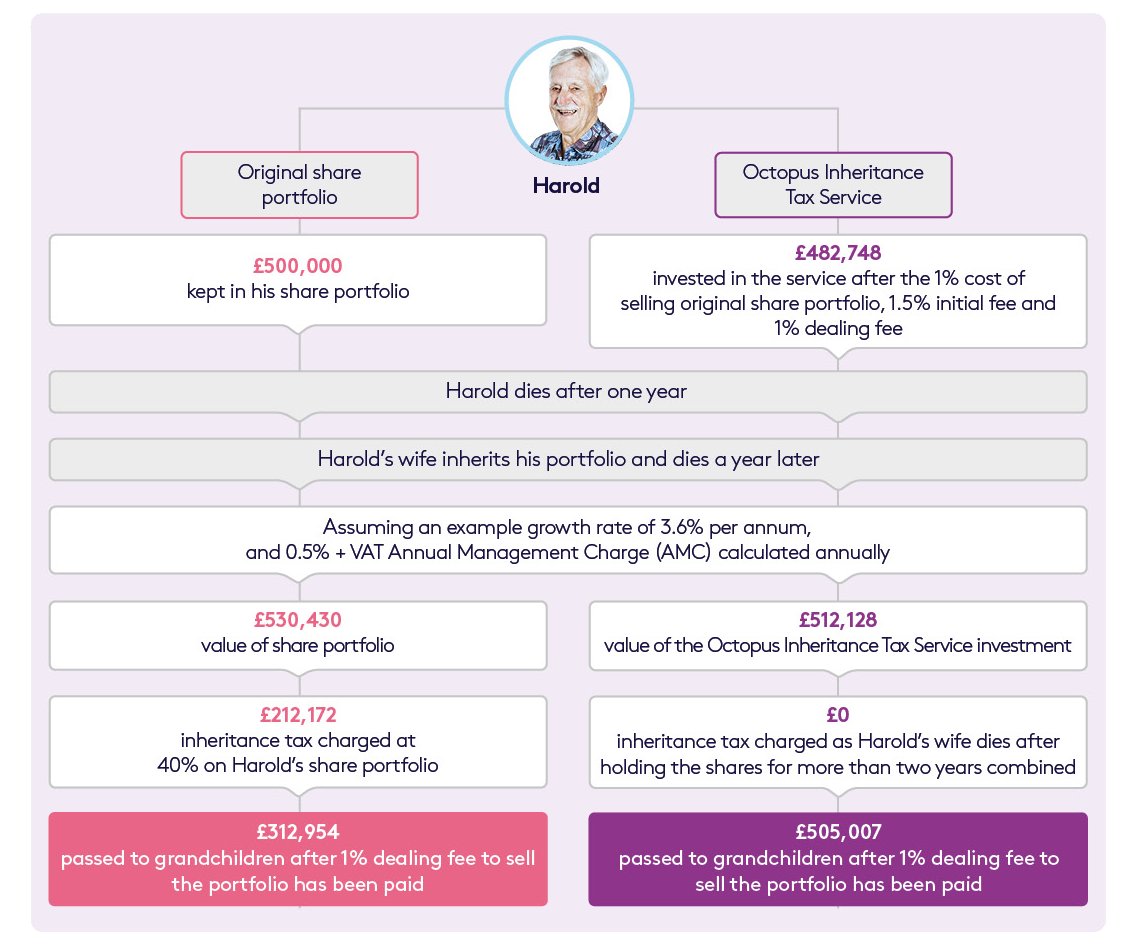

Let’s see how it might look if Harold were to sell £500,000 of his existing share portfolio and invest in the Octopus Inheritance Tax Service, a service that invests in the shares of one or more unquoted companies expected to qualify for BR.

Note: Tax legislation, rates and allowances are correct at time of publishing for the tax year 2025-26.This example is for illustrative purposes only and each investor’s own tax situation may be different. For ease of comparison, we’ve assumed identical charging structures, an annual growth rate of 3.6%, and that annual management charges are calculated and paid based on the investment value at the end of each annual period. The dealing fee on shares sold to pay the AMC has not been factored in. The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ. This example does not include any charges paid for financial advice. In practice the Octopus Inheritance Tax Service has an initial charge of 1.5%, a deferred AMC of up to 0.5% + VAT and a dealing fee of 1%. AMC is calculated daily and paid pro-rata, contingent on performance, when shares are sold. This example assumes that the investments will be held until death and the nil-rate band is offset against other assets.

Please note:

- This example is for illustrative purposes only and each investor’s own tax situation may be different.

- For ease of comparison, we’ve assumed identical charging structures, an annual growth rate of 3.6%, and that annual management charges are calculated annually.

- The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ.

- This example does not include any charges paid for financial advice.

- The Octopus Inheritance Tax Service has an initial charge of 1.5%, a deferred AMC of 0.5% + VAT and a dealing fee of 1%. AMC is calculated daily.

- This example assumes that the investments will be held until death and the nil-rate band is offset against other assets.

Get in touch with your local IHT expert to discuss this scenario

More planning scenarios