FP Octopus UK Micro Cap Growth Fund

For investors targeting long-term capital growth through exposure to progressive, growth companies.

The FP Octopus UK Micro Cap Growth Fund targets long-term capital growth by investing in a portfolio of the UK’s best small and micro companies. An actively managed, highly diversified fund which seeks to produce excellent risk-adjusted returns.

Please note: Awards and ratings are based on past events and are not an indication of future performance. Ratings are not a recommendation. FE Crown Fund Ratings do not constitute investment advice offered by FE and should not be used as the sole basis for making any investment decision.

Risks to bear in mind

Capital at risk

The value of an investment, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest. Please read the prospectus and the Key Investor Information Document when considering one of our funds.

Smaller company share prices can be more volatile

Investments in smaller company shares are likely to fall and rise in value more than shares in larger, more established companies listed on the main market of the London Stock Exchange. They may also be harder to sell.

Reasons to invest

Smaller companies grow faster

That means share prices have a better chance of increasing at a faster rate over the long term.

Portfolio diversification

Smaller companies behave differently to larger ones. They tend to be more nimble and so can take advantage of new opportunities quickly.

Invest ahead of the mainstream

An investment team that specialises in smaller company investing can find undiscovered value across the AIM spectrum.

Meet the fund managers

Experience matters when investing in AIM. The fund management team is one of the most experienced in the UK.

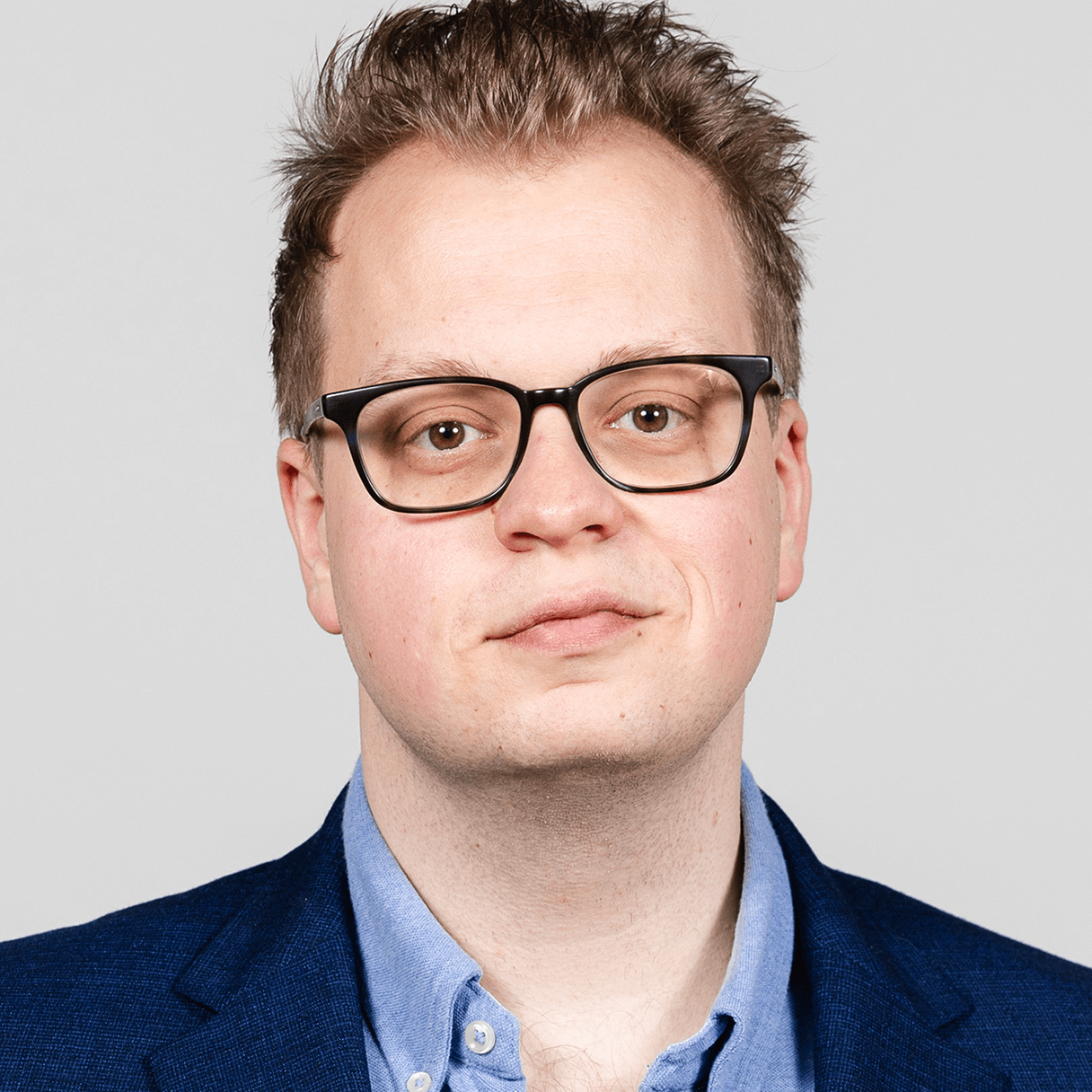

Richard Power

Lead Fund Manager

With overall responsibility for the Quoted Companies team at Octopus, Richard has over 25 years’ experience of smaller company investing. He is lead manager of our FP Octopus UK Micro Cap Growth Fund, also oversees the investment process of the team which include the AIM IHT portfolios, and AIM VCTs. Richard is also a co-manager on the FP Octopus UK Multi Cap Income & FP Octopus UK Future Generation Funds. Richard started his career in 1995 at Duncan Lawrie, where he managed a successful small companies fund. He subsequently joined Close Brothers to manage a smaller companies investment trust before moving to Octopus Investments Limited to head up the Quoted Companies team in 2004.

Chris Mcvey

Deputy Head of Octopus Quoted Companies

Chris is the Deputy Head of Octopus Quoted Companies, joining in December 2016. He has been a specialist within the quoted UK Smaller Company market for almost 20 years. Chris works across all the Quoted Company portfolios.

He is lead manager on the FP Octopus UK Multi Cap Income Fund, and a co-manager on the FP Octopus UK Micro Cap Growth Fund, and FP Octopus UK Future Generations Fund.

He is lead manager on the FP Octopus UK Multi Cap Income Fund, and a co-manager on the FP Octopus UK Micro Cap Growth Fund, and FP Octopus UK Future Generations Fund.

Dominic Weller

Co-Fund Manager

Dominic is a Fund Manager on the Quoted Companies team. He works across sectors and co-manages the FP Octopus UK Micro Cap Growth Fund, FP Octopus UK Multi Cap Income Fund and the Octopus AIM VCTs.

He is a member of the Octopus Investments Responsible Investment Committee and leads the team’s stewardship efforts. He is a CFA charter holder.

He is a member of the Octopus Investments Responsible Investment Committee and leads the team’s stewardship efforts. He is a CFA charter holder.

Learn more about the fund

In this recording, Richard introduces the fund, talks about finding high growth, progressive companies and outlines the importance of our core/satellite approach.

Fund manager updates

Insights

19 Dec 2025

UK government doubles down on incentives for home-grown innovation

The UK government is stepping up its support for home-grown innovation, introducing enhanced incentives to fuel growth in technology and enterprise. These measures aim to create new opportunities for investors and advisers, driving long-term returns while strengthening the UK’s competitive edge.

5 Dec 2025

A Fund Manager Interview with Chris McVey – Lead Fund Manager of the FP Octopus UK Multi Cap Income Fund

Chris McVey, Lead Fund Manager of the FP Octopus UK Multi Cap Income Fund, sat down for an exclusive interview with Citywire to discuss the UK…

18 Jun 2025

AIM turns 30: Three decades of supporting UK innovation

As we celebrate 30 years of AIM, we reflect on its evolution, economic impact, and enduring role in scaling high-growth UK businesses.

The fund takes a core / satellite approach

![]()

Core: Established companies

Established, cash-generative leaders in their field

Seasoned management targeting superior growth

![]()

Satellite: Emerging stars

Initial public offering

Exceptional growth opportunities

Market inefficiencies

Example Core fund companies

Fund highlights

| Launch date | 12 July 2007 |

| Fund Sector | IA UK Smaller Companies |

| Number of holdings | 60-90 |

| ISIN | GB00BYQ7HN43 |

Fees and charges

| Fund Initial Charge | 0.00% |

| Ongoing Charge Figure (capped)* | 1.10% |

*Calculated as at 9 May 2022 based on the P Acc share class

How to invest

Invest through your preferred platform

How to invest

Apply through your preferred platform

Apply directly

The minimum initial investment is £1000. Clients can hold this fund in a SIPP or ISA.

Download application form

Download ISA transfer application form

Key documents

| FP Octopus UK Micro Cap Growth factsheet | Download |

The Fund’s prospectus, supplementary information document, application forms, and Key Investor Information Document can be found on the Fundrock website

Our other funds

FP Octopus UK Multi Cap Income Fund

Find companies with long-term income and growth potential.

FP Octopus UK Future Generations Fund

For investors targeting long-term capital growth with a focus on companies looking to solve problems for the planet and people.

Move forward with clarity and confidence

Visit our Autumn Budget hub to find everything advisers need to translate Budget changes into meaningful conversations.

Quoted fund webinars

On demand webinarQuoted funds

Available now on demandUnlocking value: The cyclical re-rating re-shaping UK Smaller Companies

Join Richard Power, Lead Fund Manager of the FP Octopus UK Micro Cap Growth Fund, as he delves into the world of the UK's best small and micro companies and discusses some of the compelling opportunities in today's market across our actively managed and highly diversified fund.

Duration: 1hour 1min

On demand webinarQuoted funds

Available now on demandUK equity income – seizing the valuation opportunity

Join Chris McVey, lead fund manager of the Octopus FP UK Multi Cap Income fund, for a concise, timely briefing on the forces propelling UK equities, in particular, faster growth, small and mid-cap, income generating businesses.

Duration: 54mins

On demand webinarQuoted funds

Available now on demandUK Small Cap discount hits 25 year high

Register for an exclusive webinar with Richard Power, Lead Fund Manager of the FP Octopus UK Micro Cap Growth Fund, as he delves into the world of the UK’s best small and micro companies and discusses some of the compelling opportunities in today’s market across our actively managed and highly diversified fund.

Duration: 45mins

Contact our team

Got a question about Octopus funds?