If you haven’t reconsidered your allocation to UK growth equities as part of your client’s portfolio, now could be the perfect time.

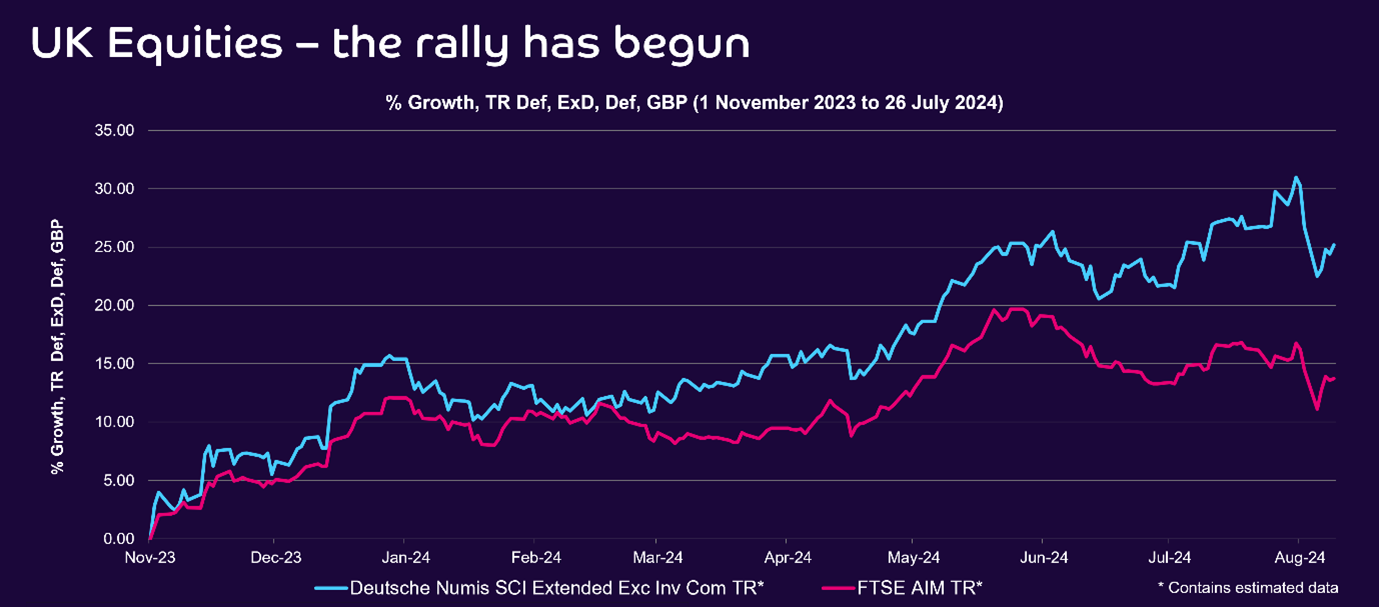

Following the market shakeout in October 2023, signs of recovery are starting to emerge.

Even with the recent period of market volatility, it is worth noting that since the beginning of November 2023, the FTSE AIM index has recovered by c.14%, whilst the Deutsche Numis Smaller Companies Index (excl Inv Tr’s) has increased by a very healthy c.25%.

We can attribute this improvement to several factors positively impacting these markets, including steadying interest and inflation rates, the unexpected resilience of the UK economy, and the more recent political stability post-election.

So, while the recovery is in its infancy and the asset class remains cheap, opportunity for investors is ripe.

Whilst these returns over such a short period of time look excellent, they follow what has been a difficult period for the asset class.

We are increasingly of the view, however, that the market has seen the bottom, and that we could be looking at an extended period of UK smaller company outperformance ahead.

UK Smaller Companies achieving significant long-term returns

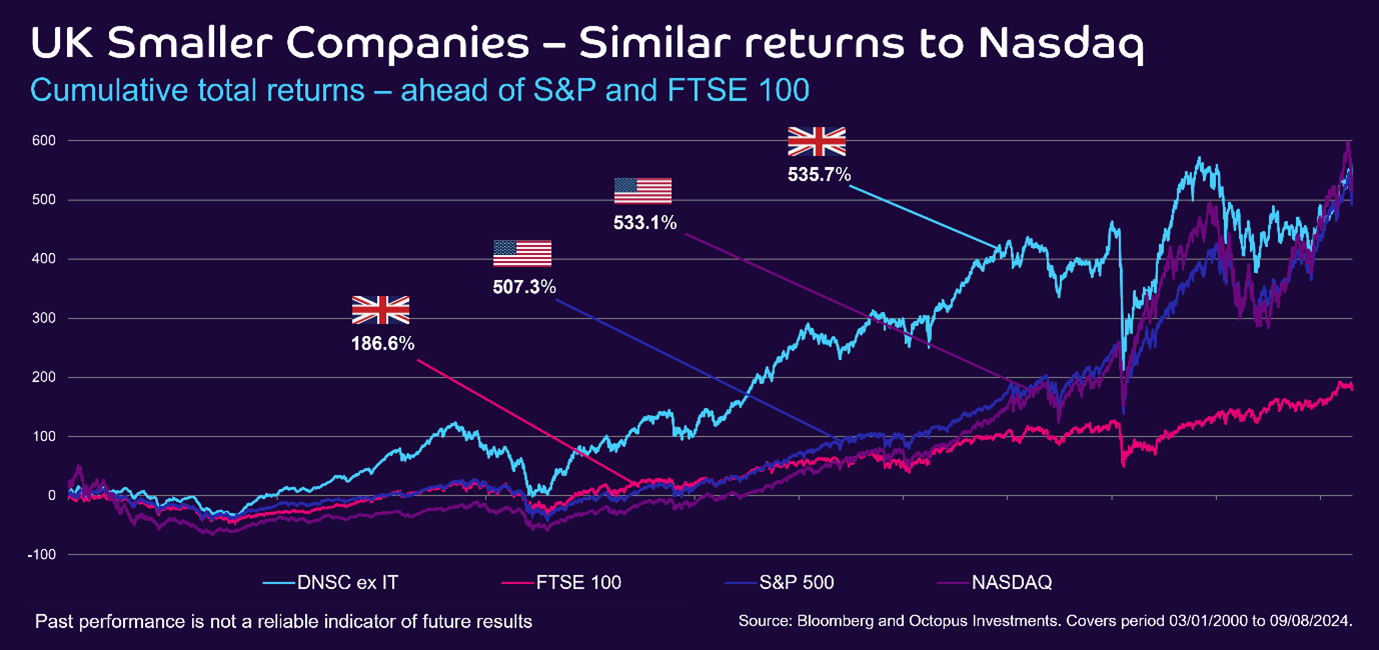

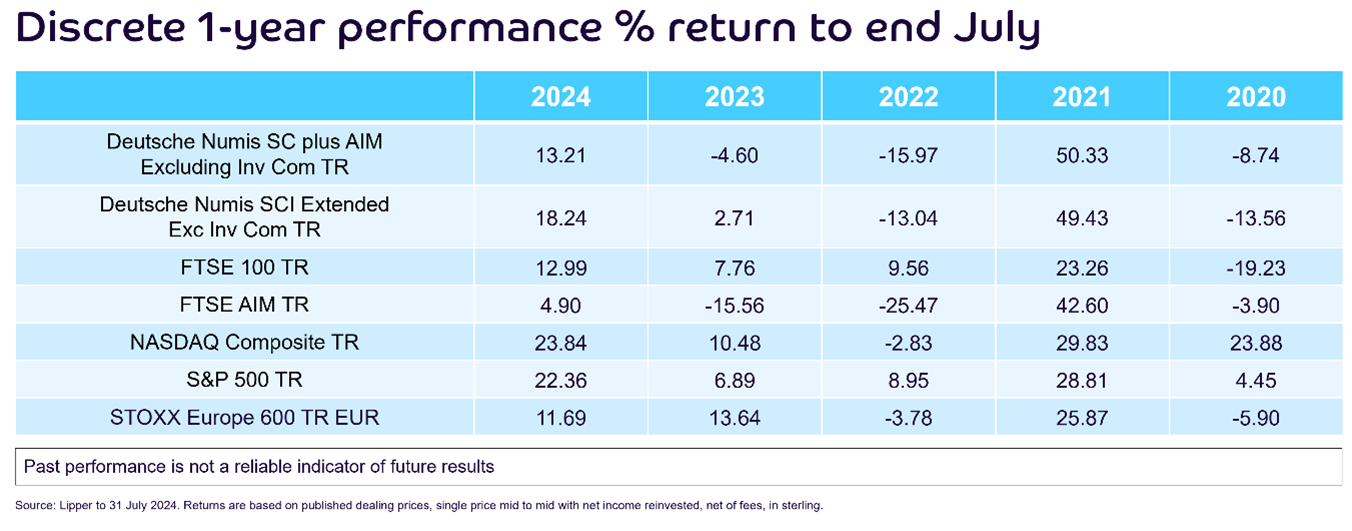

Over recent years, what has been stark, has been the global equity market’s fixation on the performance of Nasdaq, and on a relatively narrow number of high-profile companies in particular – the so called ‘Magnificent Seven’.

Recent US-led market volatility should remind investors of the risks associated with such narrow asset allocation, and to the benefits of diversification.

If we consider the mid to long-term time horizon, as we suggest that most investors should do, it is worth reminding ourselves that returns from UK Smaller Companies have been comparable to Nasdaq, despite the recent period of UK market malaise.

In the chart below we can see that since the millennium, UK Smaller Company returns have slightly outperformed that of Nasdaq, and that it is only since the recent ‘perfect storm’ of a derating of UK growth equities, coupled with a significant rerating of Nasdaq, that Nasdaq returns have caught up with UK growth equities over this period.

Looking ahead, we expect UK Smaller Companies to once again deliver superior returns from current levels as the subdued UK Smaller Company valuation multiples continue to recover.

Our reasoning for this confidence lies in the strong underlying earnings fundamentals, and the material disconnect between operational performance and share prices currently seen in many stocks within the UK Smaller Companies sector.

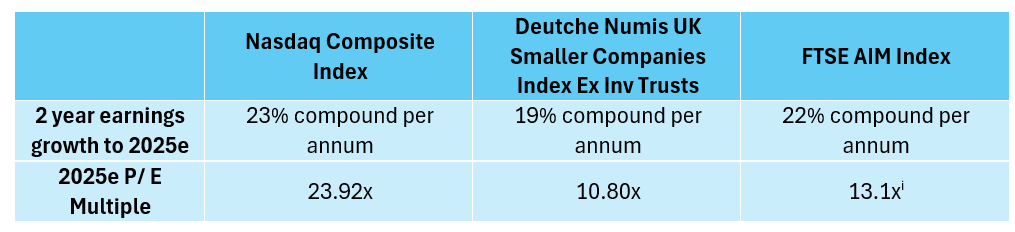

UK Smaller Companies vs Nasdaq – similar growth expectations but very different valuations

Looking at the earnings growth expectations of the respective indexes above, you can see a comparable, and attractive, earnings growth profile for all growth markets highlighted – a healthy c.20% compound annual earnings growth per annum.

Despite the similar operational return expectations from the underlying assets, with over two years of capital flows away from smaller UK growth companies, and a market fixation on Nasdaq recently, there is currently a significant valuation rating differential between markets. Nasdaq is trading on a c.25x price/earnings multiple, whilst the other two UK growth indices are trading on c.11x and c.13x respectively.

We suggest that this extent of valuation disconnect is unlikely to remain.

UK GDP growth continues to confound

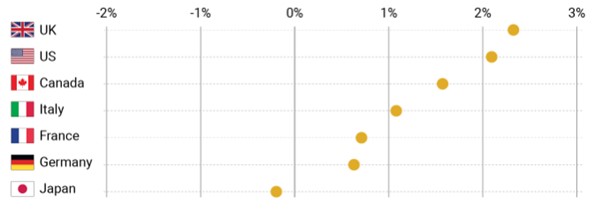

The resilience of the UK economy has been underestimated. After several post-COVID upgrades to its economic performance data, in late June this year, the ONS once again revised up its performance of UK Q1 GDP to 0.7% (from 0.6%). This was the fastest growth since 2021 and the highest of any G7 country1.

Additionally, data from the previous month indicated that the economy grew at 0.4% in the month, double the expected figure. This growth was driven by continued expansion in services and a bounce back in housebuilding. As a result, the UK’s annual GDP growth reached 1.4%, once again surpassing forecasts1.

G7 Countries – Real GDP Q2 2024 (% change against 6 months ago*)

Looking forward, latest IMF projections predict that UK GDP growth will continue to compound at a faster rate than many of its G7 peers2. Given the recent tendency to underestimate UK GDP performance, we suspect there is scope for the UK economy to once again deliver ahead of expectations. This is evidenced by the Bank of England’s recent upgrade of its 2024 real GDP growth forecast from 0.5%, to a more reassuring 1.25%3.

A more confident economic outlook is further likely to encourage global asset allocators to reassess the relative underweight positions within UK equities than many currently hold.

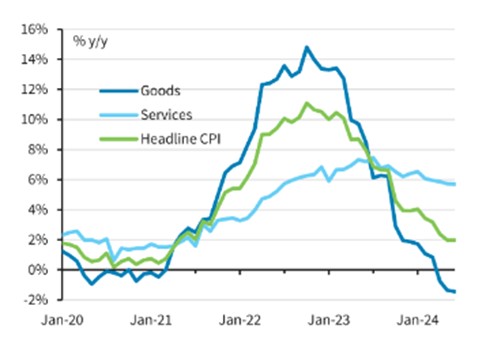

Interest rates and inflation – a return to normalcy

Interest rates, and relatively sticky UK inflation, have been additional factors impacting markets. Thankfully we’re now seeing levels gradually return to historic norms.

The Bank of England has mirrored a recent cut by the European Central Bank, with a 0.25% trim on UK interest rates, bringing it down to 5%3. We anticipate further cuts as we progress through the remainder of the year, with the current expectations for UK policy rates to progress back to 3.5% by the end of 20252.

Although the US Fed has not yet adjusted rates, recent commentary from the central bank, coupled with weakening economic data, suggest that they will soon begin normalising interest rates, with first cut expected in September.

UK CPI – goods, services and core

With regard to what this means for equities, previous cycles show a cut in interest rates have typically sparked a significant recovery in the price of risk assets, including the shares of listed companies. Notably, the UK market has historically been the quickest to respond.

A stable outlook for UK politics

Another major factor impacting markets has been the political fallout from the Brexit referendum and the period of political instability that ensued.

Ahead is the prospect of a more positive period of UK political stability following the commanding majority won by the labour government in the general election. The message emanating from the party has been a focus on fiscal responsibility, and growth generation, both of which will be a further boost to UK equities.

This stability, when compared to recent history and developed market peers currently facing their own challenges, could serve as a catalyst for potential flows back towards the asset class.

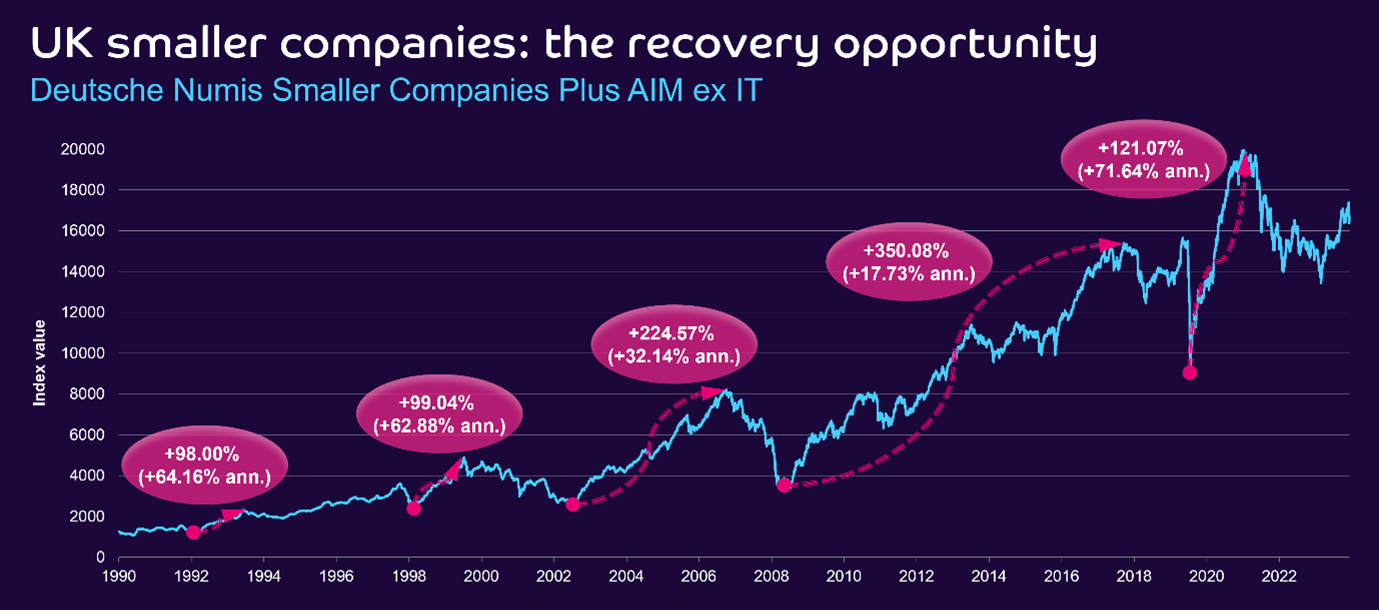

UK Smaller Companies – the recovery potential from here

With all these factors aligning, we believe we are in the early stages of a market recovery.

Clearly it is difficult to assess exactly how far the market will recover, however it’s worth reflecting on previous market trough to peaks.1

Looking back over the last thirty years, recoveries following similar market pull-backs have been substantial, as seen in the encouraging returns highlighted above.

With the key concerns holding back UK equities now behind us, we strongly believe that we are merely at the beginning of a significant recovery period for UK smaller company equities.

Risks to bear in mind

- The value of an investment can fall or rise and you may not get back the full amount you invest.

- Smaller company shares are also likely to fall and rise in value more than shares in larger, more established companies listed on the main market of the London Stock Exchange. They may also be harder to sell.

- Past performance is not a reliable indicator of future results. Nothing here should be viewed as advice. Any suitability decisions should be based on a comprehensive review of your clients’ objectives, needs and attitude towards risk.

- Personal opinions may change and should not be seen as advice or recommendation

1 Office for National Statistics, GDP monthly estimate, May 2024

2 Internation Monetary Fund, World Economic Outlook, May 2024

3 Bank of England Monetary Policy Report, May 2024