GuideVenture Capital Trusts

How to claim VCT tax relief

A Venture Capital Trust (VCT) is a listed company that buys small stakes in a large number of early-stage companies.

VCTs offer attractive tax benefits to compensate investors for some of the risks involved in backing young, smaller businesses. These tax benefits depend on the VCT maintaining its qualifying status.

VCT investors can claim income tax relief of up to 30% on investments up to £200,000 each year, subject to individual tax circumstances. Any dividends received are tax free, with VCTs typically targeting a 5% dividend yield.

Please be aware of the risks before investing:

- The value of an investment in VCTs, and any income from them, can fall as well as rise. You may not get back the full amount you invest.

- VCT shares could fall or rise in value more than other shares listed on the main market of the London Stock Exchange. They may also be harder to sell.

- Tax treatment depends on individual circumstances and tax rules could change in the future.

- Tax reliefs depend on the VCT maintaining its VCT-qualifying status.

How does claiming income tax relief for a VCT investment work?

What is needed in order to claim income tax relief on a VCT investment?

Claiming VCT tax relief in your online self-assessment

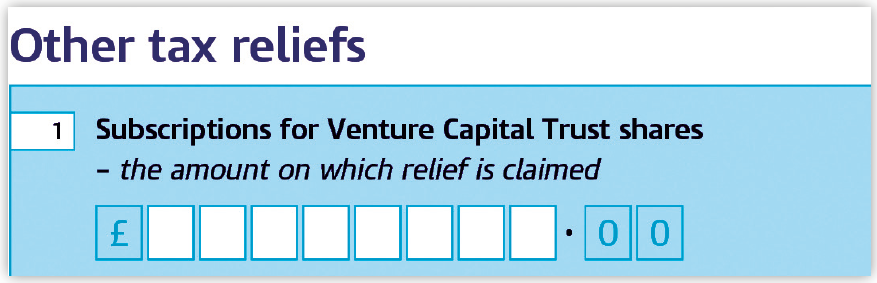

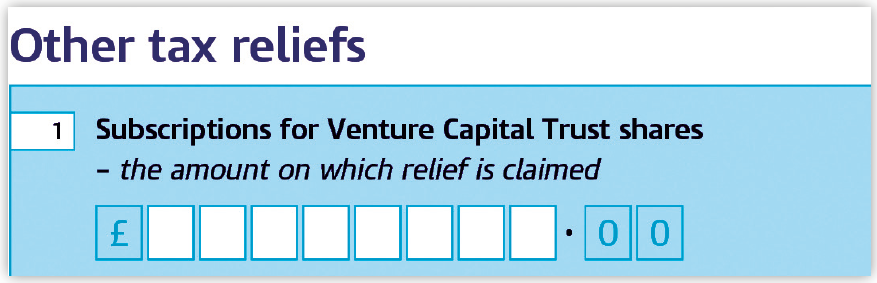

If you complete a self-assessment tax return, you can apply for your VCT tax relief by completing an SA101 additional information form.

Enter the total value of your VCT investment in the appropriate section labelled ‘Subscriptions for Venture Capital Trust shares’ under ‘Other tax reliefs’.

Claiming VCT tax relief when self-employed

If you are self-employed and make payments on account, contact HMRC who can talk you through how to reduce your payments.

Tax relief claimed through self-assessment will reduce the amount of tax that you will have to pay. If that means you have already paid too much income tax, the excess can either be repaid by cheque or directly into your bank account by completing the relevant part of the self-assessment form.

Claiming VCT tax relief by adjusting your tax code

If you’ve invested in a VCT towards the start of a tax year, you could choose to call or write to HMRC asking them to adjust your tax code.

This means the amount of income tax you pay will be reduced on a month-by-month basis until your income tax relief is used up. You’ll need to include your national insurance number, a P60 form if you have one, and a photocopy of your VCT tax certificate.

How will you receive the tax relief?

Investors can receive income tax relief in a few ways, depending on how and when tax was paid. If tax has not yet been paid for the year, it simply lowers the investor’s upcoming bill. If tax has already been paid, HMRC may issue a refund by bank transfer or cheque, depending on the investor’s preferences and payment history.

What is needed in order to claim income tax relief on a VCT investment?

Once your clients have invested in a VCT, they can claim income tax relief of up to 30% on the amount they’ve invested.

Income tax relief can be used to reduce or offset an income tax liability investors have for the tax year in which VCT shares are allotted.

After shares are allotted, investors will be issued with a VCT tax certificate and a VCT share certificate. They’ll need the tax certificate to make a claim for income tax relief.

How does claiming income tax relief for a VCT investment work?

There are two ways investors can claim VCT tax relief, depending on individual circumstances.

Claiming VCT tax relief in an online self-assessment

If investors complete a self-assessment tax return, they can apply for VCT tax relief by completing an SA101 additional information form.

Enter the total value of the VCT investment in the appropriate section labelled ‘Subscriptions for Venture Capital Trust shares’ under ‘Other tax reliefs’.

Claiming VCT tax relief when self-employed

If investors are self-employed and make payments on account, contact HMRC who can talk them through how to reduce payments.

Tax relief claimed through self-assessment will reduce the amount of tax that investors will have to pay. If that means they have already paid too much income tax, the excess can either be repaid by cheque or directly into their bank account by completing the relevant part of the self-assessment form.

Claiming VCT tax relief by adjusting a tax code

If your clients have invested in a VCT towards the start of a tax year, they could choose to call or write to HMRC asking them to adjust their tax code.

This means the amount of income tax investors pay will be reduced on a month-by-month basis until their income tax relief is used up. They’ll need to include their national insurance number, a P60 form if they have one, and a photocopy of their VCT tax certificate.

How will your client receive the tax relief?

Investors can receive income tax relief in a few ways, depending on how and when tax was paid. If tax has not yet been paid for the year, it simply lowers the investor’s upcoming bill. If tax has already been paid, HMRC may issue a refund by bank transfer or cheque, depending on the investor’s preferences and payment history.

Things to bear in mind

Some things to bear in mind

- You cannot claim more income tax relief than the amount of income tax you owe in any tax year.

- You can only claim tax relief on the first £200,000 you invest in any single tax year.

- If you dispose of VCT shares within five years of the date of issue, you will have to let HMRC know and repay any upfront tax relief claimed.

Some things to bear in mind

- Investors cannot claim more income tax relief than the amount of income tax they owe in any tax year.

- Investors can only claim tax relief on the first £200,000 they invest in any single tax year.

- If investors dispose of VCT shares within five years of the date of issue, they will have to let HMRC know and repay any upfront tax relief claimed.

Key risks

- The value of an investment in VCTs, and any income from them, can fall as well as rise. Investors may not get back the full amount they invest.

- Tax treatment depends on individual circumstances and may change in the future.

- Tax reliefs depend on the VCT maintaining its VCT-qualifying status.

- VCT shares are by their nature high risk, their share price may be volatile and they may be hard to sell.

Key risks

- The value of an investment in VCTs, and any income from them, can fall as well as rise. Investors may not get back the full amount they invest.

- Tax treatment depends on individual circumstances and may change in the future.

- Tax reliefs depend on the VCT maintaining its VCT-qualifying status.

- VCT shares are by their nature high risk, their share price may be volatile and they may be hard to sell.