Seccl, the Octopus-owned custodian and platform technology provider, last week released new research exploring the rising number of advisers and investment managers looking to take control of their clients’ platform experience. The findings indicate a new and disruptive area of the market is taking root – as Ruth Handcock, CEO of Octopus Investments (and Chair of Seccl) explains…

If you asked most advisers whether the platform market is undergoing a period of historic disruption, they’d probably shrug and say, ‘not really’.

And you could hardly blame them. After all, while the technology that underpins most areas of life has transformed beyond recognition over the last ten to fifteen years, the software that supports the platform market has changed somewhat more… iteratively.

But while it’s always hard to assess the significance of any change when you’re in the middle of it, research unveiled last week would suggest that advisers and platforms could be entering a new and exciting chapter of their relationship.

According to a survey conducted for Seccl, the Octopus Group custodian and platform tech firm that I chair, 44% of advisers have given at least some thought to operating a platform of their own – whether that’s to better integrate their systems and tools, drive down the cost to the end customer, or to create economies of scale.

To clarify, unlike ‘white labelling’ – where firms can brand and potentially influence the pricing or terms through which a platform is provided – advisers or DFMs who choose to operate their own platform will take full control of the platform experience (explaining why this trend is sometimes referred to as one of ‘platform ownership’).

Under this model, firms typically rely on a custodian and underlying technology provider such as Seccl to provide the platform infrastructure, but take on the responsibility of day-to-day platform administration themselves – and also sign platform terms directly with the client, removing any third-party from the picture.

It’s a big decision that won’t be right for many firms – and so to see over 40% considering it shows just how far the market has moved in recent months and years (I’d wager that if you’d asked the question only 18 months ago, that figure would have been substantially smaller).

So, what’s behind the change?

The sizeable interest in this new platform model is just one of many takeaways from Seccl’s new paper, Advisers Assemble! Why more advisers and DFMs are choosing to operate their own platform.

It brings together some of the key findings from research conducted by award-winning consultancy the lang cat, which included a survey of nearly 200 advisers and in-depth interviews with over a dozen individual firms. You can also watch Sam, Seccl’s Co-CEO, and Mark, the lang cat’s Principal, discuss these findings during a super interesting launch webinar – check it out here.

For me, the most striking observation had to do with control – or, rather, the lack of it.

According to the research, only 2% of advisers feel fully in control of the platform service that their clients receive – a staggeringly low figure given the relative importance of that service to their end delivery of advice.

And yet, at the same time, 89% feel that their clients hold them responsible for it, to some degree or another.

That’s a remarkable mismatch, which goes a long way to explaining why we’re seeing more and more advisers looking to take greater control over the platform experience that their clients receive.

After all, much as providers might convince themselves otherwise, advisers have always been the most important actors in the financial advice industry (besides clients themselves!). They are the ones who know their clients best, who really understand the objectives they’re trying to meet, and build the plans that can get them there. Why shouldn’t they be the ones best judged to define and shape the platform through which those plans are executed?

Driving operational efficiency

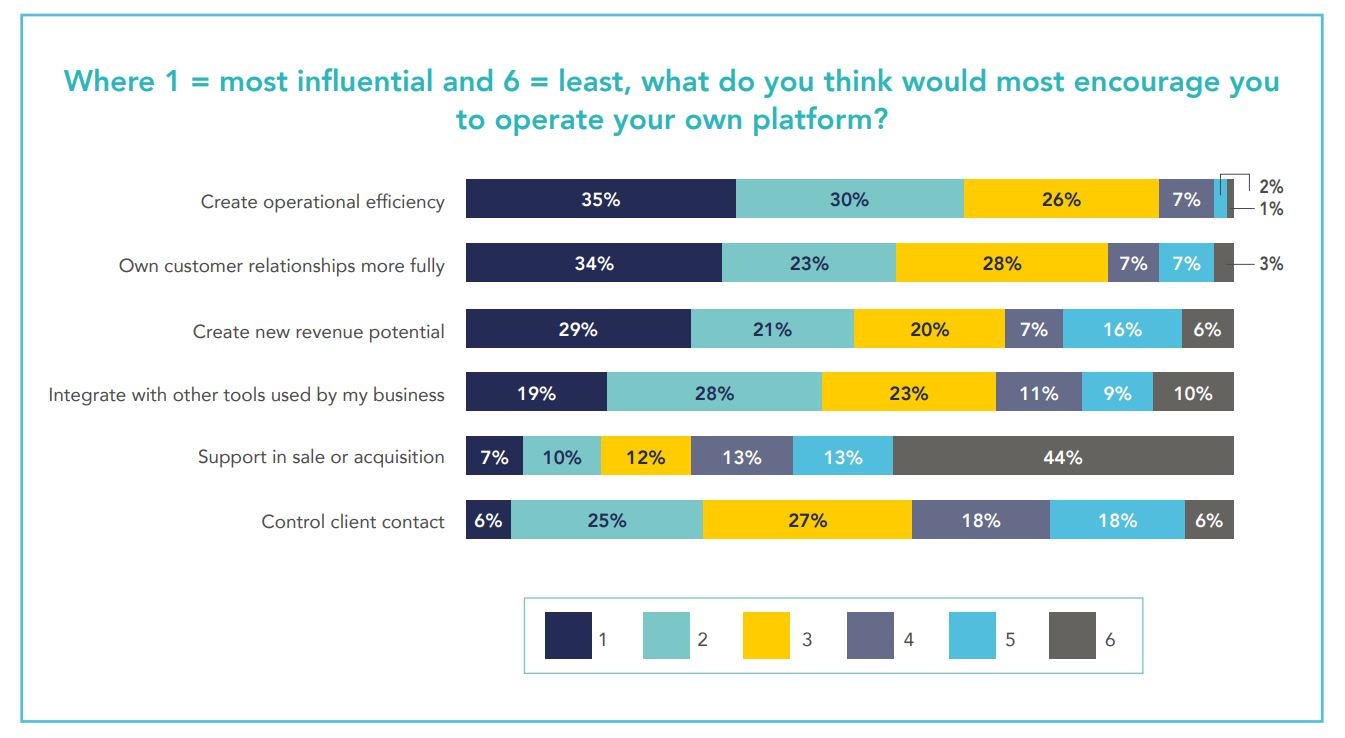

But it’s not just about control. The research also demonstrates that operational efficiency ranks highly in the list of motives that might encourage firms to operate their own platform.

It’s testament, I think, to the inefficiency that currently defines many firms’ interactions with their platform, whether due to clunky, paper-based operations, or a lack of integration that means long-suffering admin staff regularly have to rekey info between systems.

But it also speaks to the important role that technology can play in helping advisers to unlock and maximise the value of their firm – a role that looks set to become more and more important with time.

Source: Seccl and the lang cat

An emerging category

There’s no doubt that we’re still a fair way from realising the disruptive potential of platform ownership – and, indeed, it’s a move that won’t be right for many firms. It will require a shift in mindset and possibly in regulatory status, too, and will involve firms grappling with new administrative roles and responsibilities (summarised neatly towards the end of the research paper).

But while it’s a big step for individual firms and the market at large, it seems like the journey has begun. Mark sums it up well in the report when he says that “big shifts in our sector don’t come all at once. I suspect twenty odd years ago we’d have seen a similar proportion of firms beginning to consider using a platform for the first time. It certainly feels like we’re seeing a new category forming, which allows firms to take greater control of the platform experience.”

It’s an exciting time – and one which promises to put advisers firmly in control of their destiny.

You can read Seccl’s report here, and watch the launch event here.