GuideEnterprise Investment Scheme

An EIS guide to loss relief

Introduction to EIS

What is the Enterprise Investment Scheme (EIS)?

The Enterprise Investment Scheme (EIS) is a government initiative designed to encourage individuals to invest in early-stage companies.

EIS provides finance for smaller, higher-risk companies to help them develop and grow. The government recognises the benefits these smaller businesses bring to the UK economy and offers a range of tax benefits for investing into them through EIS. These benefits include upfront income tax relief, tax-free capital gains, capital gains deferral, relief from inheritance tax, and loss relief on each investment that returns less than you put in.

EIS investments are high-risk, and the returns of the individual companies may vary. Some companies may do well, while others may drop in value. However, because EIS investors can take advantage of loss relief, the impact of any losses made on individual companies can be reduced. This is the case even if an investor holds a portfolio of EIS companies that, overall, has delivered a positive return.

Key investment risks of Enterprise Investment Schemes (EIS)

This guide provides additional information on loss relief, one of the unique tax benefits associated with EIS investments. Investing in EIS qualifying companies is high risk and you must consider the following before making an investment:

- The value of an EIS investment, and any income from it, can fall as well as rise. You may not get back the full amount you invest.

- Tax treatment depends on individual circumstances and may change in the future.

- Tax relief depends on portfolio companies maintaining their qualifying status.

- EIS shares could fall or rise in value more than other shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

What is EIS loss relief?

EIS loss relief

EIS investments are shares in small, early-stage companies, targeting high growth. As a result, these shares have a high risk of losing value, when compared to other investments.

Should the value of EIS shares drop to nil or if the shares are sold for less than the original amount invested, loss relief is available. It allows an investor to offset a loss made on an EIS company against either their capital gains tax bill or their income tax bill, depending on which better suits their individual needs.

Please note, an investor can still lose money overall, even if they claim loss relief. This is because, while they can use loss relief to reduce the impact of the loss, it won’t eliminate the loss entirely.

How much loss relief can be claimed?

To qualify for loss relief, the value of an investment, when it is sold has to have fallen below what is called the effective cost. The effective cost is the amount invested minus whatever was claimed in income tax relief.

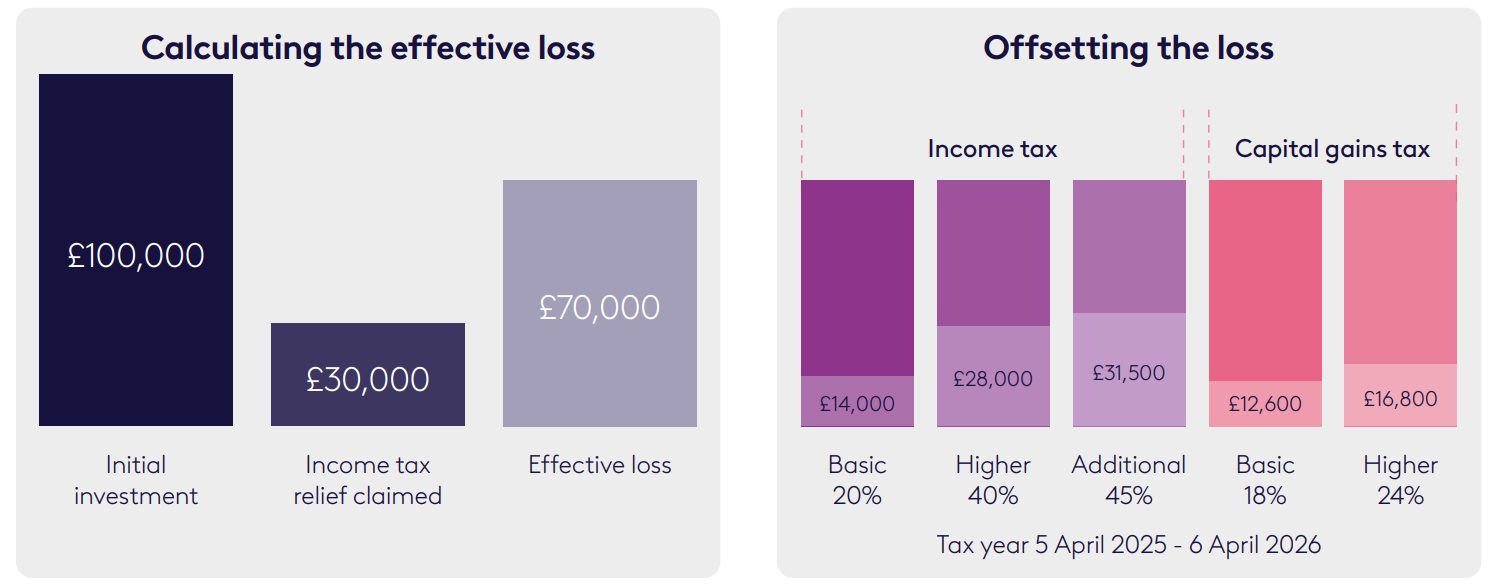

The loss available for relief is equal to the sale proceeds received minus the effective cost. For example, if £100,000 was invested into EIS shares and upfront income tax relief of £30,000 was claimed, the effective cost of that investment would be £70,000. If the company fell to zero value, the effective loss for which relief is available is £70,000.

Claiming loss relief against income tax

An EIS investor will be able to offset a loss against their income tax bill for the current and/or previous tax year. The loss is deducted from the investor’s income before income tax is calculated. The value of this relief can be worked out by multiplying the value of their effective loss by their marginal rate of income tax.

Claiming loss relief against capital gains tax

It may be more suitable for an investor to offset their loss against their capital gains tax bill for the current tax year. The loss is deducted from the investor’s capital gains before capital gains tax is calculated. Should the loss exceed the capital gains for the current year, any excess is carried forward to future tax years and set against the first available gain. The value of this relief can be worked out by multiplying the value of their effective loss by their marginal capital gains tax rate.

Calculating the effective loss and loss relief

The example below shows how loss relief is calculated for an EIS-qualifying company where an investment falls to zero.

The value of loss relief will depend on your marginal rate of tax and whether you are claiming against income tax or capital gains tax.

Companies that become valueless

If shares in an EIS-qualifying company fall in value to zero, in certain circumstances, investors may have the option of making a negligible value claim. They can do this by informing HMRC that the shares are worth nothing or next to nothing, even if they haven’t been sold.

The negligible value claim will treat the shares as being sold, sometimes called a “deemed disposal”. This allows loss relief to be claimed. If shares are sold in the future, the proceeds will be subject to capital gains tax. If the negligible value claim is made against income in the preceding tax year, the shares need to have been of negligible value at that time.

How does loss relief work with a portfolio of EIS companies?

An EIS fund manager will often construct a portfolio of EIS-qualifying companies. However, for loss relief purposes, each company is considered a distinct investment. This means that if any of the individual holdings within the portfolio are sold at an effective loss, loss relief can be claimed even if the overall portfolio performance is positive.

How to claim EIS loss relief

How to claim

Using a self-assessment form

If you complete a self-assessment tax return, you can claim EIS losses against either income tax or capital gains tax by completing the SA108 form when either the shares are disposed of or when the shares are of nil value.

Loss relief claimed through self-assessment may reduce the amount of tax that an individual needs to pay for the relevant tax year. If that means they have already paid too much income tax, they can request that HMRC repay the excess either by cheque or directly into their bank account, by completing the relevant part of the self-assessment form.

To receive a self-assessment form, you can download one from hmrc.gov.uk or ask HMRC to send you one. HMRC also have SA108 summary notes available to help you fill out this form. Alternatively, if you wish to fill out your return online and you don’t currently complete a tax return you can register at hmrc.gov.uk. There are notes throughout the process to help you fill it out.

FAQ

FAQs

If a beneficiary inherits EIS shares, can they claim loss relief if they have fallen in value?

The loss relief available will depend on the beneficiary’s circumstances. Please find examples of beneficiaries and the potential implications for them below:

Spouses

A spouse who received the EIS shares prior to the death of the original owner, should be able to claim loss relief against capital gains or income, depending on their personal circumstances. The loss relief available is based on the investment amount paid by the original investor net of income tax claimed. If the shares were inherited on the death of the original owner, please see the implications below under ‘Other beneficiaries’.

Executors

The executor of an estate, may be able to offset the loss, net of income tax relief claimed, against the income or gains of the deceased where the loss happened prior to death. If the loss occured after the original owners death, please see the implications below under ‘Other beneficiaries’.

Other beneficiaries

For other beneficiaries, loss relief is only available against capital gains.

The loss available relates to the fall in value from the date the beneficiary received the shares, even if the shares have lost most or all of their value since the original investment date.

Where the shares were received on the death of the original owner, HMRC treat the shares as having been acquired by the Executors/beneficiaries at their market value at the time of death.

We suggest that you talk to your accountant or financial adviser for more information.

What should an investor do if the value of their shares falls to zero?

If shares in an EIS-qualifying company fall in value to zero, in certain circumstances investors may have the option of making a negligible value claim, by informing HM Revenue & Customs that the shares are worth nothing or next to nothing, even if they haven’t been sold. Usually, a claim for loss relief is based on the price at which you sell your shares. But if the shares have nil value you may be able to make a claim for the amount of the effective loss.

What happens to any deferred capital gains?

When EIS shares are sold or a negligible value claim is made, any gains you deferred through your EIS investment, will come back into charge. The deferred gain will be taxable like any other gain in the tax year it comes back into charge. However, loss relief on your EIS shares may be available to offset against the deferred gain.