Estate planning for clients who want an inheritance tax-efficient ISA

Estate planning

What to do for clients who want to use an ISA to plan for inheritance tax

An Individual Savings Account (ISA) offers valuable tax benefits during someone’s lifetime, so it’s common for many clients to build up a large ISA pot.

But most are unaware that ISAs are subject to inheritance tax. This planning scenario explains how a suitable client can use their ISA to plan for inheritance tax, without losing ISA tax benefits or control over their assets.

Remember, investments that qualify for Business Relief (BR) won’t be right for everyone. It puts investor capital at risk and comes with other considerations that we explain further below.

About this planning scenario

This is a tax-planning scenario designed to help you build appropriate strategies for your clients.

Nothing here should be viewed as advice. Any suitability decisions should be based on a client’s objectives and needs, as well as their attitude and capacity for risk.

Advisers should consider the value of tax reliefs for a client and the impact of charges relevant to the product represented or any product chosen.

Meet Peter

Meet Peter, who wants to use his ISA to plan for inheritance tax

Peter is in his 70s. He never married, and he plans to leave his estate to his only daughter.

His house alone is worth more than £500,000, so he expects his daughter will need to pay some inheritance tax when he dies.

Peter would like to pass on as much of his wealth as possible, so he speaks to his financial adviser about his options.

Peter is shocked to learn that his ISA is included in the value of his estate for inheritance tax purposes. He’d always assumed that ISAs were exempt.

Like many people his age, Peter has been a committed ISA investor for years. He’s built up a large pot of ISA investments and these would be liable for inheritance tax were he to die without any planning in place.

Peter is reluctant to sell down his ISA pot after years of investing. He asks his adviser if there’s a way he can keep the benefits of his ISA wrapper, while also planning for inheritance tax.

A tax-planning solution

The adviser assesses Peter’s objectives, appetite for risk and capacity for loss and deems him suitable for an investment that qualifies for Business Relief (BR). He suggests transferring £100,000 held

in Peter’s stocks and shares ISA into a BR-qualifying ISA portfolio.

His adviser explains that some BR-qualifying investments can be held within an ISA. These can be left to his daughter free from inheritance tax, provided they are held for two years and at the time he dies.

BR-qualifying ISA portfolios invest in the shares of companies listed on the Alternative Investment Market (AIM). They are a higher risk investment than Peter’s existing ISA portfolio, and the tax relief is designed to provide some compensation to investors for taking additional risk.

A BR-qualifying ISA would retain the same tax benefits his ISAs have always enjoyed, but after two years the ISA becomes free from inheritance tax, assuming it is still held at the time of death. It also offers access to the growth potential of UK smaller companies.

Key risks

Peter’s adviser explains the risks of investing in an AIM ISA

Peter’s adviser makes it clear that the value of a BR-qualifying investment, and any income from it, can fall as well as rise. He may not get back the full amount he invests.

His adviser also makes it clear that withdrawals cannot be guaranteed, as the shares of unquoted and AIM-listed companies can be harder to sell than shares listed on the main market of the London Stock Exchange. Their share price may also be more volatile.

Peter’s adviser explains that BR is assessed by HMRC on a case-by-case basis, and that this assessment happens when an estate makes a claim. The ability to claim the relief will depend on the companies in his portfolio qualifying for BR at the time the claim is made.

Tax treatment will also depend on personal circumstances, and tax legislation could change in the future.

Get in touch with your local IHT expert to discuss this scenario

How it works

How an AIM ISA Investment can work in practice

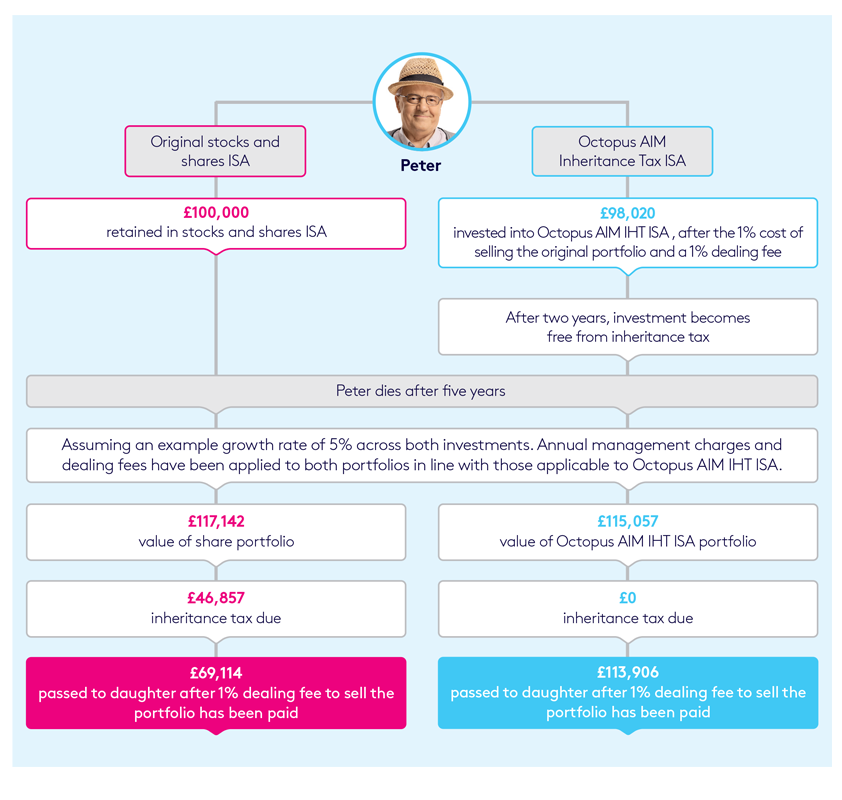

Let’s see how it might look if Peter were to invest in the Octopus AIM Inheritance Tax ISA,

a service that invests in an ISA portfolio of companies listed on the Alternative Investment Market (AIM).

Please note:

- This example is for illustrative purposes only and each investor’s own tax situation may be different.

- This example assumes that the investment will be held until death, the nil rate band is offset against other assets, and the Octopus AIM Inheritance Tax ISA investment qualifies for BR.

- For ease of comparison, we’ve assumed identical charging structures and an annual growth rate of 5%.

- This example assumes there is no fee for transferring from an existing ISA.

- The risk profile of each portfolio, charging structure, and any growth or losses is likely to differ.

- This example does not include any charges paid for financial advice.

Find out more about how the Octopus AIM Inheritance Tax ISA could help clients like Peter

Other scenarios