We’ve recently celebrated the three-year anniversary of Octopus Ventures EIS. Three years on, it’s as relevant as the day it launched, offering advised clients access to a portfolio of EIS-qualifying companies, selected by Octopus Ventures, one of Europe’s largest venture capital firms.

Some things have changed in that time – we’ve managed EIS portfolios through a global pandemic and rising inflation. But what has remained constant is this: a clear place for EIS investments in suitable clients’ portfolios. If anything, considering EIS should be higher on your agenda.

A good reason to consider EIS: the value of your advice

With rates on cash savings as high as 6%, it might feel as though there are fewer opportunities to advise on.

Because the risk-free rate has risen so significantly, an investment might need to target 8% or more annually to achieve better-than-cash returns after the impact of advice fees.

This is occurring at a time where, under Consumer Duty, we’re thinking more than ever about the value of advice.

So, you may be considering higher-risk investments for some of your clients. The enhanced level of research required to recommend these investments justifies the time taken to consider and advise on them.

And if you have suitable clients who are looking to target higher returns, then it makes sense to consider EIS. The combination of growth potential and tax reliefs make it well worth exploring.

EIS: a powerful structure for growth

For a company to qualify for EIS funding, it must be in the early stages of its growth journey. The company must also be unquoted (which includes being AIM-listed for these purposes).

Buying the shares of these kinds of companies can come with significant growth potential because they’re at the beginning of their growth curve. Of course, with this growth potential comes higher risk.

To compensate for some of the risk of investing in early-stage businesses, EIS-qualifying investments allow investors to claim several valuable tax reliefs.

Loss relief can be claimed against your income or capital gains tax liabilities, and growth is tax free. This is a powerful set of reliefs for a high risk, high growth potential portfolio.

Additionally, investors can benefit from upfront income tax relief on up to 30% of the amount invested, capital gains deferral and relief from inheritance tax.

Since growth is tax-free with EIS, a non-tax efficient investment would need to deliver a much higher annual return to generate an equivalent post-tax outcome for investors. The return a non-tax efficient investment would need to generate is even greater if you also include the upfront income tax the investor receives.

With EIS, investors can access higher levels of post-tax target returns associated with higher risk investing, while benefitting from the available tax reliefs.

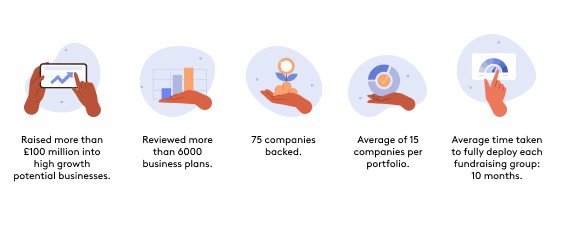

Three years of Octopus Ventures EIS in numbers

But your clients need to be aware of the risks

The generous tax reliefs on offer are provided as some compensation to investors willing to accept the additional risks that come with a high-risk investment.

An EIS investment could fall in value, potentially to nil, and investors may not get back the full amount invested.

There are also tax, volatility and liquidity risks to consider.

Shares in unquoted companies cannot easily be sold, as it may take time to find a buyer. When investing in an EIS portfolio, an exit is only possible when each individual company is sold. So a client’s investment should be considered illiquid and a long-term investment.

The shares of unquoted companies can also fall or rise in value more sharply than shares in larger, more established companies.

A number of EIS tax reliefs depend on companies maintaining their EIS-qualifying status for at least three years. It is possible that a company might cease to be EIS-qualifying and EIS reliefs previously granted would need to be paid back.

HMRC could change existing tax legislation. Tax treatment also depends on personal circumstances.

How to add venture capital to a portfolio whilst considering risk

Clients with significant assets and the objective to significantly growth their wealth, may be comfortable taking on more risk with a portion of their assets. Adding investments in early-stage businesses, such as through EIS, to a client’s existing portfolio lets a client build a riskier portfolio to suit their appetite.

Venture capital investing also offers diversification benefits within a well-balanced portfolio.

A portfolio can be made up of assets that have different risk profiles and different degrees of correlation, while the overall level of risk in the portfolio is at an appropriate level for the client.

Drawing on the research of Dr Brian Moretta of Hardman & Co, we created a whitepaper showing how, through the rebalancing of assets, smaller company investments can be added to a client’s portfolio while being mindful of their overall exposure to risk.

Why now’s an exciting time for venture capital

The economic environment is challenging right now, but this can present material opportunities for some early-stage, EIS-qualifying companies.

Rising unemployment levels, for example, mean there’s a growing pool of talent that didn’t previously exist, especially in technology. This can enable entrepreneurial creativity, with the brightest minds finding new opportunities to disrupt sectors and create value.

Meanwhile, funding is scarce and less capital is available in the market. For us, this means our investment team isn’t facing as much competition, so we have the pick of the best opportunities.

Fewer start-ups are raising money, so those that manage to successfully raise capital will be building their business in an environment where there’s less competition than would have existed in an economic boom.

This all makes for an exciting time to invest in EIS.

1. Global league tables: 2022 Annual, PitchBook, 9 February 2023.