WhitepaperBusiness ReliefInheritance tax

Business Relief on death

Business Relief on death is a valuable inheritance tax exemption that allows qualifying business assets to be passed on to beneficiaries with either 50% or 100% relief from inheritance tax charges. This whitepaper details how this works in different scenarios.

Last updated: 5 January 2026

What is Business Relief?

Business Relief (previously called Business Property Relief or BPR) allows qualifying investments held for two years to be left to beneficiaries with inheritance tax relief.

For deaths before 6 April 2026, unquoted BR investments and AIM BR shares are free from IHT for an unlimited value. For deaths after 6 April 2026, unquoted BR investments receive full relief up to £2.5 million (50% relief above this), whilst AIM BR shares attract 50% relief regardless of value. See our Autumn Budget estate planning now and moving forward page for details.

BR investments carry capital risk and aren’t suitable for everyone. Tax treatment depends on individual circumstances which may change.

Learn more in our Business Relief explained guide.

How Business Relief is treated in an inheritance tax calculation

How Business Relief is treated in an inheritance tax calculation

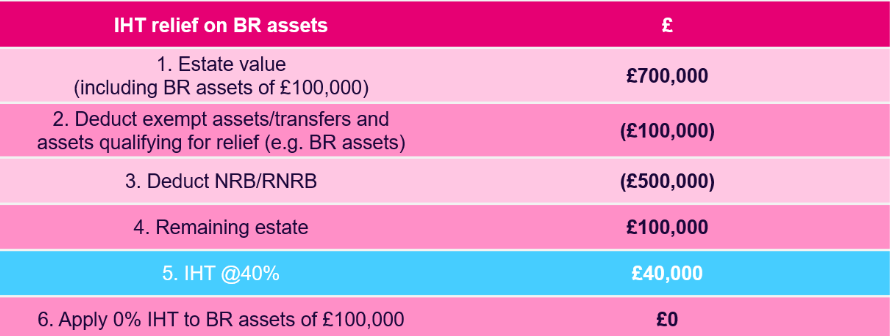

When calculating a potential IHT bill, total up the value of all assets in the estate, then deduct BR-qualifying assets, then deduct the nil rate band (NRB) and residence nil rate band (RNRB) as applicable, then apply 40%. BR-qualifying assets are added back but at 0%.

Remember, a BR investment does not use up the nil rate band (NRB) or residence nil rate band (RNRB).

Example: IHT calculation to demonstrate how unquoted BR is incorporated in an IHT calculation.

Spouses and Business Relief

Spouses and Business Relief on death

On death, where a spouse who is married or in a civil partnership transfers a BR-qualifying asset to their surviving spouse, the transfer should be an exempt transfer for the deceased spouse. The surviving spouse is deemed to take on the ownership period of the deceased spouse for BR purposes.

It is only on death that this transfer of ownership period applies, as it does not apply for in-life transfers between spouses.

Find out more in our BR and in-life gifting whitepaper.

Ask Octopus

Do you have a question about inheritance tax and estate planning?

Use our free helpdesk to Ask Octopus

Business Relief and beneficiaries

Business Relief and beneficiaries

What happens to BR assets held for two years on death?

Where Business Relief assets are held for two years and the individual passes away, and the shares are transferred to beneficiaries, other than a spouse, the asset should be 0% in the deceased’s estate.

The beneficiary should then immediately qualify for BR in their own right under BR successive transfer rules, such that if the beneficiary were to pass away the next day, their estate should also qualify for BR.

What happens to BR assets held for less than two years on death?

Where Business Relief assets are held for less than two years on death, the asset should be subject to IHT in the deceased’s estate.

For the beneficiary taking on the shares, they would need to hold the shares for a further two years to qualify for BR (previously called BPR) in their estate.

Will drafting and Business Relief

Will drafting and Business Relief

The way assets are drafted in a will is important, not only to maximise the relevant reliefs from inheritance tax, but also to ensure it reflects the wishes for beneficiaries.

Assets in a will can typically fall into three categories:

- Specific gifts (i.e. an item described precisely).

- Non-specific gifts or a general gift (e.g. ‘all my personal possessions’).

- Residuary gifts (e.g. remainder of estate).

Where a BR asset is being left in the will and the will also includes exempt transfers to spouses or charity, then in order to achieve the optimal IHT planning, such BR transfers are typically left as specific gifts.

Read more about Business Relief in our will drafting guide.

How to claim Business Relief

The primary form for when someone passes away is the IHT 400 ‘Inheritance Tax Account’.

The additional forms to claim Business Relief will depend on the type of Business Relief asset held. This will either be:

- IHT412 ‘Unlisted stocks and shares and control holdings’. This form, as the name suggests, are for unlisted stocks and shares and/or controlling holdings.

- IHT413 ‘Business and partnership interests and assets’. This form relates to sole trader businesses and partnership interests (unincorporated businesses).

Tax legislation, rates and allowances are correct at time of publishing for the tax year 6 April 2024 – 5 April 2025.

For deaths before 6 April 2026, Business Relief investments (AIM or unquoted shares) held for two years attracts 100% inheritance tax (IHT) relief to an unlimited value.

From 6 April 2026, 100% IHT relief will continue for the first £2.5 million of combined agricultural and unquoted Business Relief qualifying property (e.g. sole traders, partnerships, unquoted companies). Amounts over £2.5 million will attract 50% IHT relief. Business Relief qualifying companies listed on the Alternative Investment Market (AIM), will attract 50% IHT relief irrespective of the investment amount.

Inheritance tax (IHT) calculator

Related resources

Related resources

Inheritance tax and Business Relief education hub

We've worked with tens of thousands of financial advisers to help develop their knowledge in specialist tax-efficient investments.

Autumn Budget Hub

Everything advisers need to translate Budget changes into meaningful conversations and smarter client outcomes.

Intergenerational planning guide

Who will advise your clients beneficiaries? Read our top tips for retaining assets under advice in the great wealth transfer.