*Information correct as at 1 July 2022

Background on Fern Trading Limited

Fern Trading Ltd is a large trading group which the Octopus Inheritance Tax Service invests in. Its £2.8 billion business is spread across sectors selected to target predictable growth for investors over the long term, no matter the economic outlook.

Fern’s businesses are therefore focused in parts of the economy where we believe demand is consistent, such as generating renewable energy, building and managing fibre broadband in underserved areas, and short term lending to experienced property professionals.

Fern’s performance in the 12 months to 1 July 2022

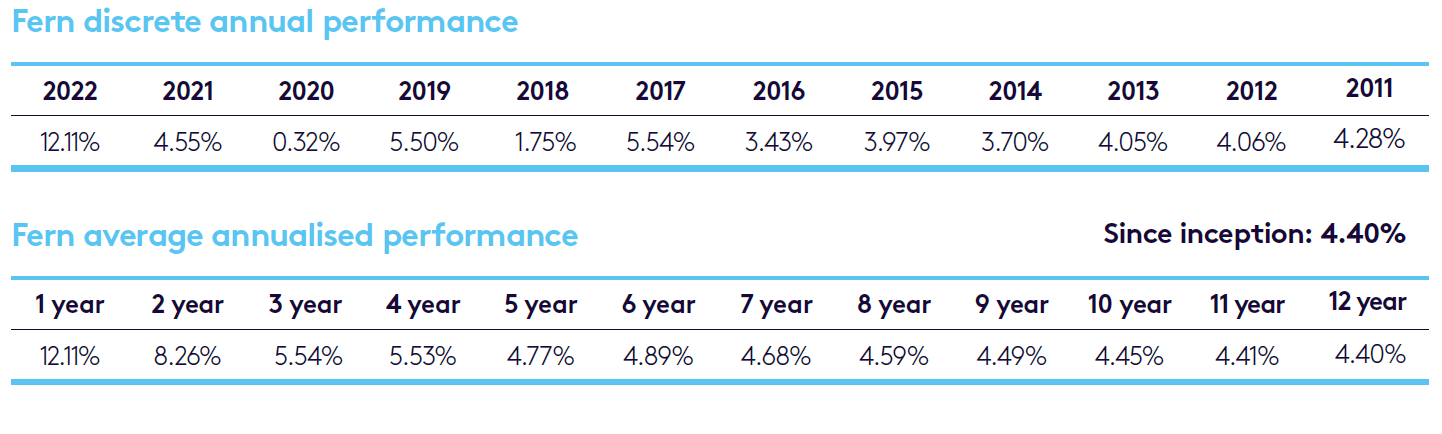

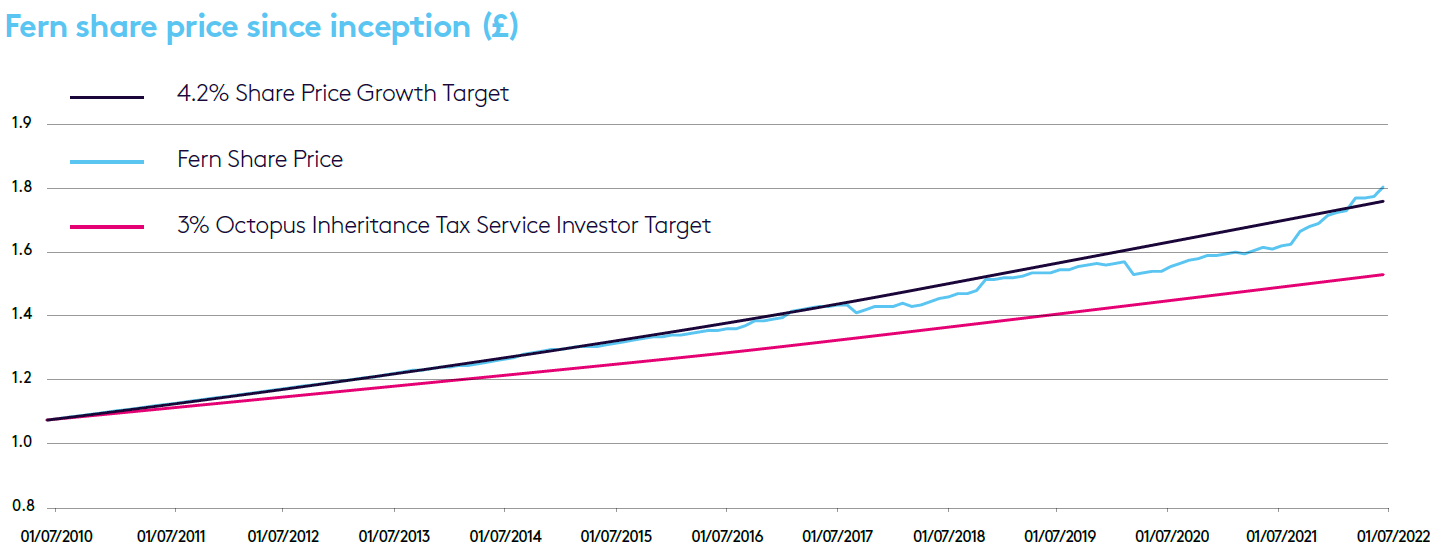

Fern’s share price increased by 12.11% over the 12 months to 1 July 2022. This is well ahead of its target for annual share price growth of 4.20%.

Past performance is not a reliable indicator of future performance.

The performance data in the table and graph on this blog page show Fern’s share price only. They do not take account of initial fees, dealing fees or annual management charges associated with investing in the Octopus Inheritance Tax Service. They should not be viewed as performance information for the Octopus Inheritance Tax Service. Performance is calculated based on the sale price for Fern’s shares at 2 July each year.

The strong outperformance is attributable to Fern’s energy division, which has seen consecutive and material increases in the value of the renewable energy sites that it owns.

Energy prices internationally have risen as the global economy recovers from the Covid-19 pandemic, and demand for energy outstrips supply. This unusually high cost of energy is being amplified by the conflict in Ukraine. EU countries are inflicting financial sanctions on Russia by seeking alternative sources for their energy, further increasing demand.

Fern’s energy division has also benefited in part from inflation. Around half of the revenues generated by Fern’s energy division are guaranteed through various forms of government subsidy, which are inflation linked. As HM Treasury forecast that high inflation is likely to be present until 2025, Fern now expects to receive more revenue for the energy it generates, increasing each site’s value.

It is important to remember that the Octopus Inheritance Tax Service targets predictable performance over the long term. It aims to generate 3% growth per annum net of annual management charge on average for investors. While we are seeing a short-term spike in growth, over the long term the average annualised growth for investors is just slightly ahead of our target.

Inflation

The Bank of England projects that inflation will rise to 11% this year, before slowing next year and being close to 2% in two years’ time [1]. A short period of high inflation should have very little impact on the long term rate at which Fern is expected to grow. This is because the assets it owns, such as its renewable energy sites, derive their value from discounting projected future cashflows over the time they are expected to operate for, typically 20 years or more.

If the outlook for long term inflation were to increase, we would expect this to have a positive impact on Fern, because it would increase the revenue each of its businesses would expect to make from a relatively fixed cost base. This is made possible by the fixed service fee of 2.5% that Octopus Investments charges for running its business. Additionally, government subsidies for renewable energy are inflation linked and wholesale energy prices typically rise and fall in line with inflation.

A controlled increase in inflation is also unlikely to have a material impact on Fern’s lending business. Fern intentionally makes short term loans which allows it to adjust the terms of its loans as appropriate for current market conditions. In fact, the Octopus Investment property lending team was created following the 2009 credit crunch, when a lot of attractive lending opportunities became available. Since then, they have lent more than £4 billion through different trading conditions and outlooks.

Benefits of investing in a large trading group

Fern is the parent company of a large trading group comprising around 300 companies. Its business is split across four core divisions: renewable energy, short term property lending, building and managing fibre broadband networks in underserved regions, and developing and operating retirement villages.

We select sectors that complement one another, performing predictably on a blended basis across various trading conditions and economic cycles.

Fern was established in 2010 and benefits from both maturity and scale. It has been able to expand into new areas while managing risk by buying established business or teams that represent only a small part of its assets due to the scale of the group. This has allowed Fern to diversify without detracting from its target of predictable performance.

While the outlook across all Fern’s sectors is strong, its well diversified business model is designed to target smoother returns in the event market conditions become unfavourable in one area.

Outlook for renewable energy

Fern has seen growth over the 12 months to 1 July 2022 ahead of its target. This results from its renewable energy division, which has become more valuable this year due to external factors causing forecast revues to grow against a fairly stable cost base (Fern pays Octopus Investments a fixed 2.5% fee for running its business).

Energy sites are valued based on the future revenues they are expected to generate. When these increase, the market value of each site today also increases. The factors that have contributed to growth in value are:

- Forecast energy prices have increased due to supply reductions.

- Around half of revenues from Fern’s renewable assets are guaranteed through some form of government subsidy which is inflation linked.

- Fern secures around a quarter of its energy revenue via fixed price Power Purchase Agreements (PPAs). These are medium term fixed price contracts (typically 2-5 years). When existing PPAs expire, Fern enters into new contracts based on current wholesale energy prices and these prices have been higher than forecast.

Outlook for property lending

Fern has intentionally focused its property lending business on short term secured loans to experienced property professionals across several sectors. The short-term nature of its business enables Fern to adapt to changes in outlook swiftly when writing new loans. This means it doesn’t have long term exposure to the property market through its existing business. This strategy has served Fern well since inception, and it has operated through periods of change several times, notably following the Brexit vote.

Our property lending team have an excellent track record, with an extremely low capital loss rate of 0.3% since they were founded in 2009. The average loan length across the book is around 22 months and the average LTV is around 62%, meaning the loan book is well placed to withstand adverse market movements over the next 24 months.

The low level of capital losses is a testament to the prudent approach Fern takes to lending. The credit team are being cautious in their credit assessment of new opportunities in light of the changing economic outlook. Fern has reduced its risk appetite for new loans and is targeting slightly lower returns from its lending business as a result. It has also prudently introduced an expected provision level (whereby Fern sets aside assets to account for potential losses on loans ahead of time). Fern took the same approach at the start of the Covid-19 pandemic and immediately following the Brexit vote – both of which were subsequently released. These small downwards movements have been factored into the current share price.

Outlook for fibre

Fern continues to build out its fibre business as part of its diversification strategy. The five fibre companies that Fern owns are continuing to construct their networks in underserved parts of the UK. The inflationary environment has resulted in higher construction costs to build their networks. However, from a valuation perspective, this is broadly offset by higher expected monthly revenues from consumers, as can be seen by many internet service providers like Virgin and BT increasing contract prices by more than RPI in recent months.[2]

The Octopus Inheritance Tax Service has operated through periods of economic uncertainty before

- Fern has been trading since 2010 and therefore has traded through the period of uncertainty around Brexit and more significantly during the Covid-19 pandemic.

- Fern’s scale (£2.8 billion market capitalisation) and diversified business strategy has enabled it to trade well through both periods.

- While returns were impacted in the short term, returns in the medium to long term have remained at or above the target of 4.2% annual share price growth.

- Periods of high inflation generally have an overall positive impact on Fern’s share price due to the renewable energy asset revenues that are partially linked to inflation.

Key investment risks

While Fern operates a diversified business to mitigate certain risks, because the Octopus Inheritance Tax Service invests in one or more unquoted companies, investors’ capital is at risk. The value of an investment can fall as well as rise. Investors may not get back the full amount they invest.

Tax treatment depends on individual circumstances and tax rules could change in the future. The relief from inheritance tax depends on the portfolio companies maintaining their qualifying status. Investors can request to sell their shares at any time, although liquidity is not guaranteed. The shares of unquoted companies could fall or rise in value more than shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

Where to find out more

To read about the Octopus Inheritance Tax Service’s underlying assets, click here.

You can find more information about the Octopus Inheritance Tax Service here.

[1] https://www.bankofengland.co.uk/knowledgebank/will-inflation-in-the-uk-keep-rising

[2] https://www.bt.com/tell-me-more