Written by Rob Skinner, Head of Octopus Inheritance Tax Service

This update focuses on Fern Trading Limited, the company that most investors in the Octopus Inheritance Tax Service own shares in and how it has performed over the past quarter and year.

As an unlisted company, Fern’s share price is not directly affected by short term market sentiment, such as that caused by Covid-19.

Every month, we undertake a valuation of Fern and recommend a share price to the Fern Board at which Fern is happy to issue new shares and Octopus, as discretionary manager of the Octopus Inheritance Tax Service, is happy to buy and sell shares on behalf of investors. We have done that again as usual to set the share price for the month of January.

January share price

Fern has a diversified strategy, with just over half of its business comprising owning and operating renewable energy sites. The other half comprises a large scale secured lending business, fibre broadband businesses and operational healthcare infrastructure businesses. A key reason for Fern selecting these sectors is that even in difficult market conditions they continue to operate and generate revenue, as has been the case over the last month and since the lockdown began. Overall, Fern’s operations performed in line with expectations which saw the share price remain at 159.0p.

12-month performance and impact on investors

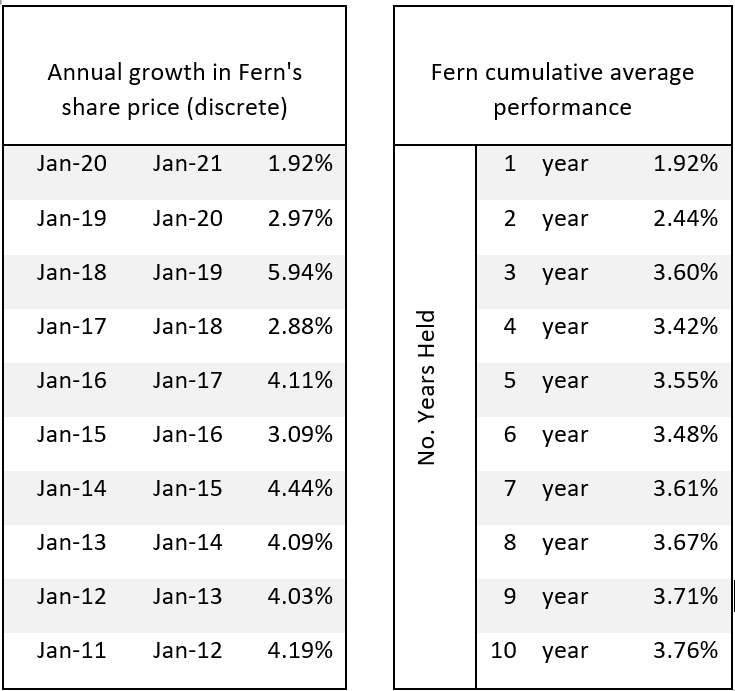

The 12-month performance of Fern to 5 January was 1.92% (see Fern Trading Ltd performance below). This is behind our target of 4.2% and is caused by a drop in Fern’s share price in April 2020 when energy price forecasts were reduced impacting the value of Fern’s energy sites. More positively, since the share price reduction in April, Fern’s share price has performed well and for the past six months has been tracking slightly ahead of target.

The vast majority of investors in Fern will have positive annualised growth of 3% or more on average over the lifetime of their investment, after the Octopus Inheritance Tax Service annual management charge (AMC). This is because the Octopus Inheritance Tax Service AMC of 1% (plus VAT) accrues within their portfolio and is only collected when an investor sells shares, and then only to the extent possible to leave the investor with 3% growth per year in their shareholding. This means that any short-term periods of underperformance (like Fern experienced in April) will reduce the AMC first before impacting the value of an investor’s portfolio. It means that Octopus is very aligned with the interests of Fern’s investors, and also acts as a buffer against price volatility that should increase in value over time.

Trading update

Fern’s divisions across energy, property lending, fibre, and healthcare, all performed well during a disruptive quarter which saw the UK enter a second full national lockdown and the introduction of regional restrictions.

Fern set up its fibre division in 2018 and has been slowly growing this part of the business since then. Fern chose the sector as it offers a number of attractive benefits, such as long-term predicable revenue streams. Plus, the sector is uncorrelated to mainstream markets and Fern’s existing businesses, making fibre a great diversifier for the group.

In October, Fern successfully raised over £150 million from its existing shareholders to support growing the fibre division. Fern is looking to capitalise on the opportunity presented by the UK’s ever-increasing demand for ultra-fast fibre broadband, which has been accelerated by the shift in more people working from home. Fern has utilised £50 million of the funds raised so far by backing the growth of its two existing companies: Jurassic Fibre and Swish Fibre. Fern has also acquired a third independent fibre provider.

Jurassic won ‘Best New Provider’ at a recent industry awards, a fantastic accolade and demonstration of the success Fern is already having in the sector.

The fibre division makes up less than 5% of the group’s value today but over the next few years Fern plans to grow this closer to 15%, which adds further diversification to the group.

Fern’s energy generation businesses, which account for around 50% of Fern’s overall value, offer predictable growth over the long term for Fern. Fern’s assets include solar and wind farms, landfill gas and biomass sites and reserve power plants. All have continued to perform well over the period, with forecasts for long-term energy prices remaining stable since the reduction experienced in April last year.

Melton Renewable Energy (MRE) is an energy subsidiary which converts biomass and landfill gas into electricity. The staff at MRE adopted strict Covid-19 shift patterns to keep all 27 sites operating at full capacity throughout the pandemic and have been able to hit all their operational targets despite the difficulties. Each year the sites convert over one million tonnes of sustainable biomass fuels into electricity.

Fern owns and operates 21 wind sites across the UK and Europe which combined have 233 wind turbines, each generating clean sustainable energy. In November, Fern acquired a new development site in France, the three-turbine site is modest compared to Fern’s existing wind business, but once complete will generate enough electricity to power over 1,500 homes.

Fern’s property lending business accounts for around 25% of its activities. The property lending business is now approaching activity levels seen pre-lockdown. We have, however, been cautious throughout the pandemic and Fern’s lending criteria remains conservative. Reassuringly, existing loans continue to perform well, and the average loan-to-value is currently 63%, creating a healthy buffer for Fern. Maturing loans are being repaid on time, as we were expecting. As a result, the total number of loans in issue has been reducing as more loans are repaid than Fern issues. Since Fern operates such a diverse group, it can then redeploy this capital into other areas of its business, rather than being forced to retain high levels of cash.

Fern’s healthcare division has maintained its good performance throughout the pandemic. One Healthcare, a private hospital developer, continues to provide capacity for non-critical procedures and overflow capacity for NHS hospitals which are focused on treating coronavirus patients, and is expected to do so until at least March.

Fern’s blended strategy of asset-backed lending together with owning and operating income-generating assets, is designed to be predictable and resilient throughout the entire market cycle. While there are no guarantees, we expect Fern’s businesses will continue to generate consistent revenues throughout the pandemic and beyond.

Fern’s pipeline remains healthy with particularly strong opportunities for growth in the fibre sector. One of the reasons Fern operates a diverse business is that it is not limited to one sector and can choose to divert capital towards sectors that are most attractive at any time.

You can read more about Fern’s business at ferntrading.com.

A reminder of the key risks

- The value of an investment in the Octopus Inheritance Tax Service, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest.

- The benefit of tax relief depends on individual circumstances. Tax treatment is assumed as per current legislation, which may change in the future.

- Qualification for BPR depends on portfolio companies maintaining their qualifying status, which is assessed at the point a claim for the relief is made.

- The shares of unquoted companies may be more volatile than shares of companies listed on the main market of the London Stock Exchange.

- The shares of these companies may also be harder to sell.

Fern Trading Ltd performance

Past performance is not a reliable indicator of future performance.

Source: Octopus Investments, 1 January 2021. The performance data table above left shows the discrete annual growth of Fern’s share price only. It does not take account of initial fees, dealing fees or annual management charges associated with investing in the Octopus Inheritance Tax Service and should not be viewed as performance information for the Octopus Inheritance Tax Service. Performance is calculated based on the sale price for Fern’s shares at 1 January each year. The performance table above right shows the average annualised growth in Fern’s share price as at 1 January 2021. For example, if you bought shares in Fern on 1 January 2016 and still held them on the 1 January 2021, then they would have grown at an average of 3.55% a year for four years. It is important to remember that the annual growth rate could have been higher or lower than the 3.55% average at certain points.