Chapter 1 – Why the advice gap looks set to grow wider

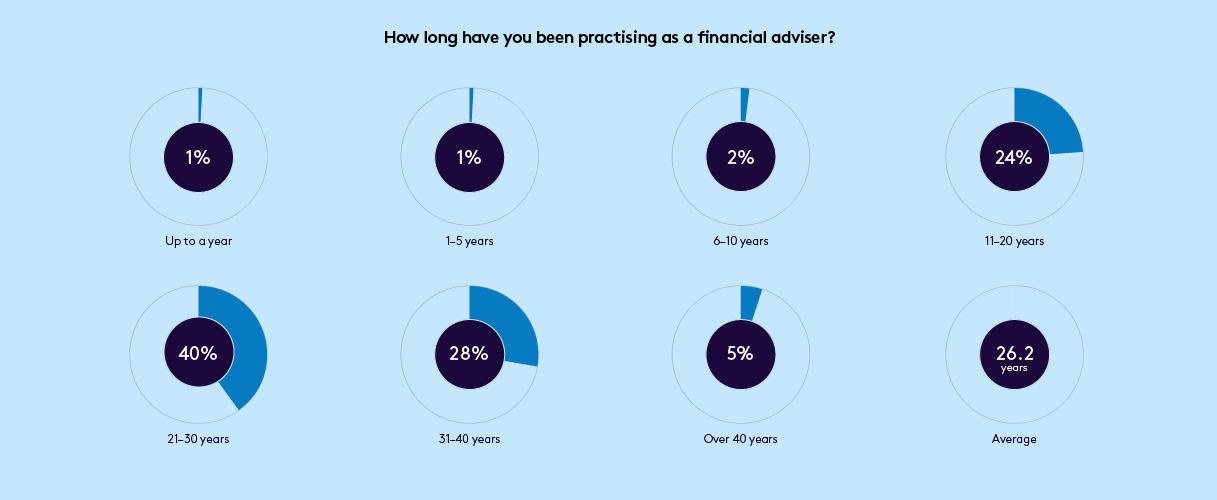

The average adviser has worked in the profession for just over 26 years. Around a third (33%) have done so for more than 30 years.

So, it’s hardly surprising that many are looking to retire in the next few years. Indeed, 29% of advisers we surveyed said they plan to retire before 2025. A further 33% say they expect to retire before 2030, meaning more than 6 in 10 advisers will leave the profession over the next decade.

Number of advisers planning to retire

“I think we all know in the industry that there is a gap and it’s going to become bigger in the next five years,” says Claire Limon, Director of Learning and Acquisition at Openwork.

“I think there is more everybody in financial services can do to help close the gap, but it needs to start somewhere.”

Scott Stevens, Head of Recruitment and Acquisitions at Quilter, agrees.

“We’re not replacing the advisers at a rate that’s actually going to make a significant enough impact on the attrition rate,” he says.

“And of course, it’s important to recognise that these individuals aren’t leaving because they don’t like the jobs they’re doing. They’re leaving because they want to retire.”

This is a key point. The vast majority of those already working in the profession say that financial advice offers brilliant career opportunities and a great work life balance. So why is it that the profession struggles to attract enough new advisers to replace those who are expected to leave in the next few years?

Perceptions of financial advice as a career

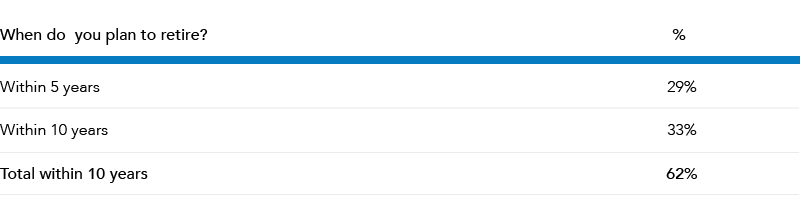

Our research found the following to be the main issues affecting advice firms’ ability to recruit new talent (respondents were allowed to provide more than one answer):

As well as surveying advice firms, we also surveyed students currently at university about whether they have considered a career in financial advice. While a healthy number (22%) said they have considered it, the vast majority have not.

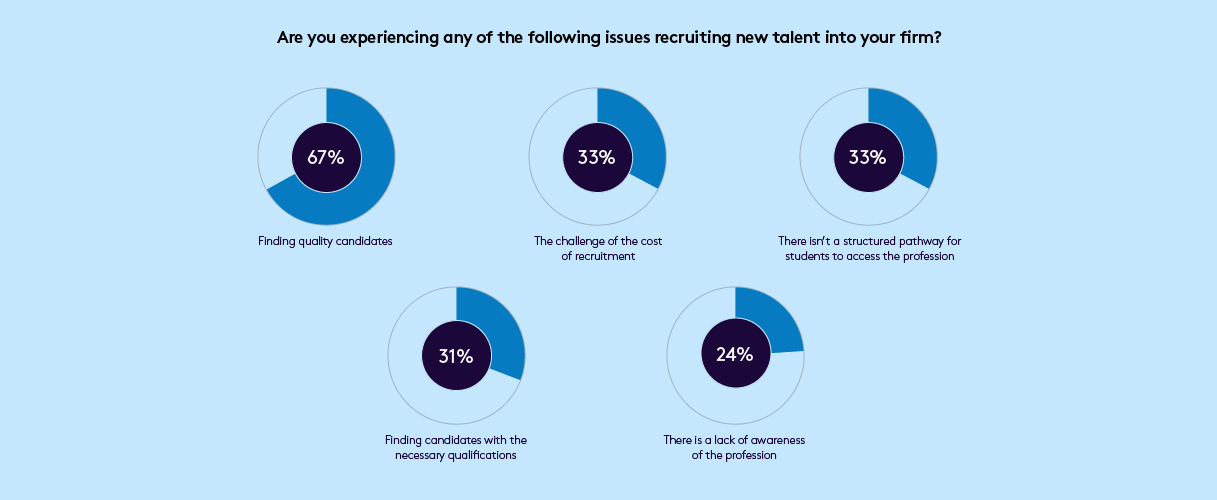

We also asked those students who have not considered a career in financial advice why that was. Here’s what they said:

These responses, and particularly those that imply financial advice is a very corporate, mathematics-heavy career, suggest there is a lack of awareness of what being a financial adviser actually means.

“I think that ‘corporate’ perception comes from banks, as that’s typically the only interaction people have with financial services at that age,” says Openwork’s Limon.

“I don’t think they really understand the industry and the fact that you’re potentially running your own enterprise if you want to, so it’s not corporate at all.”

“Financial services as a whole still suffers from the male dominated Wolf of Wall Street stereotype,” adds Cary Curtis, CEO and founder of recruitment agency Give A Grad A Go, which already works with a large national advice firm.

“The rise of fintech has helped shift this, but increasingly that means graduates prefer those companies, rather than traditional financial services. That reflects a wider trend where graduates are now more reluctant to go into what they see as corporate jobs where you have to be suited and booted.”

Louise Sagar, a chartered financial planner at Fairstone, suggests the perceptions formed in the years before the retail distribution review (RDR) have proven hard to shift.

“I think the industry still suffers from a bit of a bad reputation, from its pre-RDR history,” she says.

“It’s really important that we try to change the perception of financial advice and get the message out there that we are helping people to achieve their goals and ambitions in life.”

Quilter’s Scott Stevens agrees that old stereotypes die hard.

“Perhaps people who haven’t been involved in financial services remember a bygone era of yesteryear, where it was a highly pressurised, white-sock sales brigade, who phoned me up because I needed a bit of life insurance, and they kept phoning until they got a yes,” he says.

Stevens suggests that such perceptions may have been passed on to a younger generation, which could deter some young people from seeking a career in financial advice.

“Those days, honestly, they disappeared over a 15 years ago. But I think an older generation still remember that, as in the parents,” he says.

“That means a career as a financial adviser in their mind might not be seen as reaching the higher echelons of society, in the same way as an accountant or a solicitor. Even though many financial advisers will be better off than most of the high street solicitors that exist today.”

Nor is the job of a financial adviser one that involves crunching numbers all day, as some students seem to believe.

“There is very little maths involved day to day,” says Rohan Sivajoti, co-founder of NextGen Planners.

“I am chartered, but I’m not technically that proficient to be honest. It’s not where my strengths lie, and I like to focus on my strengths. It’s really not spreadsheets and graphs, it’s having conversations and listening to people.”

Straightforward lack of awareness of the profession is also seen as a problem.

“There’s a problem with misconception, but also no conception at all,” says Owen Cook, a financial adviser at Ablestoke in London.

“Lots of people simply don’t know what financial advice or financial planning is.”

Raising awareness of financial advice as a career

We asked advice firms who are looking to recruit within the next six months where they plan to find new talent. Their answers fell into three areas – hiring apprentices/graduates, hiring existing advisers from other firms, and hiring candidates with experience in other industries who are looking to change careers.

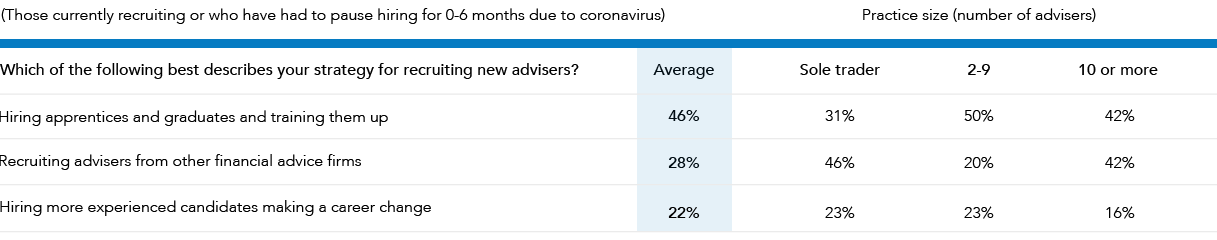

Reponses broke down as follows:

Your recruitment strategy

Clearly, two of these strategies – hiring apprentices/graduates and or those looking for a career change – would benefit from successful efforts to raise the profile of financial advice as a career option. They are also strategies that, if successful, should contribute to narrowing the advice gap.

“It’s not enough just trying to say to people, come and join this industry,” says Openwork’s Claire Limon.

“It’s about making them more aware of what it really involves, and what good practice looks like. I think if people understand that better, they’re going to be more interested in the industry, because it’ll suddenly come to life for them.”

Our research supports this. When we explained to students more about what financial advisers do, there was a marked shift in the numbers who said they would consider it as a career, with an impressive 45% saying they would consider working in the profession.

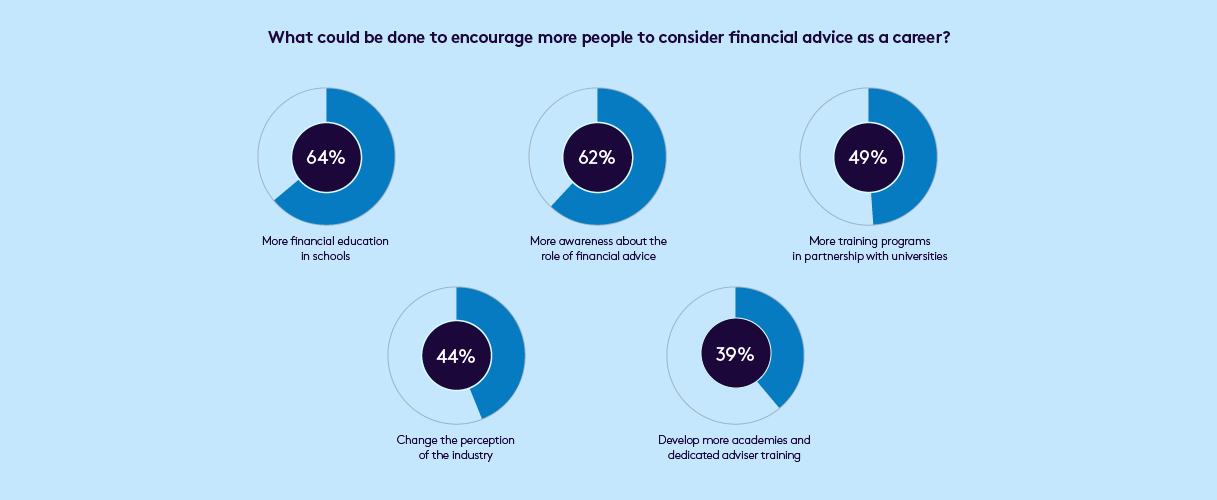

It’s therefore no surprise that the advisers we surveyed shared this view. When asked what could be done to encourage more people to consider a career in financial advice, the top answer was more financial education in schools, followed by more awareness of the role of financial advice.

Our research also supports the idea that a concerted push to raise awareness of the role of financial advice would pay off. When we explained to students more about what financial advisers do, the number of students who said they would consider it as a career doubled, with an impressive 45% now saying they would consider working in the profession.

More Chapters

Introduction

The advice gap looks set to grow substantially – with significant implications for the financial advice profession.

Chapter 2 – Raising awareness of financial advice as a career

This chapter outlines how we can attract the next generation of talent as well as the significant commercial benefits of doing so.

Chapter 3 – Harnessing technology and new ways of working

Technology has huge potential to help close the advice gap, but where should you start, and what are the barriers that still need to be overcome.

Contributor profiles

Still want more? Here you can find extended conversations with some of the report’s contributors.

Related Insights

14 May 2020

Four ingredients to grow your business through professional connections

Hear from Strategic Partnerships Manager Charlotte Fairhurst on how to set yourself apart when establishing professional connections.

Want to find out more?

Contact us to find out more about our institutional offering.