We have some good news for UK Equity Income investors: UK equity dividends are staging a speedy recovery and will grow from here. However, the disappointing news for some is that it may not be in the stocks your current equity income fund holds. Even if you spread your money across several of these traditional funds, chances are you’ll remain heavily exposed to a handful of large companies which may struggle to drive dividends back to pre-pandemic levels.

Investors should look to diversify toward a multi-cap approach to target a sustainable and growing UK equity dividend income stream. Below, we outline why.

Many traditional UK equity dividends have had a torrid time over the past year with pay-outs falling by 44% in 2020¹. Whilst optimism is returning, and we expect a stabilisation in pay-outs this year, many traditional dividend paying stocks will not be in a position, in either the short or medium term, to reinstate pay-outs back to previous levels.

If, however, investors are prepared to look further afield, there are a plethora of fantastic companies elsewhere within the UK which will pay significant dividends. What is more, they will be progressively growing them going forward.

The pandemic has simply accelerated the dividend cuts we felt were inevitable. This has affected a significant element of the traditional dividend stalwarts which are the mainstay of much of the IA UK Equity Income sector. Many were arguably already over-distributing and showing anaemic levels of revenue and earnings growth.

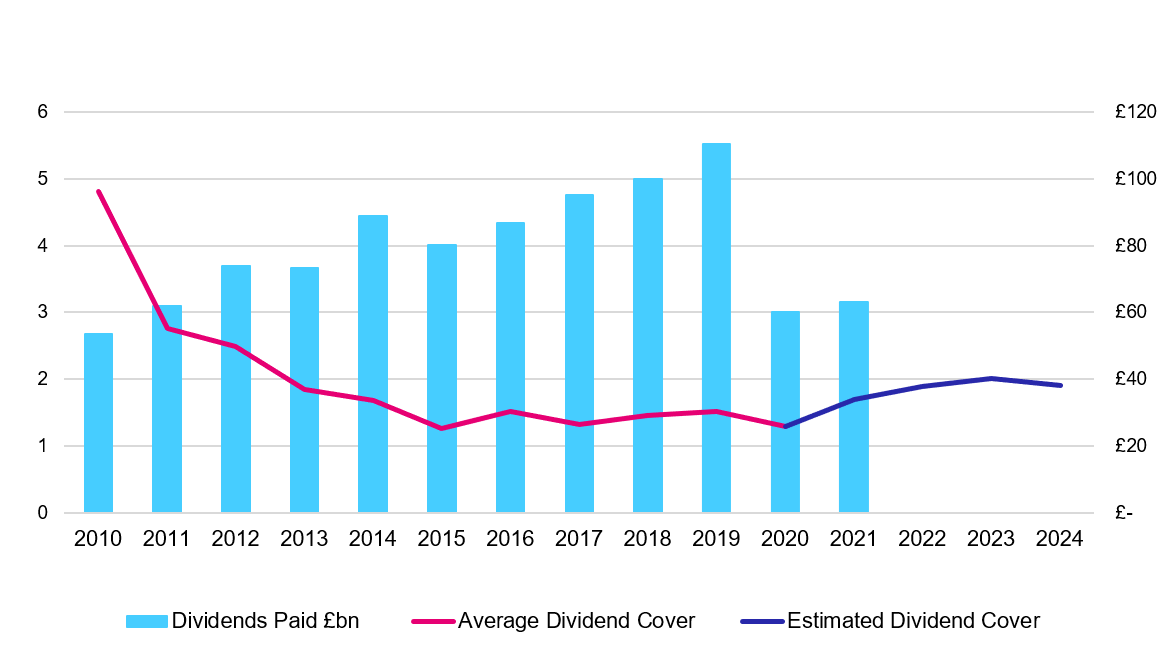

Looking back over the last decade, whilst the level of dividends being paid by the UK equity market was continuing to increase, this growth in pay-out was not matched by a growth in earnings. Dividend cover as a result declined to well below what we saw as a sustainable level of 2x.

¹Source: Citywire, January 2021

FTSE All Share – Dividend history & expectations¹

Looking forward, we have disappointing news for investors holding on to these stocks in the hope dividends will recover. The evidence suggests they will not. Despite significant cuts in dividends paid, the dividend cover for the FTSE All Share, whilst it has improved, still remains below 2x. Whilst we think this is now a sustainable level to rebase, many companies are not in a position to re-instate to previous levels any time soon.

On a more positive note, however, there are plenty of opportunities for a growing and significant income stream. That is, if investors take a multi-cap approach to dividend generation and look to many of the faster growing dividend paying companies within the FTSE 250, FTSE Small Cap and FTSE AIM indexes. Please bear in mind that investors need to be comfortable with the additional investment risks that come with smaller company investing. The value of smaller companies may fall, as well as rise, meaning you may get back less than you initially invest. Their share price can also be more volatile than their FTSE 100 counterparts. They can also be harder to sell.

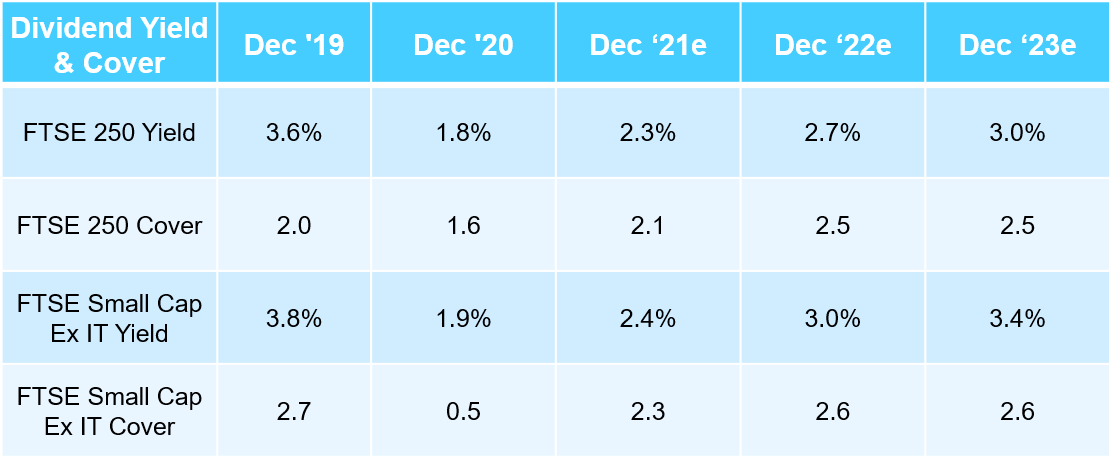

Whilst the headline dividend rates, payable by these indices, are not as eye-catching as the FTSE 100 yields once were, these dividends pay-outs are recovering well. What further excites us is that the dividend cover remains substantially above 2x, giving plenty of headroom for individual companies to pay dividends ahead of current consensus estimates.

Ex FTSE 100 – dividend recovery is expected²

UK Equity markets are well positioned, especially considering the underperformance against global equity markets over recent years. With the UK economy expected to stage a solid comeback following the vaccine roll-out, many companies within these more domestically focussed small and mid-cap indices are well positioned to outperform and grow both earnings and dividends well ahead of the FTSE 100.

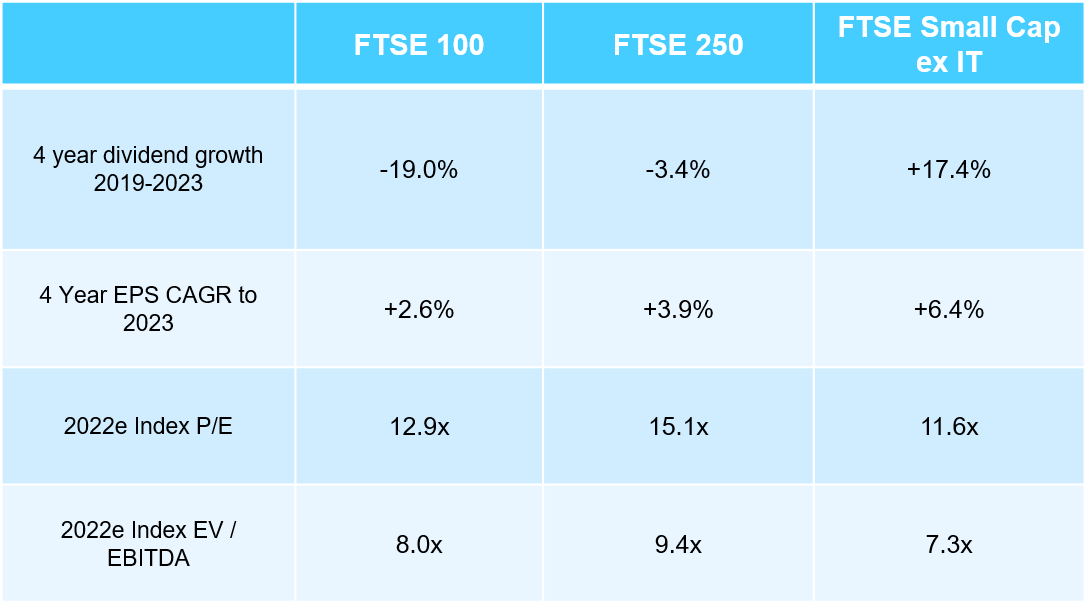

SMID – EPS & DPS to outgrow large companies, yet valuations comparable³

Looking to 2023, consensus data expects the FTSE 250 to have largely recovered dividend per share pay-outs back to pre-pandemic levels, with the FTSE Small Cap ex Investment Trusts Index expected to be paying significantly in excess of 2019. The FTSE 100 on the other hand is still expected to see pay-outs remaining at c. 20% below pre pandemic levels.

Both of these indices are also expected to deliver compound annual earnings growth over the four years to 2023 comfortably in excess of that expected by the FTSE 100. Despite this, small and mid-cap focussed indices are trading on multiples which we believe are not fully commensurate with the opportunities offered.

Within the FP Octopus UK Multi Cap Income Fund, we apply stringent criteria to our stock selection, including a focus on how reliable the dividend is. We also consider the kind of dividend an investment might pay a few years from now. We have a strong core of companies within the portfolio that we believe lie on this 3-5 year steady trajectory of dividend growth supported by underlying earnings. Please remember that the mention of stocks is for illustrative purposes only and should not be seen as an investment recommendation.

Here’s a closer look at a couple of them:

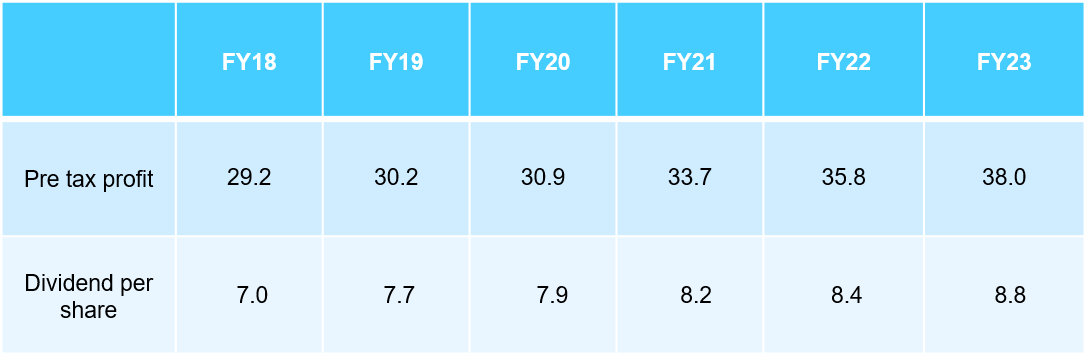

- Strix £580m market cap FY22 Dividend Yield 3.1%⁴

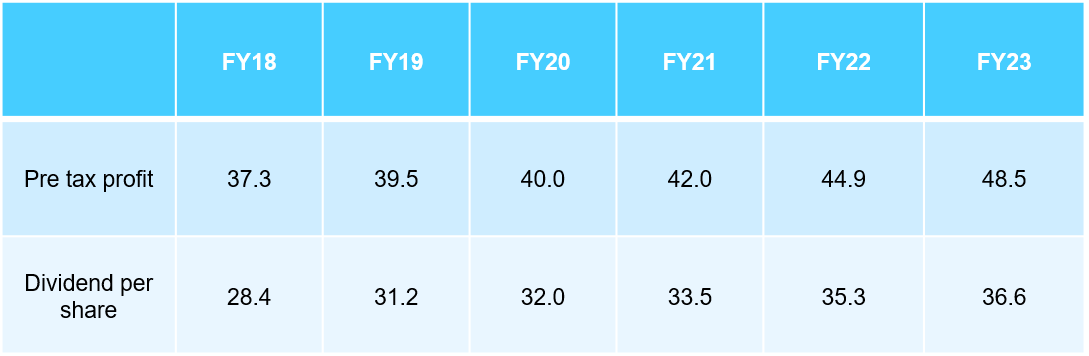

The global leader in kettle safety control technology with over 55% market share. On a prospective basis for the year to December 2021, the stock is expected to pay a healthy 3% dividend yield, with the Dividend per Share pay-out expected to grow by 11.3% between FY20 and FY23, backed up by pre-tax profit growth of c23% over the same period.

Source: Factset May 2021

- EMIS £755m market cap FY22 Dividend Yield 2.9%⁵

A leading UK provider of IT software and systems for the healthcare industry, and importantly right now, for the NHS, with approximately 82% recurring revenues at the recent full year results, and a balance sheet with over £53m net cash. At current levels, the group is expected to deliver an attractive prospective yield of 2.8% for the year to December 2021, with the Dividend Per Share expected to grow by over 14% between FY20 and FY23, backed up by pre-tax profit growth of over 21% over the same period.

Source: Factset May 2021

If you’d like to hear more, join our webinar on Wednesday 23rd June at 11am where Chris McVey, will be explaining the benefits of the fund’s broad investment universe, and our core-satellite approach, which looks to build a portfolio capable of better than market capital performance, and a growing dividend through the cycle.

This is very much an interactive forum and you’ll be able to ask Chris any questions you like.

Risks to bear in mind

The value of an investment can fall or rise and you may not get back the full amount you invest. Smaller company shares are also likely to fall and rise in value more than shares in larger, more established companies listed on the main market of the London Stock Exchange. They may also be harder to sell.

Our investments are not suitable for everyone. We do not offer investment or tax advice. Personal opinions may change and should not be seen as advice or a recommendation. Before investing you should read the Prospectus, the Key Investor Information Document (KIID) and the Supplementary Information Document (SID) as they contain important information regarding the fund, including charges, tax and fund specific risk warnings and will form the basis of any investment. The Prospectus, KIID and application forms are available in English at octopusinvestments.com. The Authorised Corporate Director (ACD) of these funds is FundRock Partners Ltd which is authorised and regulated by the Financial Conduct Authority no. 469278, Registered Office: 8/9 Lovat Lane, London EC3R 8DW. Issued by Octopus Investments Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 33 Holborn, London EC1N 2HT. Registered in England and Wales No. 03942880.CAM010999.

¹ Source: Link UK Dividend Monitor Q3 2020, Factset May 2021

² Source: Factset May 2021

³ Source: Factset May 2021

⁴ Source: Factset May 2021

⁵ Source: Factset May 2021