WhitepaperBusiness ReliefInheritance tax

Business Relief and replacement relief

Last updated: 5 January 2026

Why is Business Relief and replacement relief relevant for financial advisers?

Since 2000, the total business population has increased by 60%.1

There were 5.5 million small or medium-sized businesses (SMEs) in the UK in 2023, representing over 99% of the business population.1

Around 120,000 SMEs are predicted to sell shareholdings in next ten years.2

What is Business Relief?

What is Business Relief?

Business Relief (previously called Business Property Relief or BPR) is a longstanding relief from inheritance tax. For suitable clients, it allows qualifying investments to be left to beneficiaries with relief from inheritance tax (IHT).

Where a BR qualifying asset is held for at least two years and on death, the asset should attract relief from IHT.

For deaths before 6 April 2026, unquoted BR qualifying investments (i.e. unquoted shares, sole traders, partnerships) and AIM BR qualifying investments are free from IHT for an unlimited value of BR asset.

For deaths after 6 April 2026, unquoted BR investments qualify are free from IHT up to £2.5 million value, and amounts in excess of this are attract 50% IHT relief. AIM BR shares attract 50% IHT relief irrespective of value. See our post Autumn Budget estate planning now and moving forward page for more details.

This whitepaper focuses on the current rules for tax year 5 April 2024 – 6 April 2025.

Please bear in mind that investments that qualify for BR put an investor’s capital at risk and won’t be right for everyone. Tax treatment depends on individual circumstances which could change in the future.

Learn more about Business Relief in our helpful Business Relief explained guide.

Ask Octopus

Do you have a question about inheritance tax and estate planning?

Use our free helpdesk to Ask Octopus

What is Business Relief replacement relief?

What is Business Relief replacement relief?

Replacement relief allows an individual to qualify for BR on a newly acquired BR qualifying asset, even if you haven’t held that new asset for two years.

Where an individual has sold a BR qualifying asset, such as shares in a business, and reinvests the proceeds in another BR qualifying asset, the new asset can be BR qualifying.

Conditions for replacement relief

Conditions for replacement relief

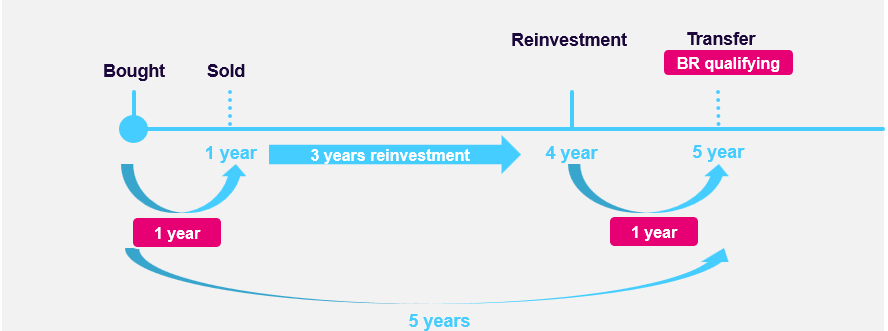

- Both the old and new asset need to be held for a combined two years out of the previous five years at the point of transferring the asset. Transferring can be on gift or death.

- There is a maximum of three years to reinvestment of the proceeds from the sale of the original BR asset in the new BR asset.

- Each asset needs to meet all BR conditions at the point of sale, replacement and transfer, except for the two-year rule.

Replacement relief and spouses

Replacement relief and spouses

There are special rules for replacement relief where a spouse dies holding proceeds from the sale of BR (previously called BPR) assets and, in their will, the proceeds are transferred to their surviving spouse.

The surviving spouse is treated like the original owner for BR replacement relief purposes and is deemed to be the individual who sold the original BR asset. The surviving spouse is therefore deemed to have the same ownership period of the deceased spouse in relation to the BR asset sold.

The surviving spouse can then reinvest the proceeds in another BR asset.

Provided they meet the conditions for replacement relief, including reinvestment within three years of sale, the new BR asset should qualify for BR for the surviving spouse.

From the deceased spouse’s perspective, the transfer is an exempt transfer from IHT as a spousal transfer.

Tax legislation, rates and allowances are correct at time of publishing for the tax year 6 April 2024 – 5 April 2025.

For deaths before 6 April 2026, Business Relief investments (AIM or unquoted shares) held for two years attracts 100% inheritance tax (IHT) relief to an unlimited value.

From 6 April 2026, 100% IHT relief will continue for the first £2.5 million of combined agricultural and unquoted Business Relief qualifying property (e.g. sole traders, partnerships, unquoted companies). Amounts over £2.5 million will attract 50% IHT relief. Business Relief qualifying companies listed on the Alternative Investment Market (AIM), will attract 50% IHT relief irrespective of the investment amount.

Related resources

Related resources

Autumn Budget Hub

Everything advisers need to translate Budget changes into meaningful conversations and smarter client outcomes.

Inheritance tax and Business Relief education hub

We've worked with tens of thousands of financial advisers to help develop their knowledge in specialist tax-efficient investments.

Estate planning for clients who’ve sold a business in the last three years

Alan recently sold his business and wants to leave the proceeds to his daughters free of inheritance tax.

1House of Commons Library, Business statistics research briefing, May 2024.

2Ownership at Work, The-Great-Employee-Ownership-Succession-Opportunity, November 2023.