GuideBusiness Relief

About SOLLA

Advising older clients about estate planning

At the Society of Later Life Advisers (SOLLA) we see a real and growing opportunity to help advisers develop their skills when it comes to advising clients in later life.

SOLLA helps older people and their families to find trusted accredited financial advisers who understand the financial needs of later life. And we help advisers develop the technical and soft skills they need to provide excellent advice to older clients.

Specialist accreditation

Our Later Life Adviser Accreditation has become the recognised gold standard for advisers specialising in the older client sector. Because it’s a voluntary accreditation, advisers who hold it send a strong signal that they have enhanced their skills and knowledge in this area. In addition to being a stand-alone award, the Later Life Adviser Accreditation is also the basis of membership of the Society of Later Life Advisers, or SOLLA.

Benefits of becoming a SOLLA Adviser

If you actively advise older clients, becoming accredited gives you independent recognition of your knowledge and advice skills. It shows clients and potential clients that you’re a specialist in later life advice, which is helpful if you want to do more business with this client sector.

This guide gives you an idea of the skills and knowledge you can expect to master as a SOLLA member. However, it’s no substitute for the training and support our members receive when they decide to specialise in this important and growing advice sector.

Why later life clients need a different approach

Why later life clients need a different approach

Let’s start with a question.

How many of your clients would you say are in or approaching what most people would call ‘later life’? Chances are the number you’re thinking of is increasing year on year.

When it comes to giving financial advice, older clients present a number of complex challenges, some of which are far outside the standard financial planning mind-set.

For example:

- They may be asset rich but cash poor, and worried about their day-to-day outgoings.

- They may have concerns over whether they can afford later life care, should they need it.

- They may have dementia or other mental health issues.

- They may wish to leave a legacy to their loved ones.

- They could have difficulty in making certain decisions or be vulnerable in other ways.

- They might have physical health issues that don’t affect their mental capacity but could impact their lifestyle.

That’s quite a long list. The good news is that we can walk you through some of the things you need to think about when having conversations with older clients. This includes giving you practical advice and tips to lead to better conversations and, hopefully, better outcomes for everyone.

Estate planning and inheritance tax

A lot of the issues facing older clients are beyond the scope of this guide. But it does contain guidance about what to consider when meeting with older clients. It also offers some helpful pointers for when you’re discussing how to plan for inheritance tax (IHT), which can sometimes be an uncomfortable subject to bring up.

Arranging meetings with older clients

Arranging meetings with older clients

It’s important to get the initial meeting right. Follow our practical tips for meeting with older clients to provide a helpful, considerate service clients will really appreciate.

Arranging remote meetings

Have a policy for arranging online meetings. Older or vulnerable clients often need additional support for meetings by telephone or online if these cannot be conducted face to face. This may especially be the case for those with cognitive issues or physical limitations who may wish to have somebody with them to help.

Other practical things to think about:

- Time of day – Older clients can sometimes be much more aware at certain times of the day. Work to their schedule, rather than what’s convenient for you.

- Surroundings – Some older clients may feel uncomfortable in unfamiliar surroundings and may prefer to hold the meeting in their own home. Others may prefer to be in a more formal setting to talk about their finances. Make it clear that you’re flexible, and that it’s their meeting.

- Discussing finances can be mentally draining – It may be necessary to carry out the meeting over several sessions. Where appropriate, give them more time to reflect fully before moving on or making a decision.

- Support – Consider whether the client would like to invite someone else to the meeting to support their decisions. Or would the client prefer to discuss their finances privately?

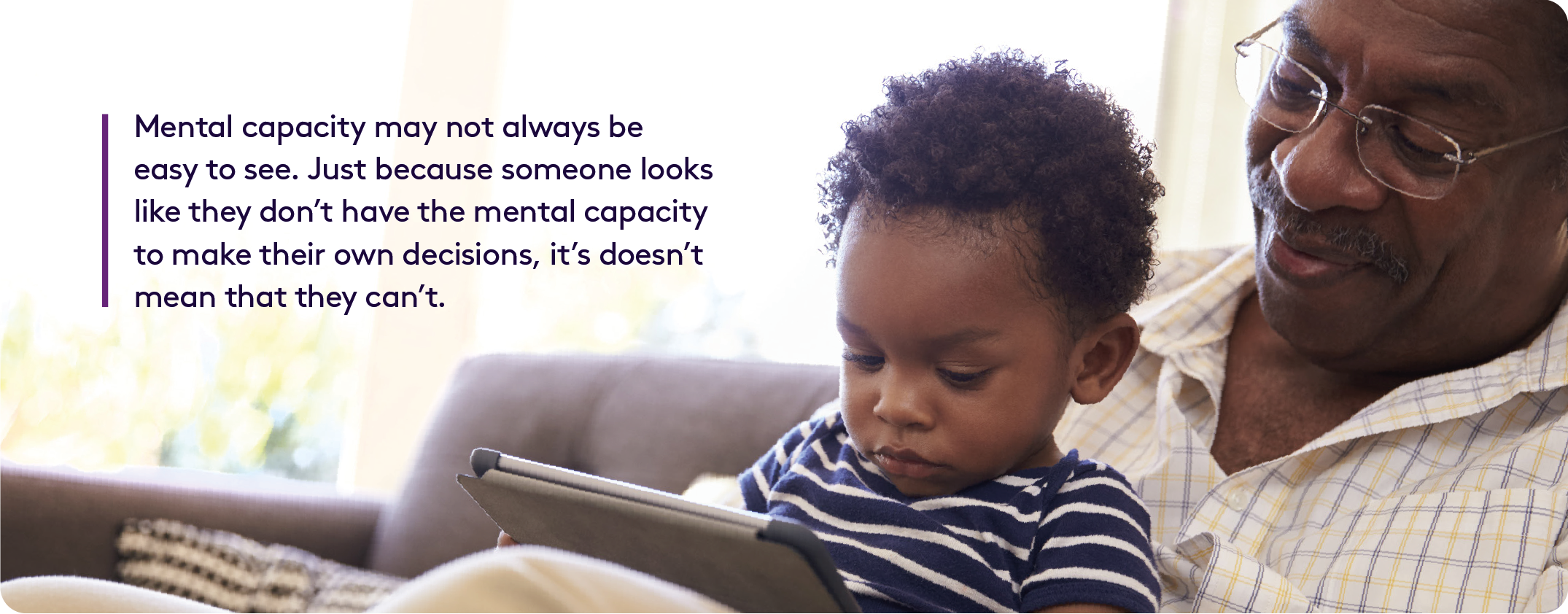

The Mental Capacity Act

Below are headline considerations from the legislation to think about before meeting someone where mental capacity could be a concern.

- Everyone has the right to make his or her own decisions. Mental capacity should be assumed unless it has been proved otherwise.

- Individuals must be given the help to make decisions themselves. This may include things like providing the person with information in a format that is easier for them to understand.

- Just because an individual makes an unwise decision, they should not be treated as lacking the capacity to make that decision.

- Any act done for a person who lacks capacity must be done in their best interests.

- Anything done for a person who lacks mental capacity should be the action that least restricts their basic rights and freedoms.

Pre-meeting checklist

- Have you arranged to meet the client at the best time of day for them?

- Are they in surroundings where they feel most comfortable?

- Where necessary, have you broken down the meeting into bite-size chunks, to give them time to absorb the information?

- Do they have any impairment issues (like hearing loss) to be mindful of?

- Where relevant, have you brought any visual aids with you?

- Do you plan on using simple language to communicate as clearly as possible?

- Have you checked whether it is appropriate for anyone else to be in the meeting?

How marital status affects inheritance tax

The Financial Conduct Authority (FCA) believes “consumers in vulnerable circumstances may be significantly less able to represent their own interests, and more likely to suffer harm than the average consumer”.

Back in 2015, the FCA published a paper discussing ‘Consumer Vulnerability’. More recently the FCA published their guidance for firms on the fair treatment of vulnerable customers, which can be found on their website.

As a financial adviser, you have a responsibility to protect the interests of your vulnerable clients. The good news is that there are lots of ways in which you can train yourself to become more comfortable identifying and working with vulnerable clients.

How SOLLA can help

SOLLA runs a number of regular training sessions and workshops dedicated to helping advisers perfect the skills required to advise older clients. We also run sessions designed to help advisers expand their later life business. Both are available for SOLLA members and non-members. Find out more at societyoflaterlifeadvisers.co.uk .

Do you have an ‘older and vulnerable clients’ policy?

Your staff may find it useful to have a specific policy for dealing with older and sometimes more vulnerable clients. Do you know what constitutes vulnerability in older people? How to identify when an older person may be vulnerable? Where can you make changes in your working practices to ensure an older person receives extra care and support when needed?

Specific free training and CPD can be found at societyoflaterlifeadvisers.co.uk/training/ Consumer-vulnerability-training. This is available for all staff as well as financial advisers.

Keep an open mind

Remember, just because someone has been financially successful doesn’t mean they aren’t vulnerable. A lot of top executives and former professionals are targeted, and taken in, by scams and people looking to exploit them.

Documenting meetings with older clients

Documenting meetings with older clients

As with any client meeting, documenting the meeting – and its outcomes – is best practice. But there are some specific tips you could consider in relation to older clients.

Getting everything down on paper

Because some clients will have difficulty remembering everything that was covered in the meeting, you should not underestimate the value of taking notes about everything. If and where appropriate, it may be worth recording the conversations for future reference (make sure you ask permission).

Consider meeting the client one-to-one

Remember that you are acting on behalf of the client, not their family. As such, this is a situation where you might want to see the client alone. In some situations, this might be the best way to make sure that you understand your client’s wishes, even if there is a power of attorney in place. Make sure you document that you met the client alone.

Where appropriate, keep beneficiaries in the loop

Once you have had an initial meeting and understood your client’s wishes, it might be appropriate to involve the beneficiaries in future meetings. This can help you to make sure that they understand what is planned, which could help avoid any misunderstanding at a later date when your client might have lost capacity or passed away. Talking to beneficiaries also gives you the opportunity to engage with potential new clients.

If you are advising the client on estate planning only, this should be made clear in your report. If the client does not wish to discuss inheritance tax planning, best practice is to ask the client to confirm this in the report.

Documenting the meeting: checklist

- Have you made full and comprehensive notes about what was discussed during the meeting?

- Have you made a list of everyone who attended the meeting, and their relationship to the client?

- Have you determined whether the client has a potential inheritance tax liability?

Making decisions on behalf of others

Making decisions on behalf of others

As with a will, clients should be encouraged to think about putting a Lasting Power of Attorney (LPA) in place.

Why put an LPA in place?

If your client can no longer take care of their affairs (either financial or health-related), an LPA ensures that a person of their choosing can make decisions on their behalf.

Not having an LPA in place can have serious implications should someone lose capacity. As the adviser to the client, you would no longer have a relationship with anyone capable of making decisions on their behalf. Their loved ones would need to apply to the Court of Protection to become a ‘Deputy’ in order to be able to make decisions for them. This can be a long and expensive process.

It’s a common misconception that having an LPA in place means that the client relinquishes control over their own decisions. An LPA provides them with the power to delegate certain decisions to their attorney either because they’re unable to make those specific decisions, or because they don’t want to make them. A deputyship offers much less flexibility for the client, whereas an LPA can be tailored to the client’s specific wishes.

What to do if you’re not satisfied with the attorney’s actions

If you feel an attorney isn’t acting within the scope of the LPA, you might feel it’s appropriate to report the matter to the Court of Protection. Refusing to work with the attorney doesn’t solve the problem – they may just go somewhere else. You should always act to protect vulnerable clients, especially when they are donors.

Best practice when advising a ‘donor’

Advisers should remember that it is the client (known as the ‘donor’) that they are advising, not the attorney.

If possible and appropriate, you should try and see the donor on their own to make sure that you understand their wishes. The attorney must always consider what the donor would have wanted if they were capable of making the decision and act in their best interests.

• You should feel satisfied that any decisions made by the attorney are decisions that the donor could not have made themselves.

• When the donor cannot make a decision, or has decided to defer to the attorney, you should feel satisfied the attorney is acting in the donor’s best interests.

• Where there is more than one attorney, you should check whether they are required to act jointly or if they can act separately.

• LPAs differ, and they will sometimes limit the powers an attorney holds. For example, they may allow the attorney to deal with certain aspects of the donor’s financial affairs and not others. You should ask attorneys to show you the original document or a certified copy. This doesn’t just prove they have authority, it also helps you understand the scope of that authority.

Power of Attorney: checklist

- Does your report reflect the fact that you are advising the donor, not the attorney?

- Are you happy that the attorney is acting in the best interests of the donor?

- Have you asked the attorneys to prove they have authority by providing the original power of attorney document or a certified copy?

- In cases where there is more than one attorney, have you confirmed whether they are required to act jointly or whether they can act jointly and separately?

- Have you checked this is a decision the donor wants the attorney to make?

About Octopus Investments

About Octopus Investments

Octopus Investments is an award-winning, fast-growing UK asset management business.

We work with tens of thousands of clients and we’ve built market-leading positions in tax-efficient investments, smaller company financing, renewable energy and healthcare.

Championing the need for estate planning

We launched our first investment that qualifies for inheritance tax relief in 2005 and have continued to specialise in this sector, becoming the clear market leader¹.

How Octopus supports advisers

We have a broad range of support services and material available for financial advisers, including:

- An award-winning adviser support team of more than 50 people.

- A dedicated estates and probate team to help executors and beneficiaries when they inherit an investment.

- Our client-friendly ‘Untangling inheritance tax’ guide.

- Online adviser tools designed to help advisers calculate their clients’ inheritance tax liabilities. These include a gifting calculator and a residence nil rate band calculator.

- Regular tax planning webinars and seminars to give advisers a thorough grounding in estate planning products. These typically qualify for CPD.

¹Tax Efficient Review, April 2021

A reminder about Business Relief

A reminder about Business Relief

Octopus is the largest provider of investments that qualify for Business Relief.

There are a number of well-established estate planning strategies to reduce or potentially even eliminate the amount of inheritance tax a client’s family are required to pay on their estate when they die. Examples include gifts, trusts and Business Relief (BR).

BR is an established form of tax relief that gives people an incentive to invest their money into trading businesses. It was introduced by the government in 1976 as a way to ensure that inheritance tax wasn’t paid on small businesses when they passed between the generations. Shares in a BR-qualifying business can be left to beneficiaries with relief from inheritance tax, provided they have been owned for at least two years at the time of death.

For deaths before 6 April 2026, Business Relief investments (Alternative Investment Market or unquoted shares) held for two years attract 100% IHT relief. From 6 April 2026 a 100% IHT relief will continue for the first £1 million of combined agricultural and unquoted Business Relief qualifying property (e.g. sole traders, partnerships, unquoted companies). Amounts over the £1 million will attract 50% IHT relief. Business Relief qualifying companies listed on AIM, will attract 50% IHT relief irrespective of the investment amount.

Identifying clients to talk to about estate planning

Identifying clients to talk to about estate planning

You may already have clients in your client bank who could benefit from a conversation about estate planning.

At Octopus we’ve been providing estate planning solutions for over 15 years. Advisers have shared with us the following tips to quickly identify the best clients to talk to:

- As a starting point, draw up a list of all your clients who are in their 70s and have assets over £325,000. Some will already have done inheritance tax planning, but you may find others who have a liability and have not yet made any arrangements.

- Anyone recently widowed may also benefit from an estate planning conversation, especially if their spouse previously handled the finances.

- It can also be a good idea to revisit clients with existing inheritance tax plans in place because some of these clients’ situations may have changed, creating a liability.

Here are some other clients you should think about too.

You may also have clients who haven’t done estate planning because traditional solutions don’t appeal to them. Investments that qualify from BR might present an interesting opportunity that these clients are not aware of. So you should definitely consider speaking to any clients you have who fit the following scenarios:

Clients who require an estate planning solution while retaining access to their wealth.

Clients who have sold a business in the last three years.

Clients with a power of attorney in place.

Clients looking to settle assets into trust.

Clients with large ISA portfolios that would be liable for inheritance tax.

Starting the estate planning conversation

Starting the estate planning conversation

Advisers tell us they have clients who would benefit from doing inheritance tax planning, but it can be a difficult conversation to start.

Here are a few ways you can start this important conversation with your clients.

Do they need to make a will or review an existing one?

Clients may need to revisit their will to make sure loved ones get the full benefit of the residence nil rate band (RNRB). If you’re talking to a client about their will, it often makes sense to have a broader conversation about inheritance tax and estate planning.

Have you got a copy of our ‘Untangling inheritance tax’ guide?

Advisers tell us clients love our ‘Untangling inheritance tax’ guide. So make sure you have a copy to hand. It’s a great way to show clients how estate planning works and how you can help them with it.

Have you used our IHT calculator?

You’ll find it on our website. You can use it to get an idea of how estate planning could benefit your clients, based on their individual circumstances. The RNRB calculator is client friendly, too, so you can use it with clients to help them better understand their situation.

Comparing different estate planning strategies

Comparing different estate planning strategies

As you know, there are several different estate planning strategies a client might use.

It’s unlikely clients will use just one estate planning strategy. So they will want to know how different strategies compare to one another:

| Discounted gift trust | BR-qualifying investments | Lifetime gifts | Life assurance | |

| How quickly is relief from inheritance tax achieved? | Immediately | 2 years | 7 years for full relief | Immediately |

| Can it provide an income? | Yes | Yes | No | No |

| Does the client keep access to their wealth? | No | Yes | No | No |

| Is a medical questionnaire required? | Yes | No | No | Yes |

| Does it use up the client’s nil-rate band? | Sometimes | Sometimes* | Sometimes | No |

At Octopus we’re specialists in BR. We know that investments that qualify for BR can appeal to clients who are comfortable taking more risk with their money. We also appreciate that BR is generally not as well understood by clients as other estate planning strategies. In the next section we share some ways that advisers have told us they explain BR to clients. BR-qualifying investments put client capital at risk and liquidity can’t be guaranteed. You can read more about the risks of investing in BR-qualifying companies here.

*For deaths before 6 April 2026, Business Relief investments (Alternative Investment Market or unquoted shares) held for two years attract 100% IHT relief. From 6 April 2026 a 100% IHT relief will continue for the first £1 million of combined agricultural and unquoted Business Relief qualifying property (e.g. sole traders, partnerships, unquoted companies). Amounts over the £1 million will attract 50% IHT relief. Business Relief qualifying companies listed on AIM, will attract 50% IHT relief irrespective of the investment amount.

Talking to clients about Business Relief

Talking to clients about Business Property Relief

Over the years, advisers have shared with us tried-and-tested ways to help clients better understand BR. Here are some practical tips.

Explain to clients why BR exists

Before getting into the nuts and bolts of how BR works, it’s often helpful to reassure your client that this is a well-established tax relief that delivers economic benefits and financial support for UK companies.

BR has existed since 1976 because governments recognise that it encourages people to take risk with their money by investing in companies that aren’t listed on the London Stock Exchange’s main market.

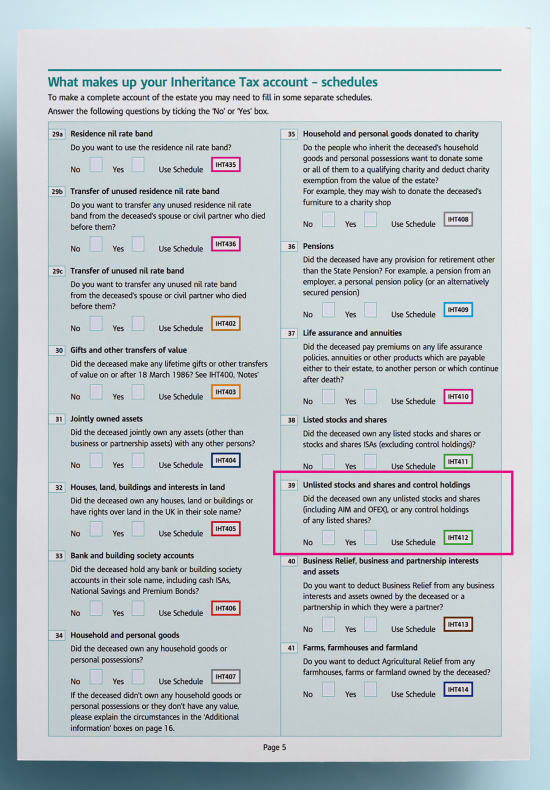

You might even show them the section of HMRC form IHT400 that refers to Business Relief (another term for BR) so they can see how simple it is to claim the relief.

Once your client knows why BR exists, it’s likely they’ll be more comfortable discussing how it can benefit them.

Explain how BR works

A client can benefit from BR by buying shares in a BR-qualifying business. The rules are that an investor must hold the shares for at least two years and still hold them at the time of death. The shares can then be left to their beneficiaries with relief from inheritance tax.

Explain how they can access BR-qualifying investments

Make it clear that there are companies (Octopus is one of them) that specialise in helping investors make BR-qualifying investments. We invest the money for them and in addition to managing their investment, we monitor it to check it remains BR-qualifying.

Explain why they might want to consider BR-qualifying investments

In addition to the potential for investment performance, there are three main benefits of holding BR-qualifying shares.

- They offer inheritance tax relief relief after two years, compared to seven years with gifting.

- They let clients hold their wealth in their own name, meaning they retain access and control.

- And BR-qualifying investments don’t use the nil-rate band allowance, leaving them free to use for other assets.

Explain the risks of investing in BR-qualifying companies

While BR is a valuable relief for clients, they can’t get it without taking on investment risk. Clients will need to weigh up the up to 40% inheritance tax saving against the fact that buying shares in a trading business puts capital at risk, meaning they may get back less than they invest.

To qualify for BR, a company must not be listed on a main stock exchange. That means investing in the shares of unquoted or AIM-quoted companies, which can fall or rise in value more than those listed on the main market of the London Stock Exchange. Such shares may also be harder to sell.

You should also make clients aware that tax rules and reliefs can change. There is no guarantee that companies that qualify for BR today will always qualify in the future. The value of tax reliefs will depend on each client’s personal circumstances.

How Octopus can help you find the right investment for your client

How Octopus can help you find the right investment for your client

When a client decides they want to make a BR-qualifying investment, the next step is finding the right investment that suits them.

So, you’ve identified clients to talk to about estate planning. You’ve had a conversation about their situation and if appropriate, explained the risks and benefits of making BR-qualifying investments. Now it’s time to choose the right investment for your client. We have a wide variety of materials and support to help you when you’re undertaking product due diligence.

If you have a technical question on estate and inheritance tax planning, the new free helpdesk, for advisers, from Octopus Investments can support you on questions like this, and more. Just submit your question or book a meeting with one of our experts.

Ask Octopus – our IHT and estate planning helpdesk

Got a technical question about estate planning?

We’re here to offer advisers support.

How Octopus can help you find the right investment for your client

We have a wide variety of materials and support to help you when you’re undertaking product due diligence:

suitability reports

expert BDM team

What are the key risks of BR-qualifying investments?

We only want people to invest with us if they’re clear on the risks as well as the potential rewards.

It’s important to remember that BR-qualifying investments are only suitable for clients who are comfortable taking more risk with their money. So you should make sure that clients understand the risks:

• BR-qualifying investments put investors’ capital at risk. The value of an investment, and any income from it, can fall as well as rise, and an investor might not get back the full amount that they invest.

• You should keep in mind that tax rules could change in the future and the tax reliefs available today may not always be available in the future.

• The availability of tax relief depends on an investor’s personal circumstances. It also depends on the companies we invest in maintaining their BR-qualifying status.

• The shares of the smaller and unlisted companies we invest in can fall or rise in value more than shares listed on a main stock market, such as the London Stock Exchange. It may not always be possible to sell shares straight away.

For more information, including details of fees, charges and risks, please read the product brochures. Qualification for relief from inheritance tax is assessed by HMRC at the point a claim for BR is made and is not guaranteed. We recommend investors seek professional advice before deciding to invest.

Inheritance tax solutions from Octopus

Inheritance tax solutions from Octopus

Octopus is the UK’s largest provider of investments that qualify for BR¹.

We have been managing a range of investment services capable of meeting specific estate planning needs for more than 15 years. Each service aims to achieve inheritance tax relief after just two years, while ensuring investors are able to keep access to their investment.

Octopus Inheritance Tax Service

A service targeting a steady, predictable return. It has been helping investors pass on more of their wealth since 2007.

Octopus AIM Inheritance Tax Service

Helping investors pass on more of their wealth, while targeting growth by investing in companies listed on the Alternative Investment Market (AIM).

Octopus AIM Inheritance Tax ISA

Investors with large ISA pots can plan for inheritance tax while keeping their wealth in an ISA wrapper.

¹ Tax Efficient Review, April 2024