WhitepaperInheritance tax

What is inheritance tax and when is it due?

Inheritance tax key considerations

Last updated: 5 January 2026

What is inheritance tax and when is it due?

Inheritance tax (IHT) is due on the value of assets a person leaves behind when they die (their entire estate) that exceeds available allowances.

It can also apply to some gifts that are made before a person dies, whereby reductions are made from an individual’s estate. Inheritance tax can therefore apply:

- During a lifetime when assets (including cash) are given away to an individual.

- During a lifetime when assets are settled into trust.

- On death, when the entire estate is given away.

The rate of IHT is 40% and is charged on the value of the estate that exceeds available allowances.

What inheritance tax allowances are available?

There are two key inheritance tax allowances to be aware of.

1. Nil rate band

Everyone is entitled to a nil rate band (NRB) of £325,000.

This is the amount an individual can leave free from inheritance tax. The NRB can also be used to make lifetime chargeable transfers up to £325,000 for any transfers within seven years of the donor’s death.

2. Residence nil rate band

For deaths that occur after 6 April 2017, the residence nil rate band (RNRB) applies to an individual’s home and can be claimed on top of the existing £325,000 NRB inheritance tax threshold. The allowance is currently set at £175,000 until April 2030. Explore our helpful guide on the RNRB allowance.

Any unused NRB and RNRB can transfer between spouses and civil partners on the death of the first spouse. Explore our helpful guide on the transferable NRB and RNRB allowances.

Ask Octopus

Do you have a question about inheritance tax and estate planning?

Use our free helpdesk to Ask Octopus

Exempt transfers on death

Exempt transfer on death

Certain transfers on death are exempt from IHT, meaning they are deducted from your estate before calculating IHT. These exempt transfers include transfers to spouses and civil partners on death.

Transfers to charities, national museums, universities, the National Trust, political parties and other institutions such as housing associations are also exempt.

How to calculate inheritance tax

How to calculate inheritance tax

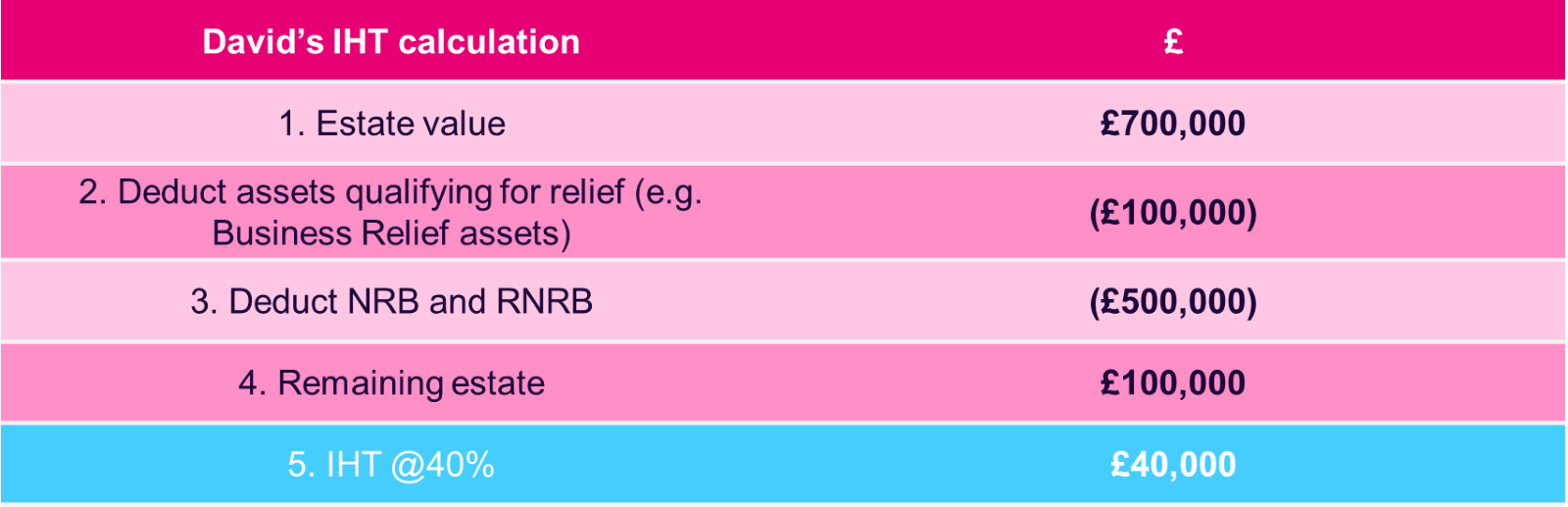

Broadly, to calculate the inheritance tax position you would:

- Total up all assets in the estate, including gifts made within seven years of death.

- Deduct any exempt transfers on death, e.g. to charity or spouses.

- Deduct any assets that qualify for relief e.g. Business Relief assets.

- Deduct the available NRB and RNRB as appropriate.

- Then apply 40% IHT on the balance.

Explore our inheritance tax calculator for more information.

When do you pay inheritance tax?

When do you pay inheritance tax?

IHT is payable six months after the death of the individual.

Payment in instalments

IHT can be paid in instalments on transfers of land, an interest in a business or certain shares where the transfer is made on the death of the transferor.

The type of shares which apply are a controlling interest in any shares; or

- Unquoted shares transferred on death provided that more than 20% of the IHT owed by that person (the transferee) relates to IHT, which can be paid in instalments, including in relation to the shares.

- Unquoted shares not transferred on death where the tax due cannot be paid without undue hardship, and on the basis that the shares are retained by the transferee at the date of death.

- Unquoted shares with a transfer value of £20,000 or more and that represents either more than 10% of the nominal value of the company, tested either at the time of the transfer or at the date of death.

IHT charged on a potentially exempt transfer (PET) or chargeable lifetime transfer (CLT) will be payable by instalments only where the transferee still owns the property at the date of the transferor’s death and the value of the property has been reduced. In the case of unquoted shares, they must remain unquoted from the date of gift to the date of death.

Direct payment of IHT

The Inheritance Tax Direct Payment Scheme applies to most banks, building societies and other regulated client money handlers. If the executors fill out form IHT 423 then this allows payment to HMRC directly to cover an IHT bill from the deceased’s bank, savings or investment account. This can often be quite handy, because probate can’t be granted until IHT is paid, and the executors may not want to sell illiquid assets (such as property) to cover the bill before probate.

Submitting an inheritance tax return

Submitting an inheritance tax return

An IHT 400 form, along with any supplementary pages, are required to be submitted by the executors to HMRC within twelve months of the deceased passing.

Inheritance tax and your tax domicile

Inheritance tax and your tax domicile

- A person’s tax domicile dictates how much of their assets are subject to inheritance tax in the UK. Tax domicile is more than just where an individual lives.

- Where an individual is UK tax domiciled (as defined by the tax rules) they are subject to inheritance tax in the UK on their worldwide assets.

- Where an individual is non-UK domiciled, they are subject to inheritance tax in the UK only on their UK assets.

- When an individual is also subject to tax in another country on the same assets, there may be relief available for the double taxation.

Amending a will after death (deed of variation)

Amending a will after death (deed of variation)

A deed of variation can be undertaken to amend the will to restructure the assets, as necessary. Depending on the amendment, this may alter the IHT due.

The deed of variation can be made up to two years after the death of the relevant individual. The beneficiaries who would be giving up assets as a result of the amendment would have to agree to the deed of variation.

Read more about will drafting and Business Relief in our helpful whitepaper.

Tax legislation, rates and allowances are correct at time of publishing for the tax year 6 April 2024 – 5 April 2025.

For deaths before 6 April 2026, Business Relief investments (AIM or unquoted shares) held for two years attracts 100% inheritance tax (IHT) relief to an unlimited value.

From 6 April 2026, 100% IHT relief will continue for the first £2.5 million of combined agricultural and unquoted Business Relief qualifying property (e.g. sole traders, partnerships, unquoted companies). Amounts over £2.5 million will attract 50% IHT relief. Business Relief qualifying companies listed on the Alternative Investment Market (AIM), will attract 50% IHT relief irrespective of the investment amount.

Related resources

Related resources

IHT Toolkit

You can educate and nurture clients with these resources when having conversations about estate planning using this handy Toolkit.

Autumn Budget Hub

Everything advisers need to translate Budget changes into meaningful conversations and smarter client outcomes.

Intergenerational planning guide

Who will advise your clients beneficiaries? Read our top tips for retaining assets under advice in the great wealth transfer.