It’s now 30 years since the launch of the first Venture Capital Trusts (VCTs). The UK government introduced VCTs to make smaller, entrepreneurial companies a more appealing option for investors – with attractive tax reliefs as an incentive to offset some of the risk.

Over the past three decades, VCTs have delivered more than £12 billion in funding to start-up companies across the UK.1 Some of these have gone on to become household names – the likes of Depop, Graze and Zoopla.

In the process, VCTs have helped to make the UK Europe’s leader in tech ‘unicorns’2 – start-up companies that achieve valuations above $1 billion. They’ve created jobs, fostered innovation and boosted the British economy.

Since launching our first VCT back in 2002, we’ve backed four of the UK’s unicorns and become the biggest VCT manager3, with more than £1.6 billion under management for over 40,000 clients.4

After 30 years, there are now plenty of VCTs in the market. Each has its own approach and points of difference with its peers. A good example is our most recently launched VCT, the Octopus Future Generations VCT (Future Generations VCT), which has just turned three years old. This, and its distinctive investment approach, make Future Generations VCT a particularly interesting opportunity at present.

But first, if you’re new to VCTs, you might be wondering what they are exactly.

How VCTs works

VCTs are companies listed on the London Stock Exchange that invest in a portfolio of early-stage businesses. You invest in a VCT by buying its shares, which can rise and fall in value like any other listed shares. Specifically, VCTs invest in unlisted, early-stage companies – start-ups that are just at the outset of their journey. This means that they offer especially exciting potential for growth.

Higher growth potential always comes with higher risk, so VCTs aren’t for everyone. But for investors who are prepared to accept the risks that come with investing in young companies, VCTs offer the potential for significant returns over a longer time horizon.

Along with the potential for impressive returns, VCTs also offer attractive tax relief in three different ways. First, if you invest in a VCT, you get 30% tax relief up front. If you invest £10,000 in a VCT, for example, you get £3,000 off your income-tax bill. This relief is available on VCT investments of up to £200,000 a year.

Second, any dividends that the VCT pays out over its lifetime are tax-free too. Any growth is also tax-free. Typically, VCTs aim to pay out regular dividends to reflect the progress of the companies in their portfolios. But they can also pay out special dividends if they sell their holdings in companies for large profits.

Some of these tax benefits are only available to investors who commit for the long term. If investors sell their VCT within 5 years, they must repay any income tax relief claimed. And of course, there’s no guarantee that the shares will rise in value or even that the VCT will pay dividends. Those are among the risks that investors in VCTs must accept in pursuit of potential gains.

The J-curve and Future Generations VCT

Octopus Future Generations VCT is a VCT we set up in 2022 to invest in businesses with high growth potential across three sustainability themes.

Because Future Generations VCT is a young but maturing VCT, it might be particularly attractive for investors who are considering investing in a VCT this year and wish to target long term capital growth. To understand why, we need to look at how VCTs mature.

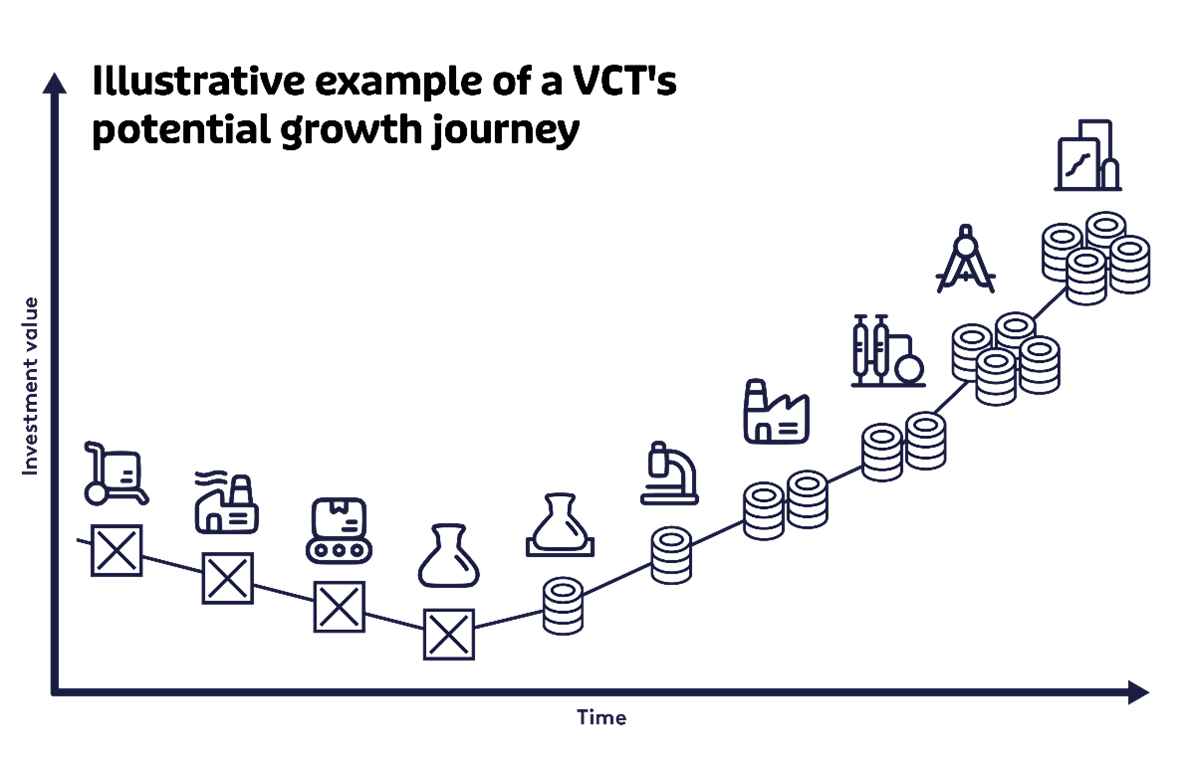

For new businesses, success takes time. Because VCTs typically invest in early-stage companies, the returns of successful VCTs tend to follow a specific pattern. We call this the ‘J-curve’, because it looks like a capital J – or perhaps a hockey stick. That is, the value of the VCT usually dips early on before recovering steeply later in the VCT’s lifespan.

The dip occurs because some early-stage companies will struggle and potentially fail, and because a new business will typically have heavy operational costs (research, set up costs, hiring etc.) that are front-loaded in the company’s growth journey. Those companies that survive and prosper tend to grow rapidly once they’ve established their businesses – potentially delivering attractive returns as a result.

The expected J-curve of returns is one reason that VCTs have five-year holding periods in order to qualify for income tax relief. This helps ensure that the VCT isn’t disrupted by withdrawals during the bumpy journey in the early years of its life.

The J-curve also makes a strong case for investing in a maturing VCT for the long term. As the VCT continues to mature, the return profile can become smoother as the VCT begins to hold companies at varying stages of maturity.

What makes Future Generations VCT stand out?

Two key characteristics distinguish Future Generations VCT from its peers and make it particularly attractive at the moment.

First Future Generations VCT has a clear focus on companies that are tackling challenges society and the planet face. To do this, it pursues three key themes: building a sustainable planet; revitalising healthcare; and empowering people to create a fairer and more equitable society. That gives it a markedly different character to other VCTs, which means that it offers attractive diversification properties.

Second, as we’ve already covered, Future Generations VCT is now at a very interesting stage in its J-curve journey. So far, Future Generations VCT’s returns have been negative. But this is exactly what should be expected with a VCT in its infancy as it follows the J-curve. In fact, this point in the fund’s lifespan is potentially a great time to invest. That’s because new investors may have avoided the bulk of the dip and could be well placed to benefit from the long ride up the handle of the hockey stick. Of course, past performance is not an reliable indicator of future results.

Should your clients choose to invest in Future Generations VCT, you’ll be doing so at a time when companies in the portfolio are starting to reach their key milestones. These include scaling up their operations and attracting further rounds of funding – and, ultimately, accelerating their growth.

Exits are another key consideration for VCT investors. These occur when a VCT sells out of its entire holding in a company, thus realising any investment gains made along the way. Typically, most exits take place between the fourth and seventh year of a VCT’s lifespan. When exits result in significant profits, Future Generations VCT can pay out special dividends to its investors.By investing from year three onward, your clients can aim to benefit from the capital returns that exits may generate.

So, by joining Future Generations VCT’s journey at a point where we believe the portfolio is gaining momentum, you could be setting your clients up for an attractive combination of a maturing and diversified VCT with exciting growth potential.

Driving returns by building a better world

The three key themes in which Future Generations VCT invests matter to us all. But the pioneering companies that help solve some of the biggest problems are increasingly attractive to investors for hard-nosed financial reasons. Their products and services are likely to become ever more important as they meet global challenges and help create whole new industries. In time, we believe this should be reflected in investment returns.

We are excited by Future Generations VCT’s holdings, including Drift, a new company in the ‘sustainable planet’ theme. DRIFT is looking to transform the clean energy space with its design for a smart sailing vessel that will use ocean wind to produce and deliver green hydrogen worldwide. These mobile, AI-powered vessels will operate without existing infrastructure, helping industries cut carbon emissions while benefitting coastal and island communities. As a COP 28 award-winning innovator, DRIFT is unlocking the power of the ocean to drive a cleaner, more sustainable future in a fast-growing market which Goldman Sachs estimates could reach €10 trillion by 2050.

Meanwhile, an early standout in the ‘revitalising healthcare’ theme, Skin+Me, which provides online skincare consultations via subscription, recently announced the launch of an exclusive retail collection in John Lewis and Boots.

And in the ‘empowering people’ theme, we’ve seen a striking early success with Cobee, which was Future Generations VCT’s first full successful exit. Cobee, which runs a platform for employee benefits and engagement, was acquired by Spanish company, Pluxee.

Like others in Future Generations VCT’s portfolio, these trailblazing companies are succeeding because of the clear commercial opportunities they offer. So Future Generations VCT’s investment attractions align with the positive outcomes it seeks.

For more information on Future Generations VCT, including key documents and how to invest online, please visit the Octopus Future Generations VCT webpage here.

Key risks to keep in mind

- This is a high-risk investment. The value of an investment in Octopus Future Generations VCT, and income from it, can fall as well as rise. Investors may not get back the full amount they invest.

- Tax treatment depends on individual circumstances and may change in the future.

- Tax reliefs depend on the VCT maintaining its VCT-qualifying status.

- VCT shares are by their nature high risk, their share price may be volatile and they may be hard to sell.

1 Venture Capital Trusts statistics: 2024, gov.uk, May 2024

2 Investment | Sectors | Technology (article), great.gov.uk, 2025.

3 AIC VCT annual fundraising data, April 2024

4 Octopus Investments, December 2024